Answered step by step

Verified Expert Solution

Question

1 Approved Answer

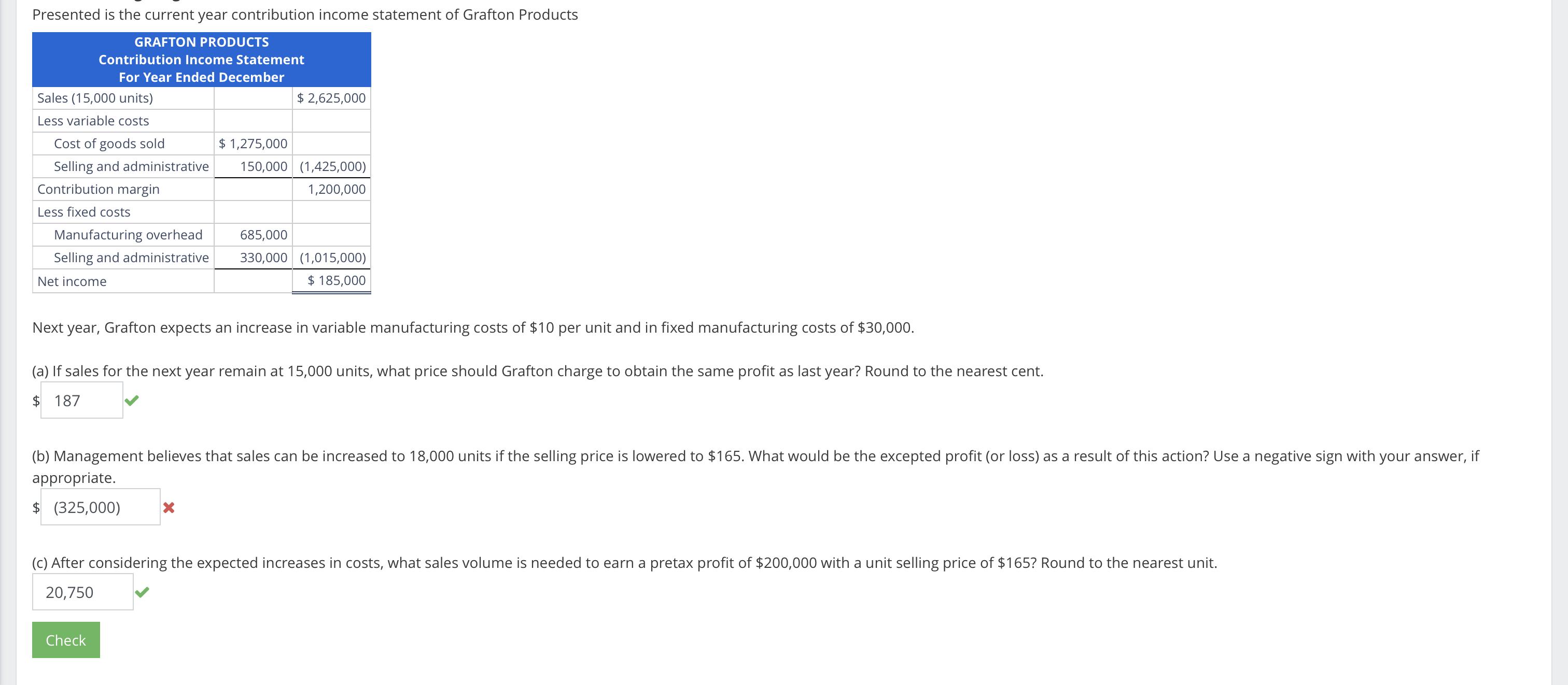

Presented is the current year contribution income statement of Grafton Products GRAFTON PRODUCTS Contribution Income Statement For Year Ended December $ 2,625,000 Sales (15,000

Presented is the current year contribution income statement of Grafton Products GRAFTON PRODUCTS Contribution Income Statement For Year Ended December $ 2,625,000 Sales (15,000 units) Less variable costs Cost of goods sold Selling and administrative $ 1,275,000 150,000 (1,425,000) 1,200,000 Contribution margin Less fixed costs Manufacturing overhead 685,000 Selling and administrative Net income 330,000 (1,015,000) $ 185,000 Next year, Grafton expects an increase in variable manufacturing costs of $10 per unit and in fixed manufacturing costs of $30,000. (a) If sales for the next year remain at 15,000 units, what price should Grafton charge to obtain the same profit as last year? Round to the nearest cent. $ 187 (b) Management believes that sales can be increased to 18,000 units if the selling price is lowered to $165. What would be the excepted profit (or loss) as a result of this action? Use a negative sign with your answer, if appropriate. $ (325,000) (c) After considering the expected increases in costs, what sales volume is needed to earn a pretax profit of $200,000 with a unit selling price of $165? Round to the nearest unit. 20,750 Check

Step by Step Solution

★★★★★

3.26 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

a If sales remain at 15000 units but variable manufacturing costs increase by 10unit and fixed manuf...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started