Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Preview File Edit View Go Tools Window Help 3- 6744.pdf Page 122 of 211 View > volunteer Standards oi... A Inspector Zoom Share D

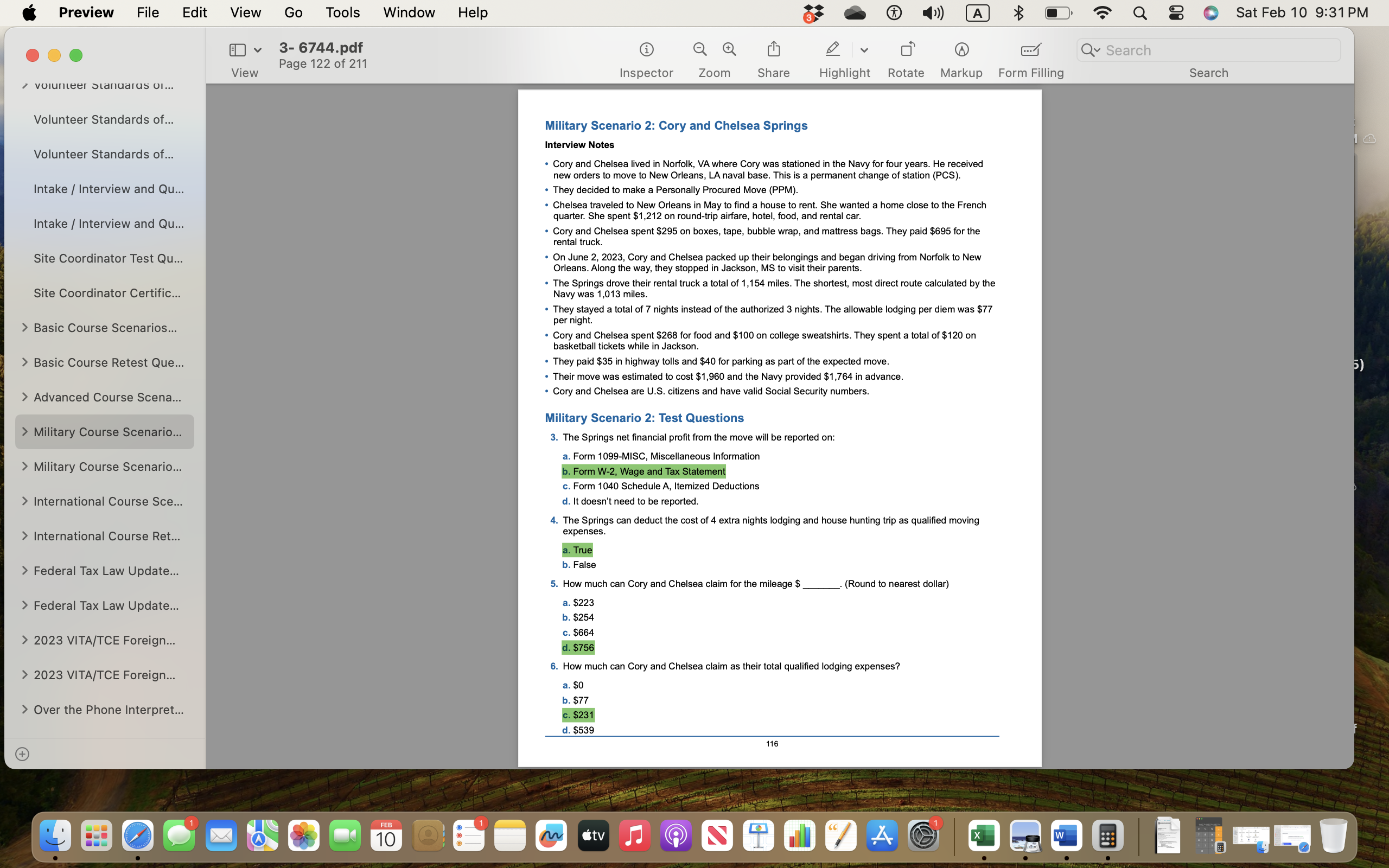

Preview File Edit View Go Tools Window Help 3- 6744.pdf Page 122 of 211 View > volunteer Standards oi... A Inspector Zoom Share D Highlight Q Search Rotate Markup Form Filling Search Volunteer Standards of... Volunteer Standards of... Intake / Interview and Qu... Intake / Interview and Qu... Site Coordinator Test Qu... Site Coordinator Certific... > Basic Course Scenarios... > Basic Course Retest Que... > Advanced Course Scena... > Military Course Scenario... > Military Course Scenario... > International Course Sce... > International Course Ret... > Federal Tax Law Update... > Federal Tax Law Update... > 2023 VITA/TCE Foreign... Military Scenario 2: Cory and Chelsea Springs Interview Notes Cory and Chelsea lived in Norfolk, VA where Cory was stationed in the Navy for four years. He received new orders to move to New Orleans, LA naval base. This is a permanent change of station (PCS). They decided to make a Personally Procured Move (PPM). Chelsea traveled to New Orleans in May to find a house to rent. She wanted a home close to the French quarter. She spent $1,212 on round-trip airfare, hotel, food, and rental car. Cory and Chelsea spent $295 on boxes, tape, bubble wrap, and mattress bags. They paid $695 for the rental truck. On June 2, 2023, Cory and Chelsea packed up their belongings and began driving from Norfolk to New Orleans. Along the way, they stopped in Jackson, MS to visit their parents. The Springs drove their rental truck a total of 1,154 miles. The shortest, most direct route calculated by the Navy was 1,013 miles. They stayed a total of 7 nights instead of the authorized 3 nights. The allowable lodging per diem was $77 per night. Cory and Chelsea spent $268 for food and $100 on college sweatshirts. They spent a total of $120 on basketball tickets while in Jackson. They paid $35 in highway tolls and $40 for parking as part of the expected move. Their move was estimated to cost $1,960 and the Navy provided $1,764 in advance. Cory and Chelsea are U.S. citizens and have valid Social Security numbers. Military Scenario 2: Test Questions 3. The Springs net financial profit from the move will be reported on: a. Form 1099-MISC, Miscellaneous Information b. Form W-2, Wage and Tax Statement c. Form 1040 Schedule A, Itemized Deductions d. It doesn't need to be reported. 4. The Springs can deduct the cost of 4 extra nights lodging and house hunting trip as qualified moving expenses. a. True b. False 5. How much can Cory and Chelsea claim for the mileage $ a. $223 b. $254 c. $664 (Round to nearest dollar) > 2023 VITA/TCE Foreign... > Over the Phone Interpret... + FEB d. $756 6. How much can Cory and Chelsea claim as their total qualified lodging expenses? a. $0 b. $77 c. $231 d. $539 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started