Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Presidio Paper Co. currently has an all equity capital structure with 11,000 shares outstanding and a stock price of $65. EBIT is $47,850 and is

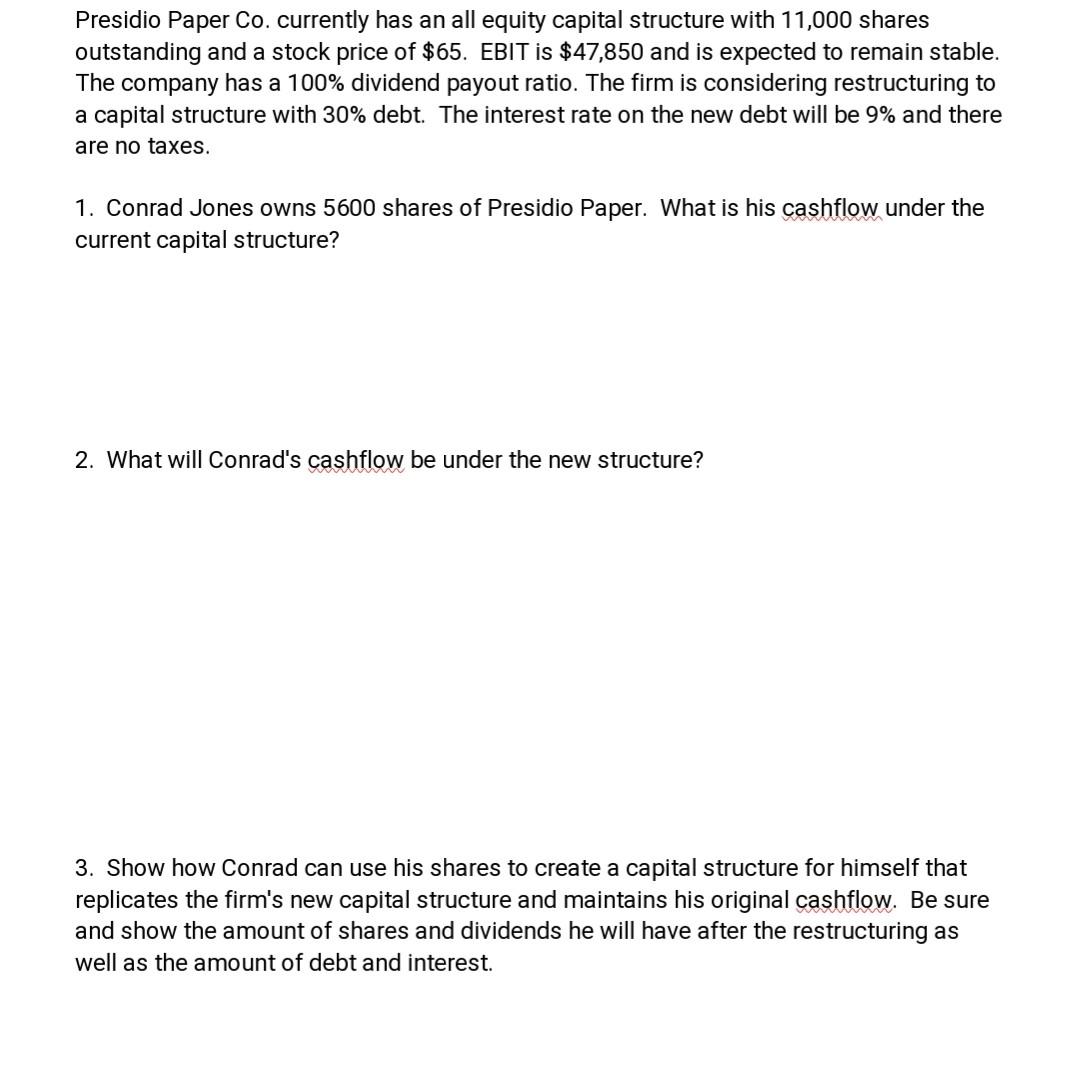

Presidio Paper Co. currently has an all equity capital structure with 11,000 shares outstanding and a stock price of $65. EBIT is $47,850 and is expected to remain stable. The company has a 100% dividend payout ratio. The firm is considering restructuring to a capital structure with 30% debt. The interest rate on the new debt will be 9% and there are no taxes. 1. Conrad Jones owns 5600 shares of Presidio Paper. What is his cashflow under the current capital structure? 2. What will Conrad's cashflow be under the new structure? 3. Show how Conrad can use his shares to create a capital structure for himself that replicates the firm's new capital structure and maintains his original cashflow. Be sure and show the amount of shares and dividends he will have after the restructuring as well as the amount of debt and interest

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started