Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Presented below is the income statement of Grand Stores, Inc for 2020: Sales Cost of goods sold Gross profit - Operating expenses Income before

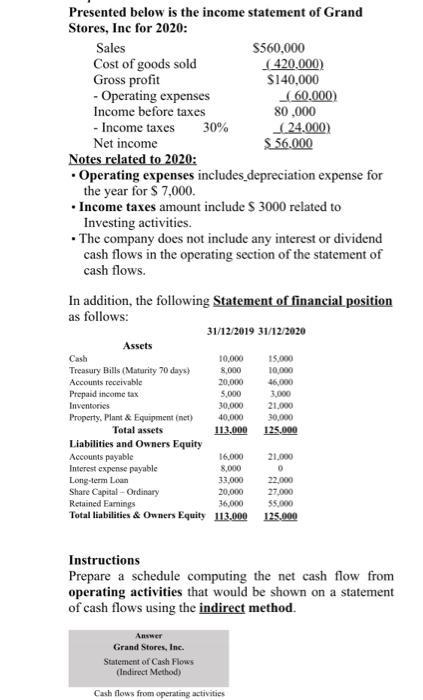

Presented below is the income statement of Grand Stores, Inc for 2020: Sales Cost of goods sold Gross profit - Operating expenses Income before taxes $560,000 (420.000) S140,000 (60.000) 80 ,000 (24.000) $.56.000 - Income taxes 30% Net income Notes related to 2020: Operating expenses includes depreciation expense for the year for $ 7,000. Income taxes amount include S 3000 related to Investing activities. The company does not include any interest or dividend cash flows in the operating section of the statement of cash flows. In addition, the following Statement of financial position as follows: 31/12/2019 31/12/2020 Assets Cash 10,000 8,000 20,000 5,000 15,000 10,000 46,000 3,000 21,000 Treasury Bills (Maturity 70 days) Accounts receivable Prepaid income tax Inventories 30,000 Property, Plant & Equipment (net) Total assets 40,000 30,000 113.000 125.000 Liabilities and Owners Equity Accounts payable Interest expense payable Long-term Loan Share Capital - Ordinary Retained Eamings Total liabilities & Owners Equity 113.000 125.000 16.000 21,000 8,000 22,000 27,000 55,000 33,000 20,000 36,000 Instructions Prepare a schedule computing the net cash flow from operating activities that would be shown on a statement of cash flows using the indirect method. Answer Grand Stores, Inc. Statement of Cash Flows (Indirect Method) Cash flows from operating activities

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started