Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pretend you are a long-short hedge fund manager. This time create a 10 stock portfolio with potential high alpha plays (both positive and negative

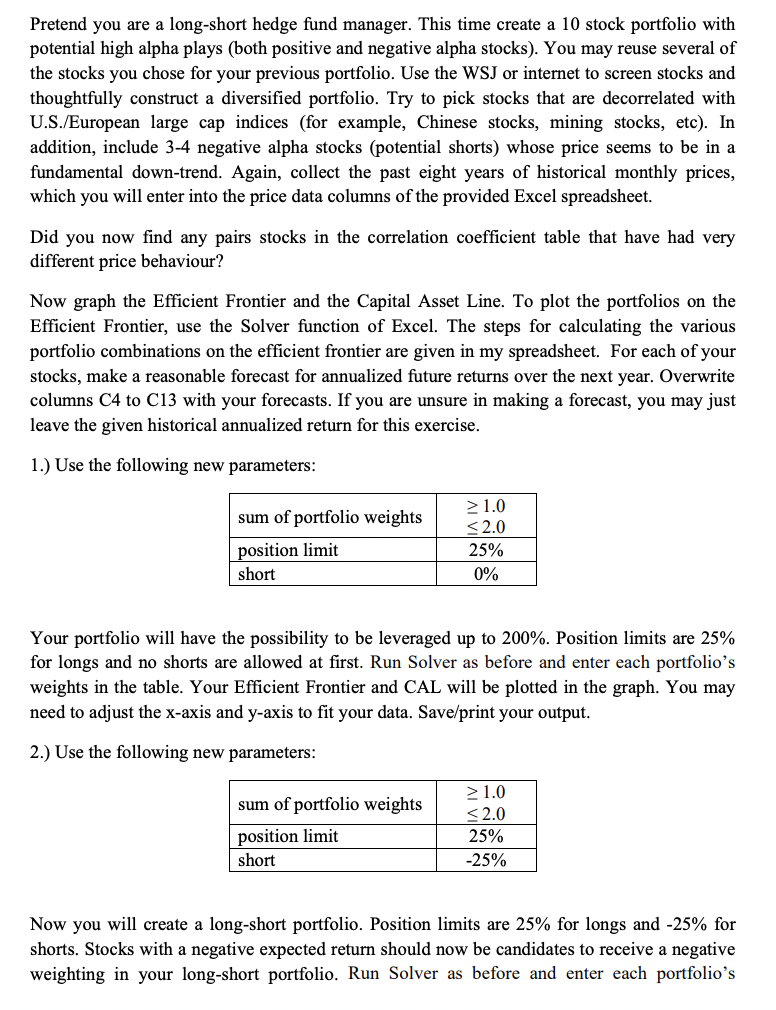

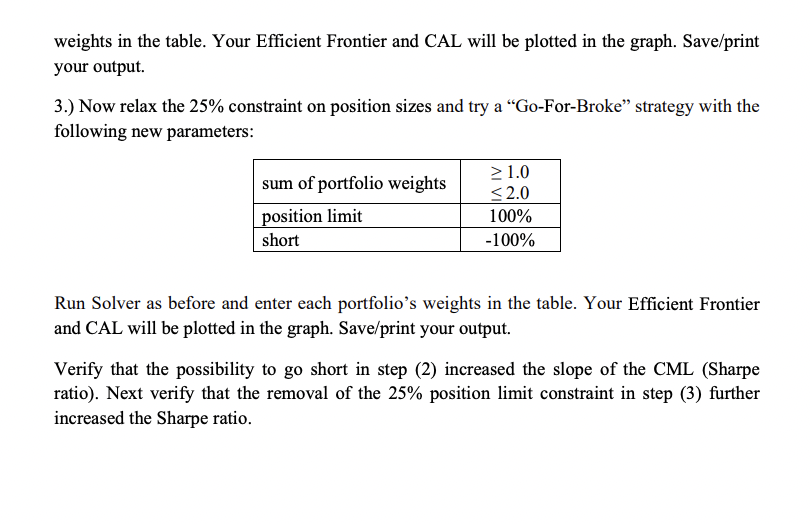

Pretend you are a long-short hedge fund manager. This time create a 10 stock portfolio with potential high alpha plays (both positive and negative alpha stocks). You may reuse several of the stocks you chose for your previous portfolio. Use the WSJ or internet to screen stocks and thoughtfully construct a diversified portfolio. Try to pick stocks that are decorrelated with U.S./European large cap indices (for example, Chinese stocks, mining stocks, etc). In addition, include 3-4 negative alpha stocks (potential shorts) whose price seems to be in a fundamental down-trend. Again, collect the past eight years of historical monthly prices, which you will enter into the price data columns of the provided Excel spreadsheet. Did you now find any pairs stocks in the correlation coefficient table that have had very different price behaviour? Now graph the Efficient Frontier and the Capital Asset Line. To plot the portfolios on the Efficient Frontier, use the Solver function of Excel. The steps for calculating the various portfolio combinations on the efficient frontier are given in my spreadsheet. For each of your stocks, make a reasonable forecast for annualized future returns over the next year. Overwrite columns C4 to C13 with your forecasts. If you are unsure in making a forecast, you may just leave the given historical annualized return for this exercise. 1.) Use the following new parameters: sum of portfolio weights position limit short 1.0 2.0 25% 0% Your portfolio will have the possibility to be leveraged up to 200%. Position limits are 25% for longs and no shorts are allowed at first. Run Solver as before and enter each portfolio's weights in the table. Your Efficient Frontier and CAL will be plotted in the graph. You may need to adjust the x-axis and y-axis to fit your data. Save/print your output. 2.) Use the following new parameters: sum of portfolio weights position limit short 1.0

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer As a longshort hedge fund manager I have carefully constructed a diversified portfolio of 10 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started