Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Previous Page Next Page Page 2 of 30 Question 2 (1 point) If the one-year interest rate is 4% on Swiss francs and 7% on

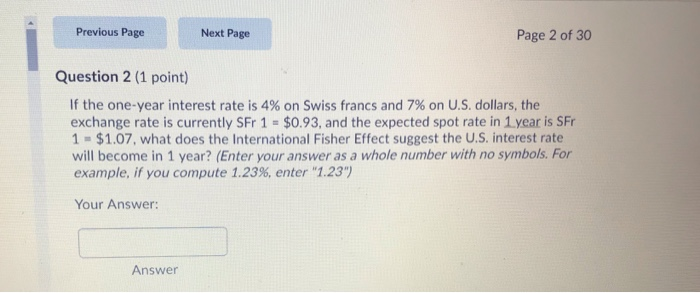

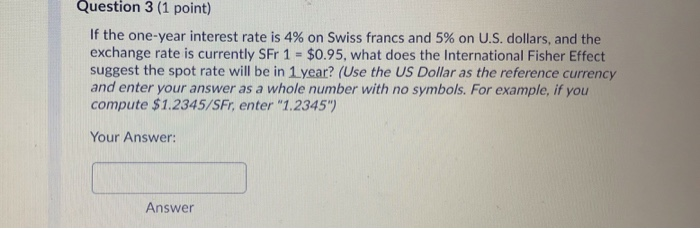

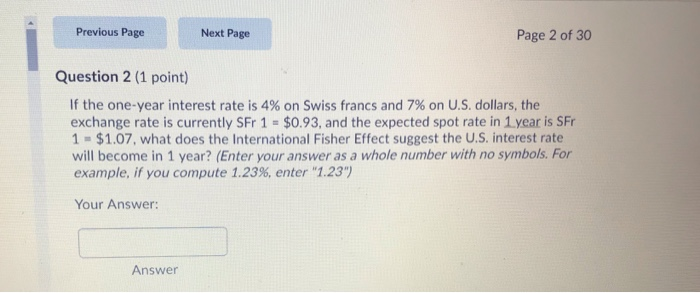

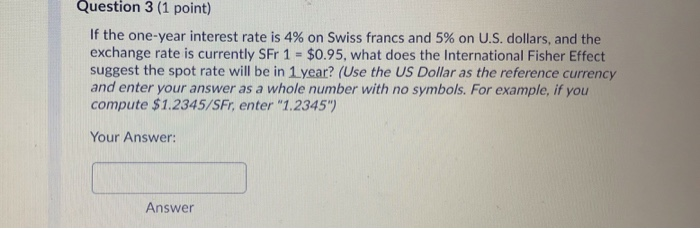

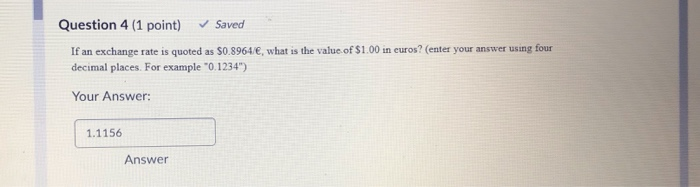

Previous Page Next Page Page 2 of 30 Question 2 (1 point) If the one-year interest rate is 4% on Swiss francs and 7% on U.S. dollars, the exchange rate is currently SFr 1 = $0.93, and the expected spot rate in 1 year is SFr 1 - $1.07, what does the International Fisher Effect suggest the U.S. interest rate will become in 1 year? (Enter your answer as a whole number with no symbols. For example, if you compute 1.23%, enter "1.23") Your Answer: Answer Question 3 (1 point) If the one-year interest rate is 4% on Swiss francs and 5% on U.S. dollars, and the exchange rate is currently SFr 1 - $0.95, what does the International Fisher Effect suggest the spot rate will be in 1year? (Use the US Dollar as the reference currency and enter your answer as a whole number with no symbols. For example, if you compute $1.2345/SFr, enter "1.2345") Your Answer: Answer Question 4 (1 point) Saved If an exchange rate is quoted as 50.8964/6, what is the value of $1.00 in curos? (enter your answer using four decimal places. For example "0.1234") Your Answer: 1.1156

Previous Page Next Page Page 2 of 30 Question 2 (1 point) If the one-year interest rate is 4% on Swiss francs and 7% on U.S. dollars, the exchange rate is currently SFr 1 = $0.93, and the expected spot rate in 1 year is SFr 1 - $1.07, what does the International Fisher Effect suggest the U.S. interest rate will become in 1 year? (Enter your answer as a whole number with no symbols. For example, if you compute 1.23%, enter "1.23") Your Answer: Answer Question 3 (1 point) If the one-year interest rate is 4% on Swiss francs and 5% on U.S. dollars, and the exchange rate is currently SFr 1 - $0.95, what does the International Fisher Effect suggest the spot rate will be in 1year? (Use the US Dollar as the reference currency and enter your answer as a whole number with no symbols. For example, if you compute $1.2345/SFr, enter "1.2345") Your Answer: Answer Question 4 (1 point) Saved If an exchange rate is quoted as 50.8964/6, what is the value of $1.00 in curos? (enter your answer using four decimal places. For example "0.1234") Your Answer: 1.1156

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started