Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Presented below is information which relates to Sandhill Company, a Canadian public corporation traded on the Toronto Stock Exchange, for 2020. Net income $449,000

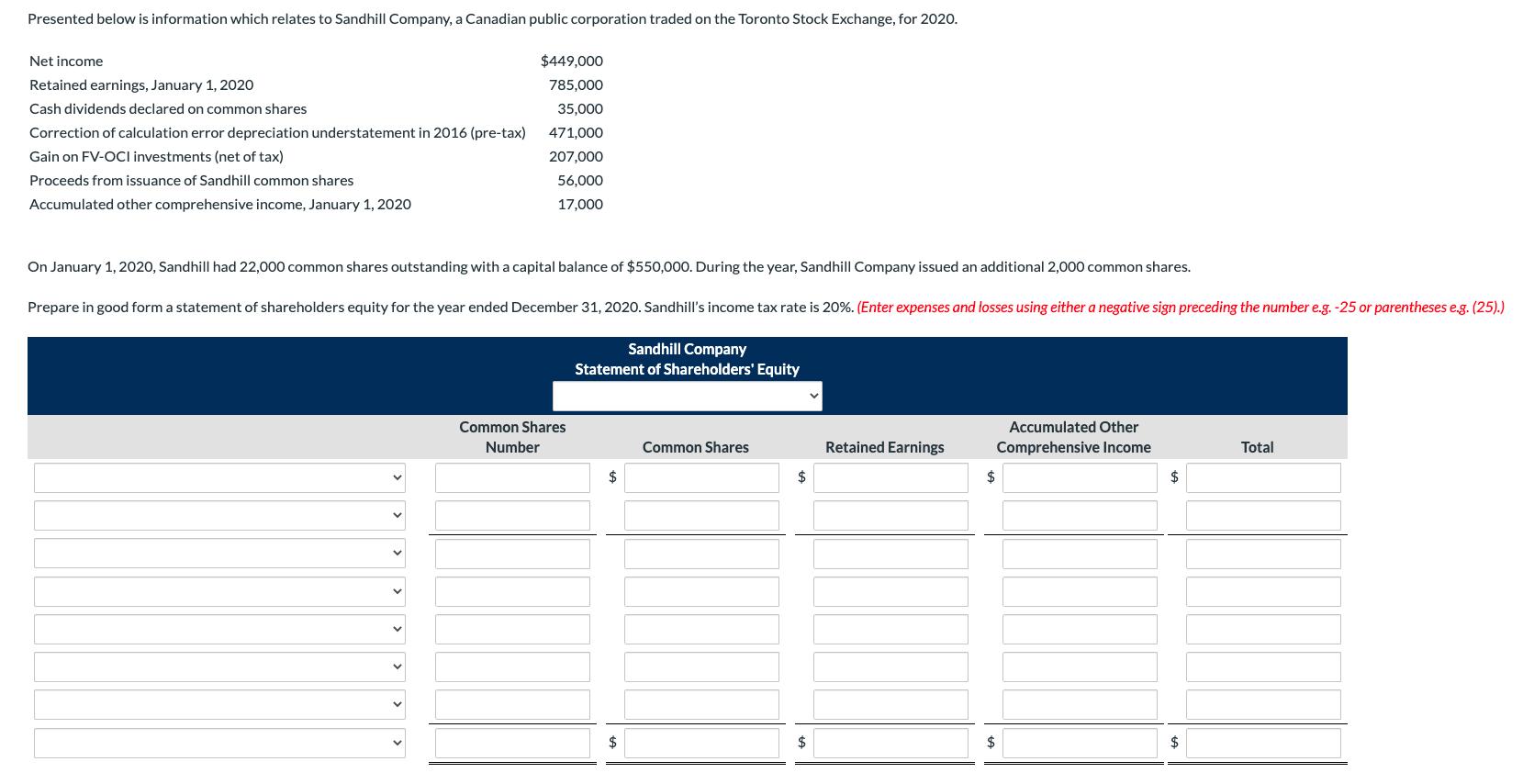

Presented below is information which relates to Sandhill Company, a Canadian public corporation traded on the Toronto Stock Exchange, for 2020. Net income $449,000 Retained earnings, January 1, 2020 785,000 Cash dividends declared on common shares 35,000 Correction of calculation error depreciation understatement in 2016 (pre-tax) 471,000 Gain on FV-OCI investments (net of tax) 207,000 Proceeds from issuance of Sandhill common shares 56,000 Accumulated other comprehensive income, January 1, 2020 17,000 On January 1, 2020, Sandhill had 22,000 common shares outstanding with a capital balance of $550,000. During the year, Sandhill Company issued an additional 2,000 common shares. Prepare in good form a statement of shareholders equity for the year ended December 31, 202O. Sandhill's income tax rate is 20%. (Enter expenses and losses using either a negative sign preceding the number e.g. -25 or parentheses e.g. (25).) Sandhill Company Statement of Shareholders' Equity Common Shares Accumulated Other Number Common Shares Retained Earnings Comprehensive Income Total $ 2$ $ $ $ $ $ $4

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Sandhill Company Statement of shareholders equity Common sharesNumber common shares Retaine...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started