Question

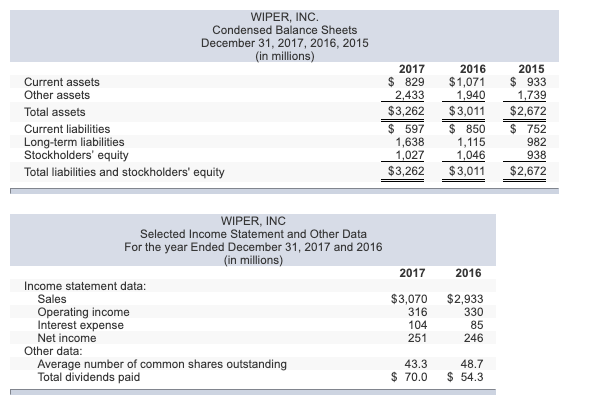

Presented here are summarized data from the balance sheets and income statements of Wiper, Inc.: b. Calculate return on equity for 2017 and 2016. (Round

Presented here are summarized data from the balance sheets and income statements of Wiper, Inc.:

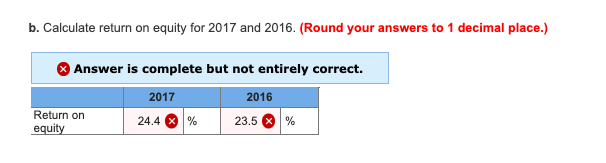

b. Calculate return on equity for 2017 and 2016. (Round your answers to 1 decimal place.)

e. If Wiper's stock had a price/earnings ratio of 12 at the end of 2017, what was the market price of the stock? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

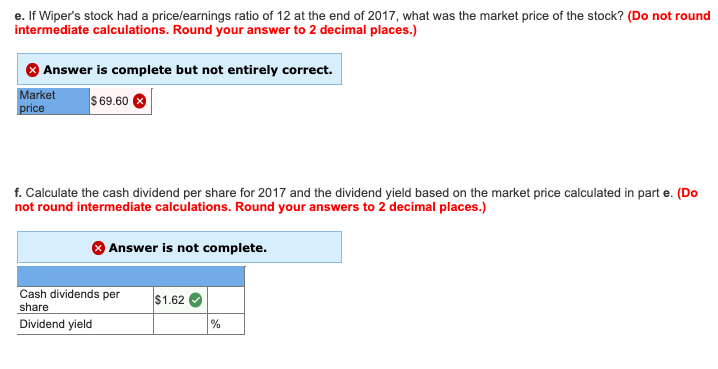

f. Calculate the cash dividend per share for 2017 and the dividend yield based on the market price calculated in part e. (Do not round intermediate calculations. Round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started