Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Presently, AllGone. Inc. is the only company in the state licensed to handle toxic waste disposal for refineries. The market demand for toxic waste

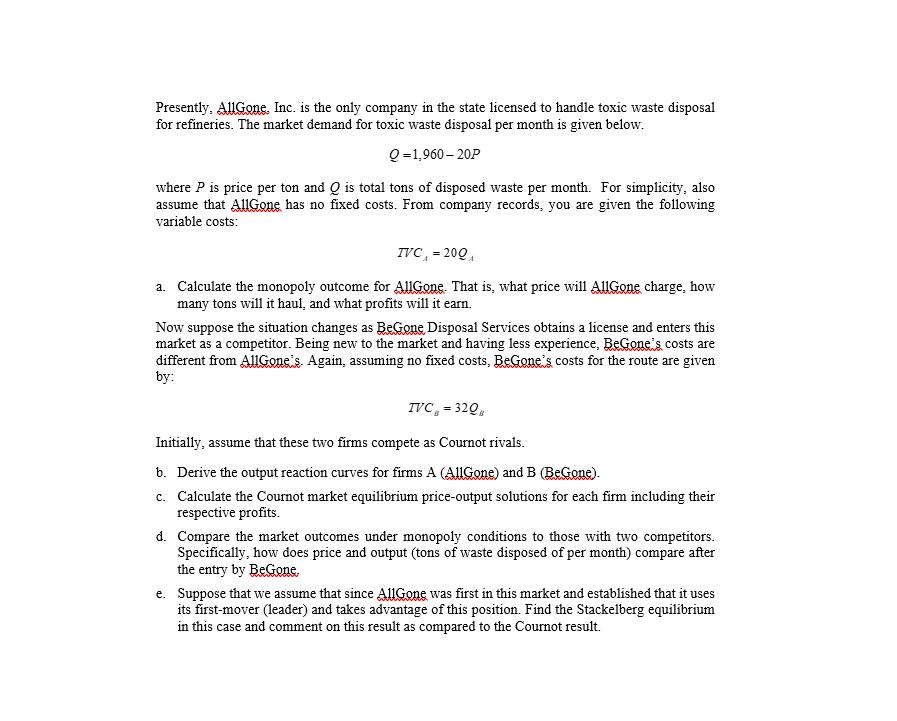

Presently, AllGone. Inc. is the only company in the state licensed to handle toxic waste disposal for refineries. The market demand for toxic waste disposal per month is given below. Q=1,960-20P where P is price per ton and Q is total tons of disposed waste per month. For simplicity, also assume that AllGone has no fixed costs. From company records, you are given the following variable costs: TVC = 200 a. Calculate the monopoly outcome for AllGone. That is, what price will AllGone charge, how many tons will it haul, and what profits will it earn. Now suppose the situation changes as BeGone Disposal Services obtains a license and enters this market as a competitor. Being new to the market and having less experience, BeGone's costs are different from AllGone's. Again, assuming no fixed costs, BeGone's costs for the route are given by: TVC = 320 Initially, assume that these two firms compete as Cournot rivals. b. Derive the output reaction curves for firms A (AllGone) and B (BeGone). c. Calculate the Cournot market equilibrium price-output solutions for each firm including their respective profits. d. Compare the market outcomes under monopoly conditions to those with two competitors. Specifically, how does price and output (tons of waste disposed of per month) compare after the entry by BeGone. e. Suppose that we assume that since AllGone was first in this market and established that it uses its first-mover (leader) and takes advantage of this position. Find the Stackelberg equilibrium in this case and comment on this result as compared to the Cournot result.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started