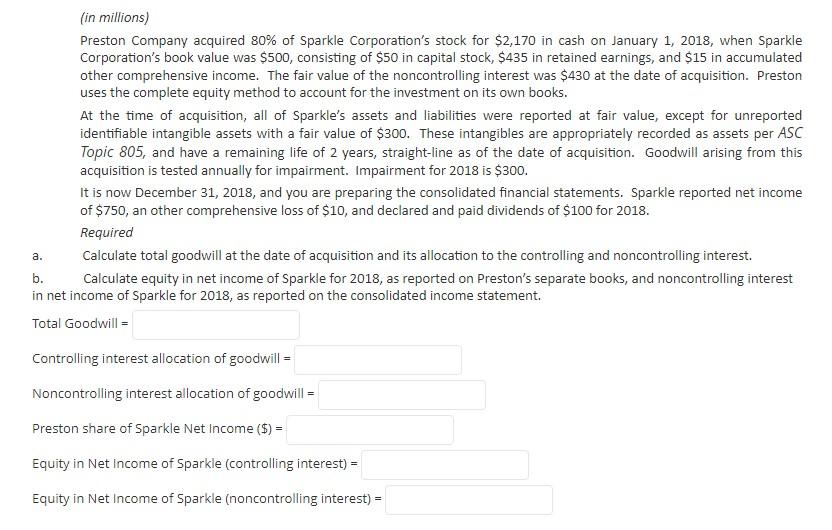

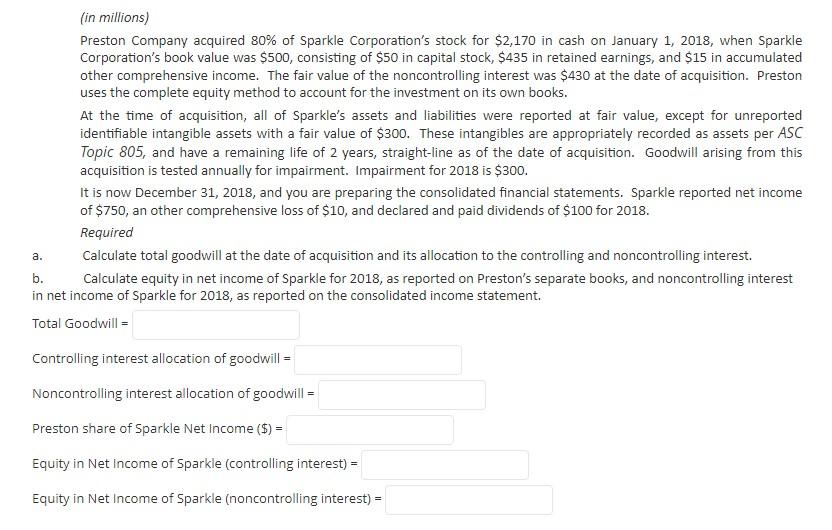

Preston Company acquired 80% of Sparkle Corporation's stock for $2,170 in cash on January 1, 2018, when Sparkle Corporation's book value was $500, consisting of $50 in capital stock, $435 in retained earnings, and $15 in accumulated other comprehensive income. The fair value of the noncontrolling interest was $430 at the date of acquisition. Preston uses the complete equity method to account for the investment on its own books. At the time of acquisition, all of Sparkle's assets and liabilities were reported at fair value, except for unreported identifiable intangible assets with a fair value of $300. These intangibles are appropriately recorded as assets per ASC Topic 805, and have a remaining life of 2 years, straight-line as of the date of acquisition. Goodwill arising from this acquisition is tested annually for impairment. Impairment for 2018 is $300. It is now December 31,2018 , and you are preparing the consolidated financial statements. Sparkle reported net income of $750, an other comprehensive loss of \$10, and declared and paid dividends of $100 for 2018 . Required Calculate total goodwill at the date of acquisition and its allocation to the controlling and noncontrolling interest. Calculate equity in net income of Sparkle for 2018, as reported on Preston's separate books, and noncontrolling interest net income of Sparkle for 2018 , as reported on the consolidated income statement. tal Goodwill = ontrolling interest allocation of goodwill = oncontrolling interest allocation of goodwill = eston share of Sparkle Net Income ($)= quity in Net Income of Sparkle (controlling interest)= quity in Net Income of Sparkle (noncontrolling interest)= Preston Company acquired 80% of Sparkle Corporation's stock for $2,170 in cash on January 1, 2018, when Sparkle Corporation's book value was $500, consisting of $50 in capital stock, $435 in retained earnings, and $15 in accumulated other comprehensive income. The fair value of the noncontrolling interest was $430 at the date of acquisition. Preston uses the complete equity method to account for the investment on its own books. At the time of acquisition, all of Sparkle's assets and liabilities were reported at fair value, except for unreported identifiable intangible assets with a fair value of $300. These intangibles are appropriately recorded as assets per ASC Topic 805, and have a remaining life of 2 years, straight-line as of the date of acquisition. Goodwill arising from this acquisition is tested annually for impairment. Impairment for 2018 is $300. It is now December 31,2018 , and you are preparing the consolidated financial statements. Sparkle reported net income of $750, an other comprehensive loss of \$10, and declared and paid dividends of $100 for 2018 . Required Calculate total goodwill at the date of acquisition and its allocation to the controlling and noncontrolling interest. Calculate equity in net income of Sparkle for 2018, as reported on Preston's separate books, and noncontrolling interest net income of Sparkle for 2018 , as reported on the consolidated income statement. tal Goodwill = ontrolling interest allocation of goodwill = oncontrolling interest allocation of goodwill = eston share of Sparkle Net Income ($)= quity in Net Income of Sparkle (controlling interest)= quity in Net Income of Sparkle (noncontrolling interest)=