Answered step by step

Verified Expert Solution

Question

1 Approved Answer

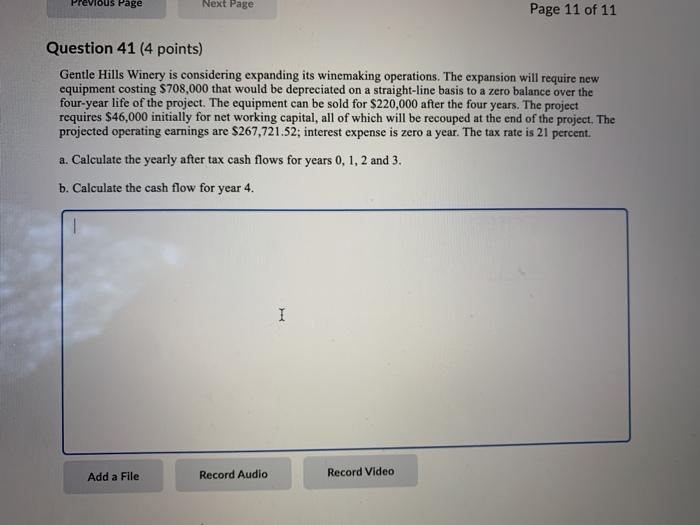

Previous Page Next Page Page 11 of 11 Question 41 (4 points) Gentle Hills Winery is considering expanding its winemaking operations. The expansion will require

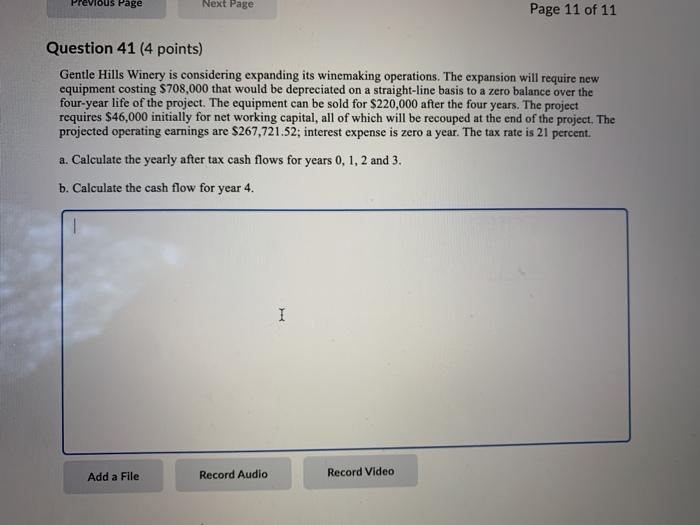

Previous Page Next Page Page 11 of 11 Question 41 (4 points) Gentle Hills Winery is considering expanding its winemaking operations. The expansion will require new equipment costing S708,000 that would be depreciated on a straight-line basis to a zero balance over the four-year life of the project. The equipment can be sold for $220,000 after the four years. The project requires $46,000 initially for net working capital, all of which will be recouped at the end of the project. The projected operating earnings are $267,721.52; interest expense is zero a year. The tax rate is 21 percent. a. Calculate the yearly after tax cash flows for years 0, 1, 2 and 3. b. Calculate the cash flow for year 4. Add a File Record Audio Record Video

Previous Page Next Page Page 11 of 11 Question 41 (4 points) Gentle Hills Winery is considering expanding its winemaking operations. The expansion will require new equipment costing S708,000 that would be depreciated on a straight-line basis to a zero balance over the four-year life of the project. The equipment can be sold for $220,000 after the four years. The project requires $46,000 initially for net working capital, all of which will be recouped at the end of the project. The projected operating earnings are $267,721.52; interest expense is zero a year. The tax rate is 21 percent. a. Calculate the yearly after tax cash flows for years 0, 1, 2 and 3. b. Calculate the cash flow for year 4. Add a File Record Audio Record Video

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started