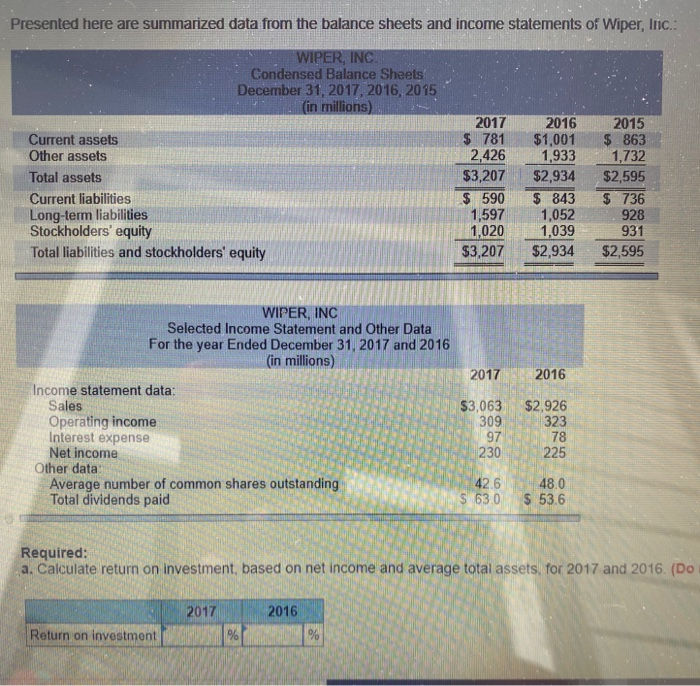

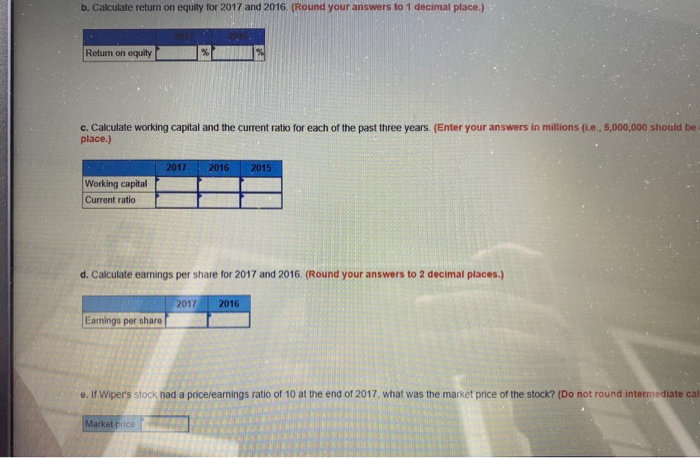

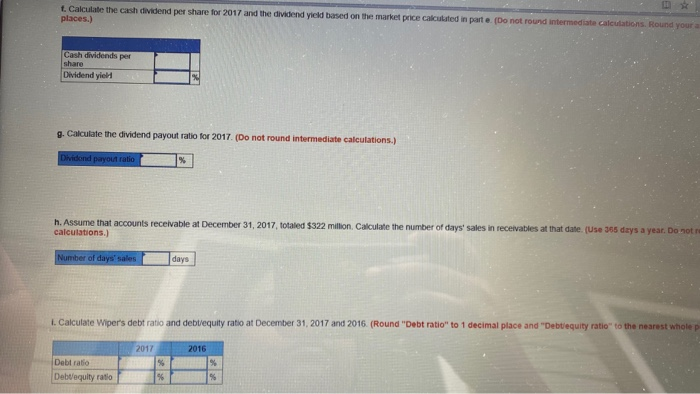

Presented here are summarized data from the balance sheets and income statements of Wiper, Inc.: WIPER, INC Condensed Balance Sheets December 31, 2017, 2016, 2015 (in millions) Current assets Other assets Total assets Current liabilities Long-term liabilities Stockholders' equity Total liabilities and stockholders' equity 2017 $ 781 2,426 $3,207 $ 590 1,597 1,020 $3,207 2016 $1,001 1,933 $2,934 $ 843 1,052 1,039 $2,934 2015 $ 863 1,732 $2,595 $ 736 928 931 $2,595 WIPER, INC Selected Income Statement and Other Data For the year Ended December 31, 2017 and 2016 (in millions) TEA Income statement data: Sales Operating income Interest expense Net income Other data: Average number of common shares outstanding Total dividends paid 2017 2016 $3,063 $2,926 309 323 9778 230 225 42.6 $ 630 48.0 $ 53.6 63.0 $53 Required: a. Calculate return on investment, based on net income and average total assets, for 2017 and 2016. (Do 2017 2016 Return on investment b. Calculate return on equity for 2017 and 2016. (Round your answers to 1 decimal place.) Return on equity % c. Calculate working capital and the current ratio for each of the past three years. (Enter your answers in millions (i.e., 5,000,000 should be place.) 2017 2016 2015 Working capital Current ratio d. Calculate earnings per share for 2017 and 2016. (Round your answers to 2 decimal places.) 2017 2016 Earnings per share e. If Wiper's stock had a price/earnings ratio of 10 at the end of 2017, what was the market price of the stock? (Do not round intermediate cal Market price t. Calculate the cash dividend per share for 2017 and the dividend yield based on the market price calculated in parte (Do not round intermediate calculations. Round your places.) share Dividend yiel Q. Calculate the dividend payout ratio for 2017 (Do not round intermediate calculations.) Dhe ato h. Assume that accounts receivable at December 31, 2017, fotated $322 million Calculate the number of days' sales in receivables at that date. (Use 365 days a year. Do not calculations.) Number of days' sales days Calculate Wiper's debt ratio and debrequity ratio at December 31, 2017 and 2016. (Round "Debt ratio to 1 decimal place and e quity rate to the nearest whole Debratio Debtequity ratio % t. Calculate the cash dividend per share for 2017 and the dividend yield based on the market price calculated in parte (Do not round Intermediate calculations. Round your places.) Cash dividends share Dividend yet Cacate the dividend payout ratio for 2017 (Do not round intermediate calculations.) D utatio h. Assume that accounts receivable at December 31, 2017 totaled $322 million Calculate the number of days' sales in receivables at that date. (Use 365 days a year. Do not calculations.) Number of days' sales d ays L. Calculate Wiper's debt ratio and debrequity ratio at December 31, 2017 and 2016. (Round "Debt ratio to 1 decimal place and Debtequity rate to the nearest whole Debratio Debuequity ratio