Press Company acquires 15% of Secretary Company's common stock for P600,000 cash and carries the investment using the cost model. A few months later,

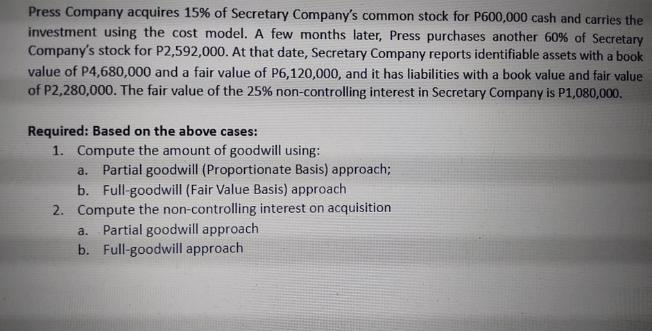

Press Company acquires 15% of Secretary Company's common stock for P600,000 cash and carries the investment using the cost model. A few months later, Press purchases another 60% of Secretary Company's stock for P2,592,000. At that date, Secretary Company reports identifiable assets with a book value of P4,680,000 and a fair value of P6,120,000, and it has liabilities with a book value and fair value of P2,280,000. The fair value of the 25% non-controlling interest in Secretary Company is P1,080,000. Required: Based on the above cases: 1. Compute the amount of goodwill using: a. Partial goodwill (Proportionate Basis) approach; b. Full-goodwill (Fair Value Basis) approach 2. Compute the non-controlling interest on acquisition a. Partial goodwill approach b. Full-goodwill approach

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Compute the amount of goodwill a Partial goodwill Proportionate Basis approach In the partial goodwill approach goodwill is calculated based on the ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started