Answered step by step

Verified Expert Solution

Question

1 Approved Answer

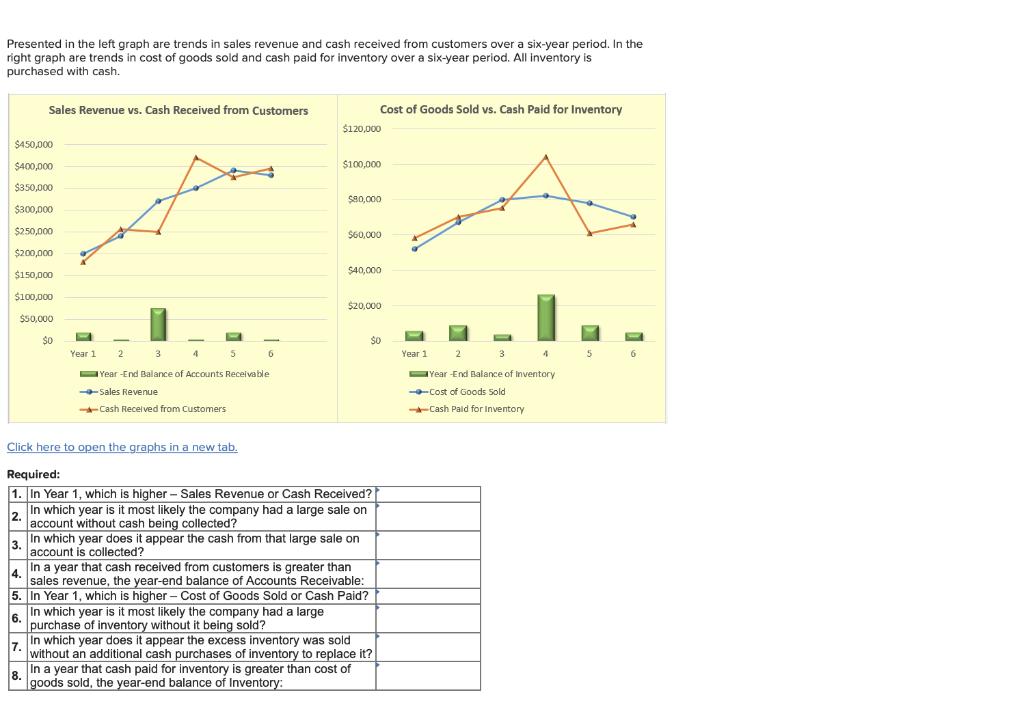

Presented in the left graph are trends in sales revenue and cash received from customers over a six-year period. In the right graph are

Presented in the left graph are trends in sales revenue and cash received from customers over a six-year period. In the right graph are trends in cost of goods sold and cash paid for inventory over a six-year period. All inventory is purchased with cash. Sales Revenue vs. Cash Received from Customers Cost of Goods Sold vs. Cash Paid for Inventory $120,000 $450,000 $400,000 $100,000 $350,000 Sa0,000 $300,000 $250,000 $60,000 $200,000 $150,000 $40,000 $100,000 $20.000 $50,000 $0 So Year 1 2 3. 4 6. Year 1 2 3 Year -End Balance of Accounts Receivable Year -End Balance of Inventory + Sales Revenue Cost of Goods Sold + Cash Recei ved from Customers Cash Paid for Inventory Click here to open the graphs in a new tab. Required: 1. In Year 1, which is higher - Sales Revenue or Cash Received? In which year is it most likely the company had a large sale on account without cash being collected? 2. In which year does it appear the cash from that large sale on 3. account is collected? In a year that cash received from customers is greater than 4. sales revenue, the year-end balance of Accounts Receivable: 5. In Year 1, which is higher - Cost of Goods Sold or Cash Paid? In which year is it most likely the company had a large 6. purchase of inventory without it being sold? In which year does it appear the excess inventory was sold 7. without an additional cash purchases of inventory to replace it? In a year that cash paid for inventory is greater than cost of 8. goods sold, the year-end balance of Inventory:

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started