Question

Previous Information: Buyouts V wants to structure the transaction as a traditional LBO in order to maximize its return on equity, while maintaining reasonable interest

Previous Information:

Buyouts V wants to structure the transaction as a traditional LBO in order to maximize its return

on equity, while maintaining reasonable interest coverage ratios. Buyouts V expects to finance

the transaction with 2.0x 2011 EB1TDA of senior debt and 1.5x 2011 EBITDA of subordinated

debt. The remaining cash consideration will be financed with equity. The senior debt and

subordinated debt carry fixed annual interest rates of 5.5% and 10%, respectively.

Buyouts V is excited about this investment but needs to make sure the deal meets the Fund's

designated investment hurdle rate. After several meetings with Half's management team and

some industry due diligence, Buyouts V develops the following assumptions:

2010 EBITDA of $6.4 million;

12.5% annual EBITDA growth;

Depreciation to equal one-quarter of EBITDA;

Capital expenditures in a year to equal the depreciation for the year;

Corporate tax rate of 35%;

Working capital and other cash adjustments to equal zero;

A minimum cash balance of $2.0 million to remain on the Company's balance sheet at all

times following the acquisition;

Interest income of 2% annually will be earned on all cash on the balance sheet;

Buyouts V to purchase the company without any cash on the balance sheet and retain all cash

on the balance sheet, if any, at the time of sale;

All remaining free cash flow used to repay senior debt ONLY (i.e., no repayment of

subordinated debt until maturity), with any free cash flow remaining after the repayment of

senior debt accumulating to cash on hand;

Subordinated debt matures in 10 years and does not require any principal amortization until

Year 10 (i.e., no free cash flow is required to pay down subordinated debt prior to Year 10

although cash interest payments are made in each year);

Employees of the company granted 8% of the ownership in Half & Full in the form of

options with a zero strike price, with all options vesting upon a change of control;

Sale of the company in December 2015 (five years after the LBO) for an EV of 6.0 times

forward EBITDA;

No financing costs or transaction fees; and

Target deal-level IRR of 25%.

Question: The next step for Buyouts V is to develop a financial model based on the assumptions

above. What is the highest price that Buyouts V should be willing to pay for the

company (debt plus equity)

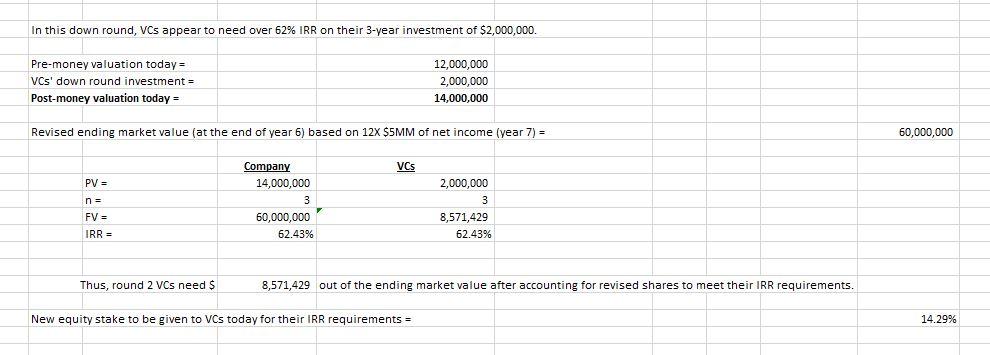

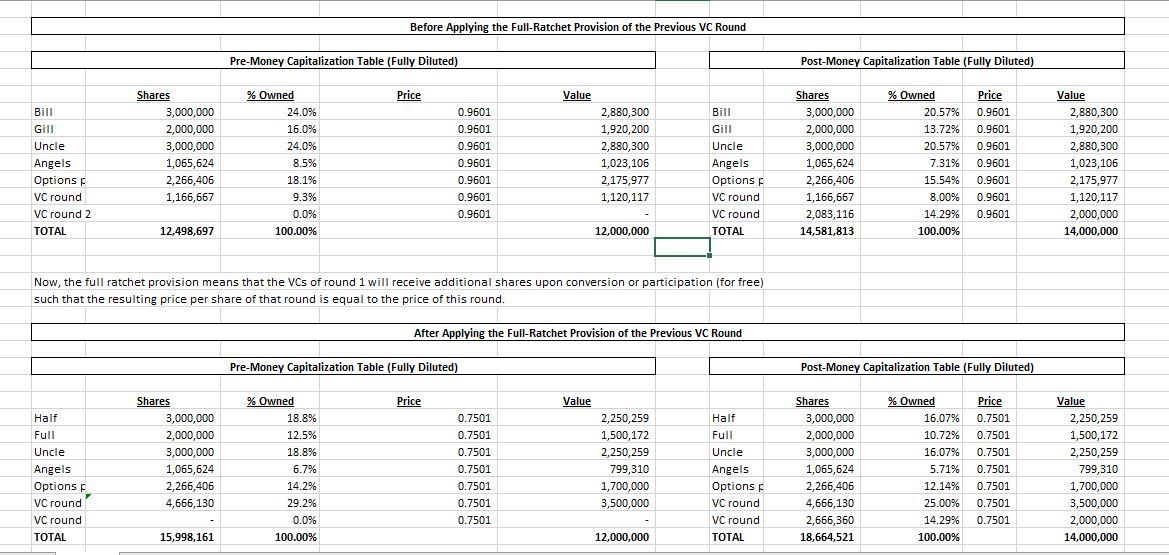

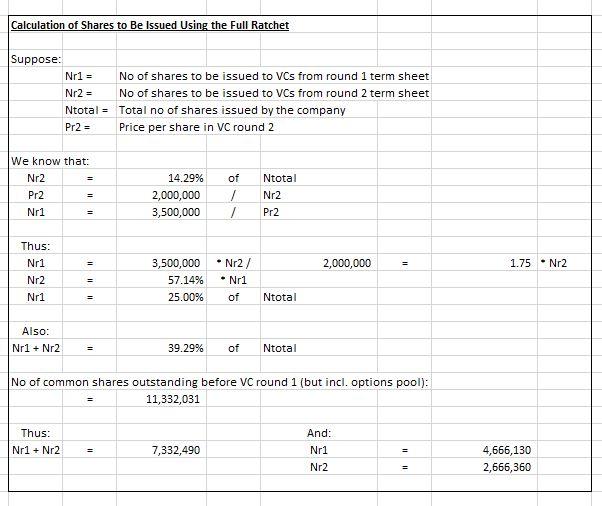

In this down round, VCs appear to need over 62% IRR on their 3-year investment of $2,000,000. Pre-money valuation today = VCs' down round investment = Post-money valuation today = 12,000,000 2,000,000 14,000,000 Revised ending market value (at the end of year 6) based on 12X $5MM of net income (year 7) = 60,000,000 VCS PV n = FV = IRR - Company 14,000,000 3 60,000,000 62.43% 2,000,000 3 8,571,429 62.43% Thus, round 2 VCs need $ 8,571,429 out of the ending market value after accounting for revised shares to meet their IRR requirements. New equity stake to be given to VCs today for their IRR requirements = 14.29% Before Applying the Full-Ratchet Provision of the Previous VC Round Pre-Money Capitalization Table (Fully Diluted) Post-Money Capitalization Table (Fully Diluted) Price Value % Owned 24.0% Bill Gill Bill Gill Uncle Angels Options VC round VC round 2 TOTAL Shares 3,000,000 2,000,000 3,000,000 1,065,624 2,266,406 1,166,667 16.0% 24.0% 8.5% 18.1% 9.3% 0.0% 100.00% 0.9601 0.9601 0.9601 0.9601 0.9601 0.9601 0.9601 2,880,300 1,920,200 2,880,300 1,023,106 2,175,977 1,120,117 Uncle Angels Options VC round VC round TOTAL Shares 3,000,000 2,000,000 3,000,000 1,065,624 2,266,406 1,166,667 2,083,116 14,581,813 % Owned 20.57% 13.72% 20.57% 7.31% 15.54% 8.00% 14.29% 100.00% Price 0.9601 0.9601 0.9601 0.9601 0.9601 0.9601 0.9601 Value 2,880,300 1,920,200 2,880,300 1,023,106 2,175,977 1,120,117 2,000,000 14,000,000 12,498,697 12,000,000 Now, the full ratchet provision means that the VCs of round 1 will receive additional shares upon conversion or participation (for free) such that the resulting price per share of that round is equal to the price of this round. After Applying the Full-Ratchet Provision of the Previous VC Round Pre-Money Capitalization Table (Fully Diluted) Post-Money Capitalization Table (Fully Diluted) Price Value Half Full Uncle Angels Options VC round VC round TOTAL Shares 3,000,000 2,000,000 3,000,000 1,065,624 2,266,406 4,666,130 % Owned 18.8% 12.5% 18.8% 6.7% 14.2% 29.2% 0.0% 100.00% 0.7501 0.7501 0.7501 0.7501 0.7501 0.7501 0.7501 2,250,259 1,500,172 2,250,259 799,310 1,700,000 3,500,000 Half Full Uncle Angels Options VC round VC round TOTAL Shares 3,000,000 2,000,000 3,000,000 1,065,624 2,266,406 4,666,130 2,666,360 18,664,521 % Owned Price 16.07% 0.7501 10.72% 0.7501 16.07% 0.7501 5.71% 0.7501 12.14% 0.7501 25.00% 0.7501 14.29% 0.7501 100.00% Value 2,250,259 1,500,172 2,250,259 799,310 1,700,000 3,500,000 2,000,000 14,000,000 15,998,161 12,000,000 Calculation of Shares to Be Issued Using the Full Ratchet Suppose: Nr1 = No of shares to be issued to VCs from round 1 term sheet Nr2 = No of shares to be issued to VCs from round 2 term sheet Ntotal = Total no of shares issued by the company Pr2 = Price per share in VC round 2 = We know that: Nr2 Pr2 Nr1 14.29% 2,000,000 3,500,000 of / / Ntotal Nr2 = Pr2 = 2,000,000 = 175 : N2 Thus: Nr1 Nr2 Nr1 3,500,000 57.14% 25.00% Nr2 / Nr1 of = Ntotal Also: Nr1 + Nr2 39.29% of Ntotal No of common shares outstanding before VC round 1 (but incl. options pool): 11,332,031 Thus: Nr1 + Nr2 7,332,490 And: Nr1 Nr2 4,666,130 2,666,360 In this down round, VCs appear to need over 62% IRR on their 3-year investment of $2,000,000. Pre-money valuation today = VCs' down round investment = Post-money valuation today = 12,000,000 2,000,000 14,000,000 Revised ending market value (at the end of year 6) based on 12X $5MM of net income (year 7) = 60,000,000 VCS PV n = FV = IRR - Company 14,000,000 3 60,000,000 62.43% 2,000,000 3 8,571,429 62.43% Thus, round 2 VCs need $ 8,571,429 out of the ending market value after accounting for revised shares to meet their IRR requirements. New equity stake to be given to VCs today for their IRR requirements = 14.29% Before Applying the Full-Ratchet Provision of the Previous VC Round Pre-Money Capitalization Table (Fully Diluted) Post-Money Capitalization Table (Fully Diluted) Price Value % Owned 24.0% Bill Gill Bill Gill Uncle Angels Options VC round VC round 2 TOTAL Shares 3,000,000 2,000,000 3,000,000 1,065,624 2,266,406 1,166,667 16.0% 24.0% 8.5% 18.1% 9.3% 0.0% 100.00% 0.9601 0.9601 0.9601 0.9601 0.9601 0.9601 0.9601 2,880,300 1,920,200 2,880,300 1,023,106 2,175,977 1,120,117 Uncle Angels Options VC round VC round TOTAL Shares 3,000,000 2,000,000 3,000,000 1,065,624 2,266,406 1,166,667 2,083,116 14,581,813 % Owned 20.57% 13.72% 20.57% 7.31% 15.54% 8.00% 14.29% 100.00% Price 0.9601 0.9601 0.9601 0.9601 0.9601 0.9601 0.9601 Value 2,880,300 1,920,200 2,880,300 1,023,106 2,175,977 1,120,117 2,000,000 14,000,000 12,498,697 12,000,000 Now, the full ratchet provision means that the VCs of round 1 will receive additional shares upon conversion or participation (for free) such that the resulting price per share of that round is equal to the price of this round. After Applying the Full-Ratchet Provision of the Previous VC Round Pre-Money Capitalization Table (Fully Diluted) Post-Money Capitalization Table (Fully Diluted) Price Value Half Full Uncle Angels Options VC round VC round TOTAL Shares 3,000,000 2,000,000 3,000,000 1,065,624 2,266,406 4,666,130 % Owned 18.8% 12.5% 18.8% 6.7% 14.2% 29.2% 0.0% 100.00% 0.7501 0.7501 0.7501 0.7501 0.7501 0.7501 0.7501 2,250,259 1,500,172 2,250,259 799,310 1,700,000 3,500,000 Half Full Uncle Angels Options VC round VC round TOTAL Shares 3,000,000 2,000,000 3,000,000 1,065,624 2,266,406 4,666,130 2,666,360 18,664,521 % Owned Price 16.07% 0.7501 10.72% 0.7501 16.07% 0.7501 5.71% 0.7501 12.14% 0.7501 25.00% 0.7501 14.29% 0.7501 100.00% Value 2,250,259 1,500,172 2,250,259 799,310 1,700,000 3,500,000 2,000,000 14,000,000 15,998,161 12,000,000 Calculation of Shares to Be Issued Using the Full Ratchet Suppose: Nr1 = No of shares to be issued to VCs from round 1 term sheet Nr2 = No of shares to be issued to VCs from round 2 term sheet Ntotal = Total no of shares issued by the company Pr2 = Price per share in VC round 2 = We know that: Nr2 Pr2 Nr1 14.29% 2,000,000 3,500,000 of / / Ntotal Nr2 = Pr2 = 2,000,000 = 175 : N2 Thus: Nr1 Nr2 Nr1 3,500,000 57.14% 25.00% Nr2 / Nr1 of = Ntotal Also: Nr1 + Nr2 39.29% of Ntotal No of common shares outstanding before VC round 1 (but incl. options pool): 11,332,031 Thus: Nr1 + Nr2 7,332,490 And: Nr1 Nr2 4,666,130 2,666,360Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started