Question

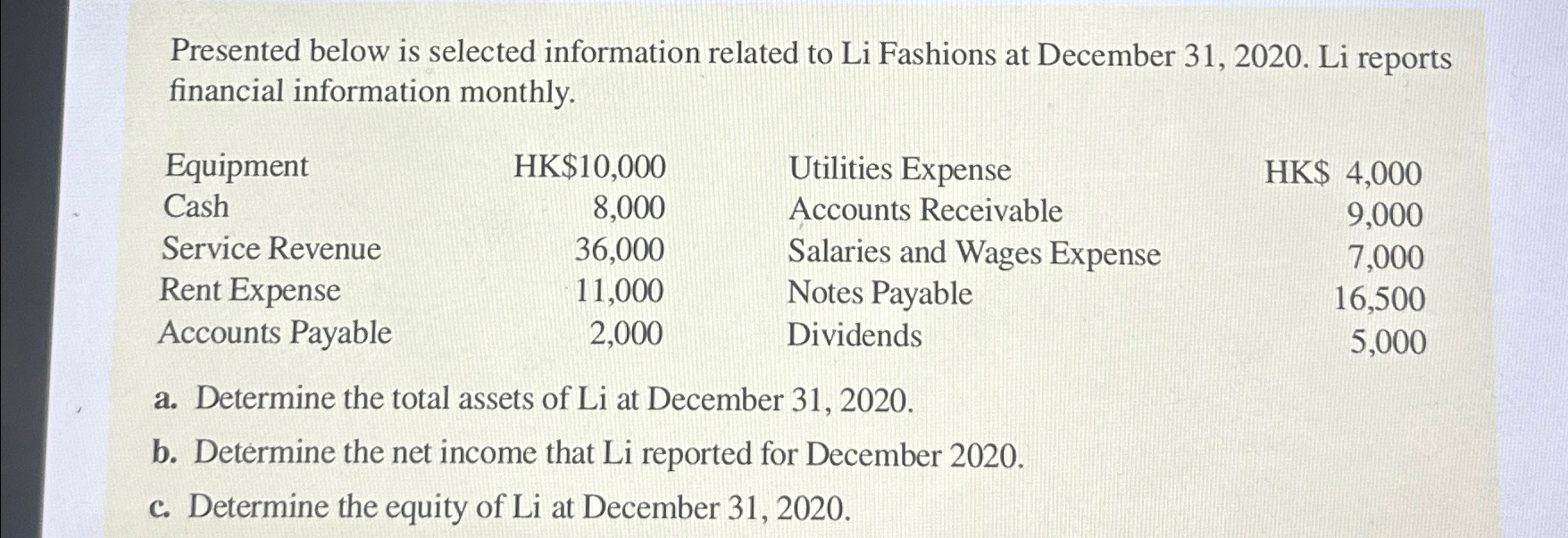

Presented below is selected information related to Li Fashions at December 31, 2020. Li reports financial information monthly. Equipment Cash Service Revenue Rent Expense

Presented below is selected information related to Li Fashions at December 31, 2020. Li reports financial information monthly. Equipment Cash Service Revenue Rent Expense Accounts Payable HK$10,000 Utilities Expense HK$ 4,000 8,000 Accounts Receivable 9,000 36,000 Salaries and Wages Expense 7,000 11,000 Notes Payable 16,500 2,000 Dividends 5,000 a. Determine the total assets of Li at December 31, 2020. b. Determine the net income that Li reported for December 2020. c. Determine the equity of Li at December 31, 2020.

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Total Assets can be determined as Equipment Accounts Receivable C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Principles

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

13th edition

978-1-119-4110, 1119411483, 9781119411017, 978-1119411482

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App