Answered step by step

Verified Expert Solution

Question

1 Approved Answer

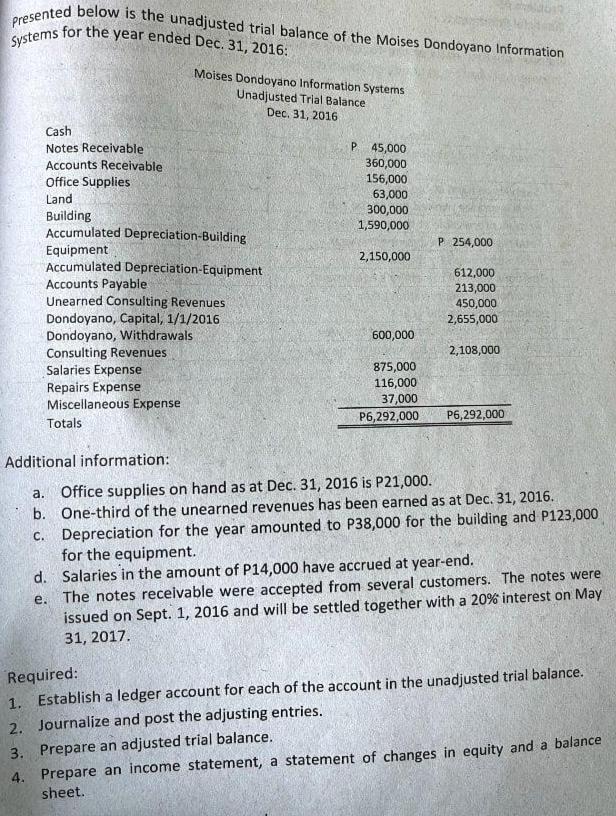

Presented below is the unadjusted trial balance of the Moises Dondoyano Information Systems for the year ended Dec. 31, 2016: Moises Dondoyano Information Systems

Presented below is the unadjusted trial balance of the Moises Dondoyano Information Systems for the year ended Dec. 31, 2016: Moises Dondoyano Information Systems Unadjusted Trial Balance Dec. 31, 2016 Cash Notes Receivable Accounts Receivable Office Supplies Land Building Accumulated Depreciation-Building Equipment Accumulated Depreciation-Equipment Accounts Payable Unearned Consulting Revenues Dondoyano, Capital, 1/1/2016 Dondoyano, Withdrawals Consulting Revenues Salaries Expense Repairs Expense Miscellaneous Expense Totals P 45,000 360,000 156,000 63,000 300,000 1,590,000 2,150,000 600,000 875,000 116,000 37,000 P6,292,000 P 254,000 612,000 213,000 450,000 2,655,000 2,108,000 P6,292,000 Additional information: a. Office supplies on hand as at Dec. 31, 2016 is P21,000. b. One-third of the unearned revenues has been earned as at Dec. 31, 2016. c. Depreciation for the year amounted to P38,000 for the building and P123,000 for the equipment. d. Salaries in the amount of P14,000 have accrued at year-end. e. The notes receivable were accepted from several customers. The notes were issued on Sept. 1, 2016 and will be settled together with a 20% interest on May 31, 2017. Required: 1. Establish a ledger account for each of the account in the unadjusted trial balance. 2. Journalize and post the adjusting entries. 3. Prepare an adjusted trial balance. 4. Prepare an income statement, a statement of changes in equity and a balance sheet. Presented below is the unadjusted trial balance of the Moises Dondoyano Information Systems for the year ended Dec. 31, 2016: Moises Dondoyano Information Systems Unadjusted Trial Balance Dec. 31, 2016 Cash Notes Receivable Accounts Receivable Office Supplies Land Building Accumulated Depreciation-Building Equipment Accumulated Depreciation-Equipment Accounts Payable Unearned Consulting Revenues Dondoyano, Capital, 1/1/2016 Dondoyano, Withdrawals Consulting Revenues Salaries Expense Repairs Expense Miscellaneous Expense Totals P 45,000 360,000 156,000 63,000 300,000 1,590,000 2,150,000 600,000 875,000 116,000 37,000 P6,292,000 P 254,000 612,000 213,000 450,000 2,655,000 2,108,000 P6,292,000 Additional information: a. Office supplies on hand as at Dec. 31, 2016 is P21,000. b. One-third of the unearned revenues has been earned as at Dec. 31, 2016. c. Depreciation for the year amounted to P38,000 for the building and P123,000 for the equipment. d. Salaries in the amount of P14,000 have accrued at year-end. e. The notes receivable were accepted from several customers. The notes were issued on Sept. 1, 2016 and will be settled together with a 20% interest on May 31, 2017. Required: 1. Establish a ledger account for each of the account in the unadjusted trial balance. 2. Journalize and post the adjusting entries. 3. Prepare an adjusted trial balance. 4. Prepare an income statement, a statement of changes in equity and a balance sheet.

Step by Step Solution

★★★★★

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Question Journal Entries S No Particulars Dr Cr 1 Bank Ac Dr 150000 To Unearned Consulting Revenue Ac 150000 2 Depreciation Account Dr 161000 To Build...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started