Question

Previous expert did the wrong problem. I will downvote if done incorrectly. PLEASE ONLY DO PROBLEM 13-4. 13-4 13-4 13-4 13-4. NOT 13-3. NOT 13-3.

Previous expert did the wrong problem. I will downvote if done incorrectly. PLEASE ONLY DO PROBLEM 13-4. 13-4 13-4 13-4 13-4. NOT 13-3. NOT 13-3. NOT 13-3. I am only including 13-3 to include necessary information. AGAIN

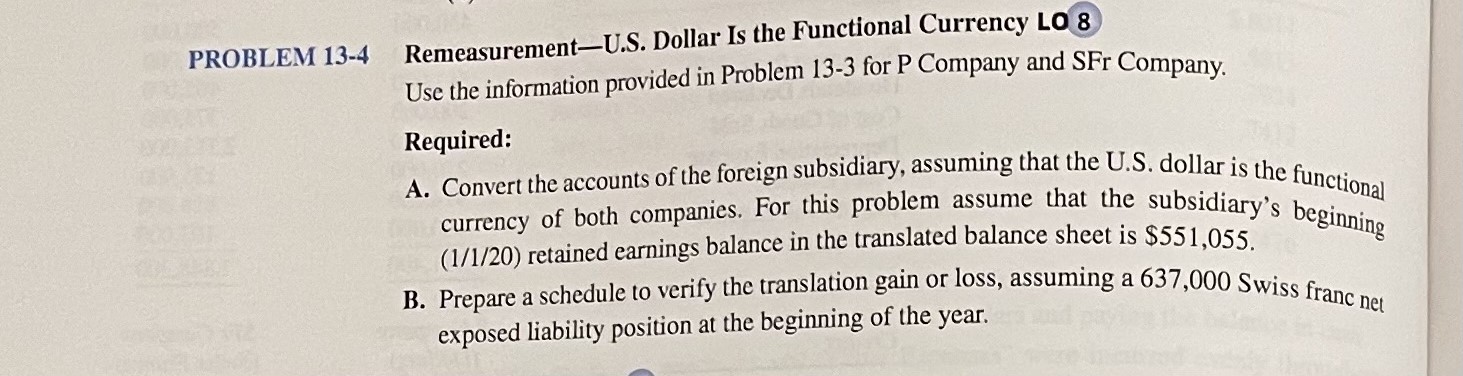

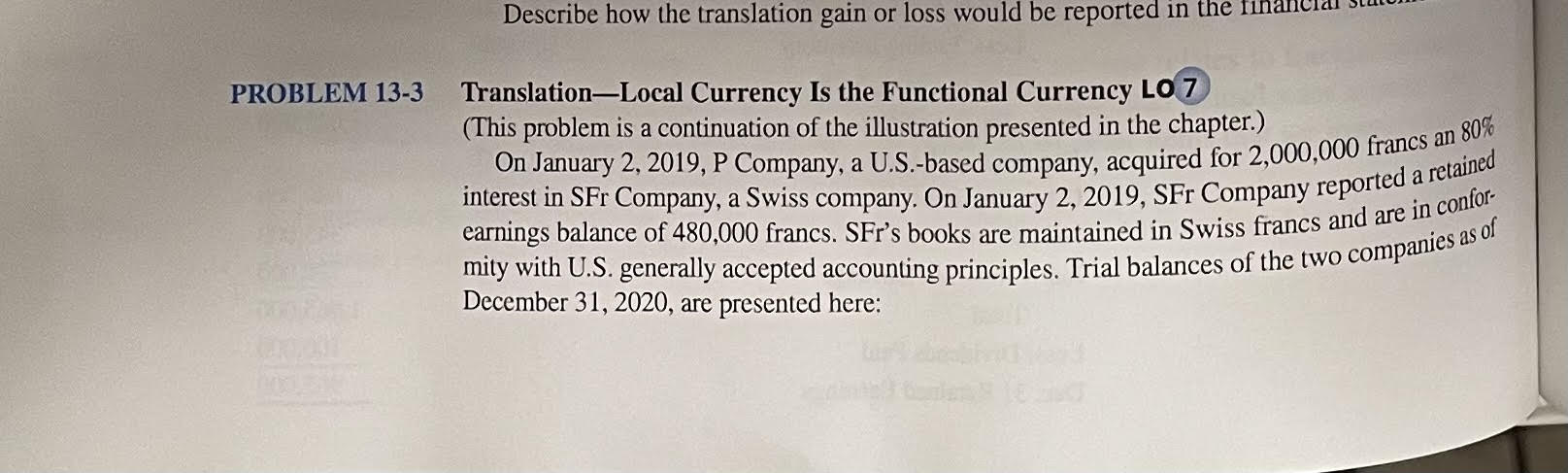

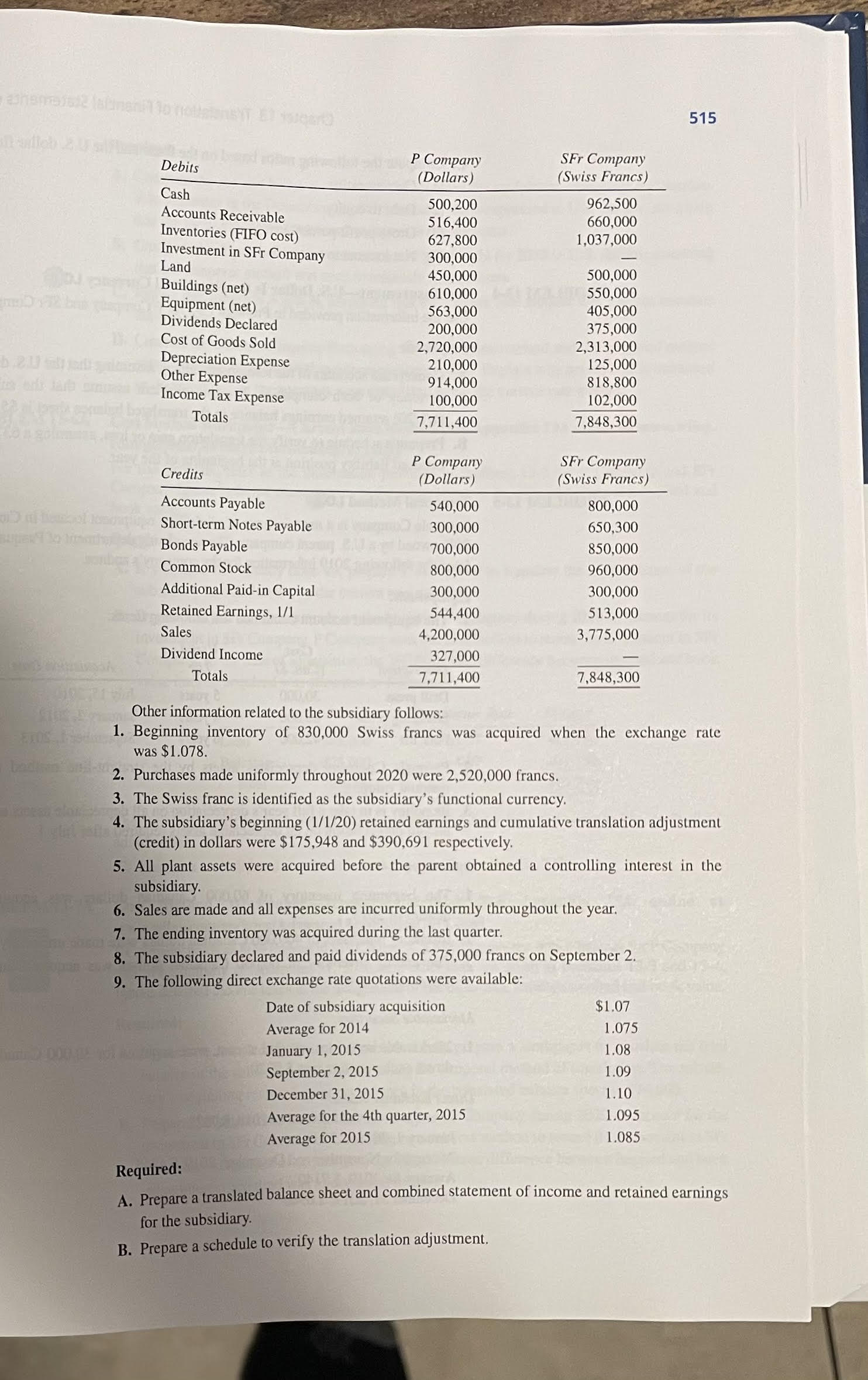

Translation-Local Currency Is the Functional Currency LO7 (This problem is a continuation of the illustration presented in the chapter.) On January 2, 2019, P Company, a U.S.-based company, acquired for 2,000,000 francs an 80% interest in SFr Company, a Swiss company. On January 2, 2019, SFr Company reported a retained earnings balance of 480,000 francs. SFr's books are maintained in Swiss francs and are in conformity with U.S. generally accepted accounting principles. Trial balances of the two companies as of December 31, 2020, are presented here: Other information related to the subsidiary follows: 1. Beginning inventory of 830,000 Swiss francs was acquired when the exchange rate was $1.078. 2. Purchases made uniformly throughout 2020 were 2,520,000 francs. 3. The Swiss franc is identified as the subsidiary's functional currency. 4. The subsidiary's beginning (1/1/20) retained earnings and cumulative translation adjustment (credit) in dollars were $175,948 and $390,691 respectively. 5. All plant assets were acquired before the parent obtained a controlling interest in the subsidiary. 6. Sales are made and all expenses are incurred uniformly throughout the year. 7. The ending inventory was acquired during the last quarter. 8. The subsidiary declared and paid dividends of 375,000 francs on September 2. 9. The following direct exchange rate quotations were available: Required: A. Prepare a translated balance sheet and combined statement of income and retained earnings for the subsidiary. B. Prepare a schedule to verify the translation adjustment. Remeasurement-U.S. Dollar Is the Functional Currency LO 8 Use the information provided in Problem 13-3 for P Company and SFr Company. Required: A. Convert the accounts of the foreign subsidiary, assuming that the U.S. dollar is the functional currency of both companies. For this problem assume that the subsidiary's beginning (1/1/20) retained earnings balance in the translated balance sheet is $551,055. B. Prepare a schedule to verify the translation gain or loss, assuming a 637,000 Swiss franc net exposed liability position at the beginning of the year. Translation-Local Currency Is the Functional Currency LO7 (This problem is a continuation of the illustration presented in the chapter.) On January 2, 2019, P Company, a U.S.-based company, acquired for 2,000,000 francs an 80% interest in SFr Company, a Swiss company. On January 2, 2019, SFr Company reported a retained earnings balance of 480,000 francs. SFr's books are maintained in Swiss francs and are in conformity with U.S. generally accepted accounting principles. Trial balances of the two companies as of December 31, 2020, are presented here: Other information related to the subsidiary follows: 1. Beginning inventory of 830,000 Swiss francs was acquired when the exchange rate was $1.078. 2. Purchases made uniformly throughout 2020 were 2,520,000 francs. 3. The Swiss franc is identified as the subsidiary's functional currency. 4. The subsidiary's beginning (1/1/20) retained earnings and cumulative translation adjustment (credit) in dollars were $175,948 and $390,691 respectively. 5. All plant assets were acquired before the parent obtained a controlling interest in the subsidiary. 6. Sales are made and all expenses are incurred uniformly throughout the year. 7. The ending inventory was acquired during the last quarter. 8. The subsidiary declared and paid dividends of 375,000 francs on September 2. 9. The following direct exchange rate quotations were available: Required: A. Prepare a translated balance sheet and combined statement of income and retained earnings for the subsidiary. B. Prepare a schedule to verify the translation adjustment. Remeasurement-U.S. Dollar Is the Functional Currency LO 8 Use the information provided in Problem 13-3 for P Company and SFr Company. Required: A. Convert the accounts of the foreign subsidiary, assuming that the U.S. dollar is the functional currency of both companies. For this problem assume that the subsidiary's beginning (1/1/20) retained earnings balance in the translated balance sheet is $551,055. B. Prepare a schedule to verify the translation gain or loss, assuming a 637,000 Swiss franc net exposed liability position at the beginning of the year

Translation-Local Currency Is the Functional Currency LO7 (This problem is a continuation of the illustration presented in the chapter.) On January 2, 2019, P Company, a U.S.-based company, acquired for 2,000,000 francs an 80% interest in SFr Company, a Swiss company. On January 2, 2019, SFr Company reported a retained earnings balance of 480,000 francs. SFr's books are maintained in Swiss francs and are in conformity with U.S. generally accepted accounting principles. Trial balances of the two companies as of December 31, 2020, are presented here: Other information related to the subsidiary follows: 1. Beginning inventory of 830,000 Swiss francs was acquired when the exchange rate was $1.078. 2. Purchases made uniformly throughout 2020 were 2,520,000 francs. 3. The Swiss franc is identified as the subsidiary's functional currency. 4. The subsidiary's beginning (1/1/20) retained earnings and cumulative translation adjustment (credit) in dollars were $175,948 and $390,691 respectively. 5. All plant assets were acquired before the parent obtained a controlling interest in the subsidiary. 6. Sales are made and all expenses are incurred uniformly throughout the year. 7. The ending inventory was acquired during the last quarter. 8. The subsidiary declared and paid dividends of 375,000 francs on September 2. 9. The following direct exchange rate quotations were available: Required: A. Prepare a translated balance sheet and combined statement of income and retained earnings for the subsidiary. B. Prepare a schedule to verify the translation adjustment. Remeasurement-U.S. Dollar Is the Functional Currency LO 8 Use the information provided in Problem 13-3 for P Company and SFr Company. Required: A. Convert the accounts of the foreign subsidiary, assuming that the U.S. dollar is the functional currency of both companies. For this problem assume that the subsidiary's beginning (1/1/20) retained earnings balance in the translated balance sheet is $551,055. B. Prepare a schedule to verify the translation gain or loss, assuming a 637,000 Swiss franc net exposed liability position at the beginning of the year. Translation-Local Currency Is the Functional Currency LO7 (This problem is a continuation of the illustration presented in the chapter.) On January 2, 2019, P Company, a U.S.-based company, acquired for 2,000,000 francs an 80% interest in SFr Company, a Swiss company. On January 2, 2019, SFr Company reported a retained earnings balance of 480,000 francs. SFr's books are maintained in Swiss francs and are in conformity with U.S. generally accepted accounting principles. Trial balances of the two companies as of December 31, 2020, are presented here: Other information related to the subsidiary follows: 1. Beginning inventory of 830,000 Swiss francs was acquired when the exchange rate was $1.078. 2. Purchases made uniformly throughout 2020 were 2,520,000 francs. 3. The Swiss franc is identified as the subsidiary's functional currency. 4. The subsidiary's beginning (1/1/20) retained earnings and cumulative translation adjustment (credit) in dollars were $175,948 and $390,691 respectively. 5. All plant assets were acquired before the parent obtained a controlling interest in the subsidiary. 6. Sales are made and all expenses are incurred uniformly throughout the year. 7. The ending inventory was acquired during the last quarter. 8. The subsidiary declared and paid dividends of 375,000 francs on September 2. 9. The following direct exchange rate quotations were available: Required: A. Prepare a translated balance sheet and combined statement of income and retained earnings for the subsidiary. B. Prepare a schedule to verify the translation adjustment. Remeasurement-U.S. Dollar Is the Functional Currency LO 8 Use the information provided in Problem 13-3 for P Company and SFr Company. Required: A. Convert the accounts of the foreign subsidiary, assuming that the U.S. dollar is the functional currency of both companies. For this problem assume that the subsidiary's beginning (1/1/20) retained earnings balance in the translated balance sheet is $551,055. B. Prepare a schedule to verify the translation gain or loss, assuming a 637,000 Swiss franc net exposed liability position at the beginning of the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started