Answered step by step

Verified Expert Solution

Question

1 Approved Answer

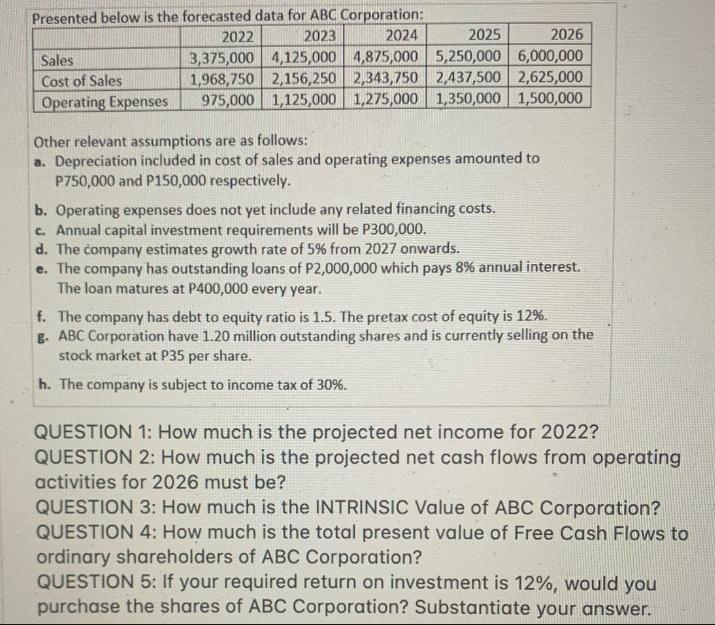

Presented below is the forecasted data for ABC Corporation: 2022 2023 2024 2025 2026 3,375,000 4,125,000 4,875,000 5,250,000 6,000,000 1,968,750 2,156,250 2,343,750 2,437,500 2,625,000

Presented below is the forecasted data for ABC Corporation: 2022 2023 2024 2025 2026 3,375,000 4,125,000 4,875,000 5,250,000 6,000,000 1,968,750 2,156,250 2,343,750 2,437,500 2,625,000 975,000 1,125,000 1,275,000 1,350,000 1,500,000 Sales Cost of Sales Operating Expenses Other relevant assumptions are as follows: a. Depreciation included in cost of sales and operating expenses amounted to P750,000 and P150,000 respectively. b. Operating expenses does not yet include any related financing costs. c. Annual capital investment requirements will be P300,000. d. The company estimates growth rate of 5% from 2027 onwards. e. The company has outstanding loans of P2,000,000 which pays 8% annual interest. The loan matures at P400,000 every year. f. The company has debt to equity ratio is 1.5. The pretax cost of equity is 12%. g. ABC Corporation have 1.20 million outstanding shares and is currently selling on the stock market at P35 per share. h. The company is subject to income tax of 30%. QUESTION 1: How much is the projected net income for 2022? QUESTION 2: How much is the projected net cash flows from operating activities for 2026 must be? QUESTION 3: How much is the INTRINSIC Value of ABC Corporation? QUESTION 4: How much is the total present value of Free Cash Flows to ordinary shareholders of ABC Corporation? QUESTION 5: If your required return on investment is 12%, would you purchase the shares of ABC Corporation? Substantiate your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started