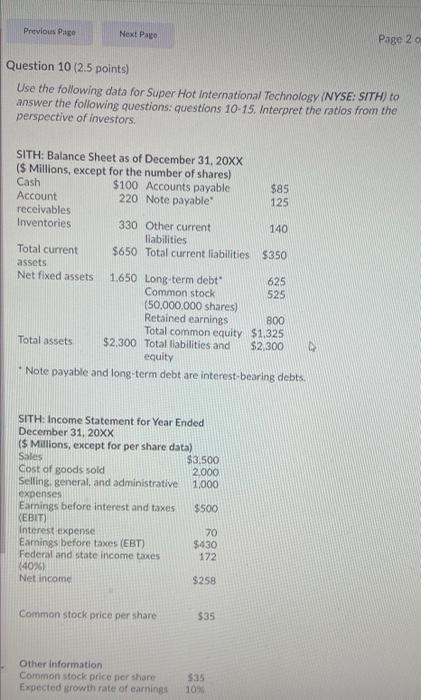

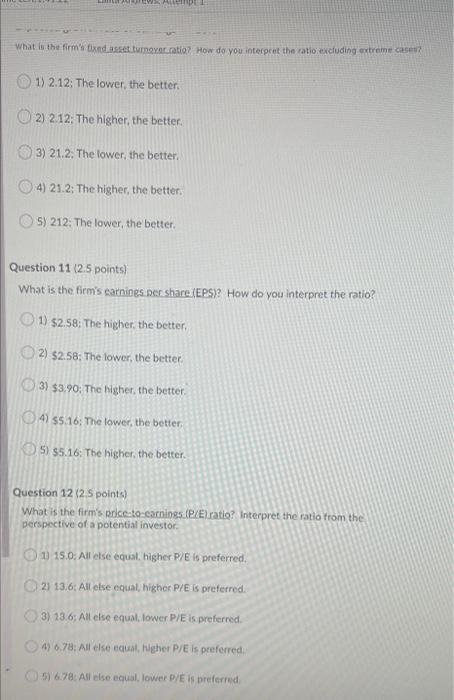

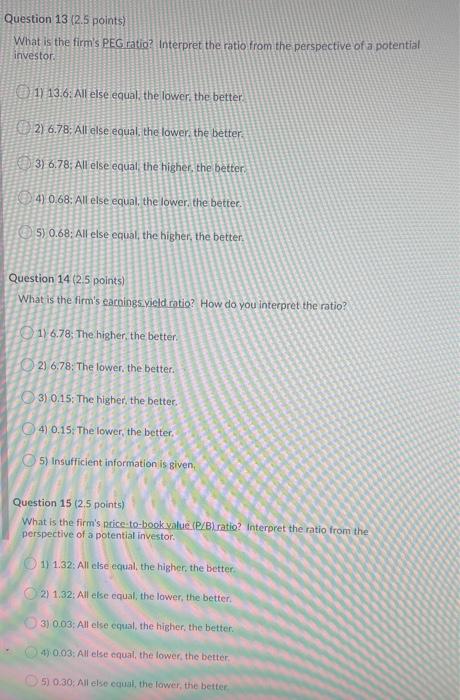

Previous Page Next Page Page 20 Question 10 (2.5 points) Use the following data for Super Hot International Technology (NYSE: SITH) to answer the following questions: questions 10-15. Interpret the ratios from the perspective of investors SITH: Balance Sheet as of December 31, 20XX ($ Millions, except for the number of shares) Cash $100 Accounts payable $85 Account 220 Note payable 125 receivables Inventories 330 Other current 140 Habilities Total current $650 Total current liabilities $350 assets Net fixed assets 1.650 Long-term debt 625 Common stock 525 (50,000,000 shares Retained earnings 800 Total common equity $1.325 Total assets $2,300 Total liabilities and $2 300 equity Note payable and long-term debt are interest-bearing debts. SITH: Income Statement for Year Ended December 31, 20XX (5 Millions, except for per share data) Sales $3.500 Cost of goods sold 2.000 Selling general, and administrative 1,000 expenses Earnings before interest and taxes $500 (EBIT) Interest expense 70 Earnings before taxes (EBT) $430 Federal and state income taxes 172 (40%) Net income $258 Common stock price per share $35 Other information Common stock price per share Expected growth rate of earnings $35 10% What is the firmwind asset tutoyer ratio? How do you interpret the ratio excluding extreme case 1) 2.12; The lower the better. 2) 2.12: The higher the better. 3) 21.2: The lower the better. 4) 21.2; The higher, the better. 5) 212: The lower, the better. Question 11 (2.5 points) What is the firm's earnings per share (EPS)? How do you interpret the ratio? 1) $2.58; The higher the better, 2) $2.58: The lower, the better. 3) $3.90: The higher, the better 4) 55 16; The lower the better 5) 55.16: The higher, the better. Question 12 12.5 points What is the firm's price-to-carnings.(CZE) ratio? Interpret the ratio from the perspective of a potential investor. 1) 15.0: All else equal higher P/E le preferred. 21 13.6: All else equal higher P/E is preferred. 3) 13.6: All else equal, lower P/E is preferred 4) 6.78: All else equat higher P/E is preferred 5) 6.7: Allelse equal, lower D/E is preferred Question 13 (2.5 points) What is the firm's PEG ratio? Interpret the ratio from the perspective of a potential investor 11 13.6: All else equal, the lower the better 2) 6.78: All else equal, the lower the better 3) 6.78: Allelse equal, the higher the better 4) 0.68: All else equal , the lower the better. 5) 0.68: All else equal, the higher, the better. Question 14 (2.5 points) What is the firm's eacoings yield ratio? How do you interpret the ratio? 1) 6.78; The higher the better 2) 6.78: The lower the better. 3) 0.15: The higher the better. 4) 0.15: The lower the better. 5) Insufficient information is given, Question 15 (2.5 points) What is the firm's price-to-book value (P/B ratio? Interpret the ratio from the perspective of a potential investor. 1) 1.32: All else equal, the higher the better 2) 1.32: All else equal the lower the better, 3) 0.03: All else equal, the higher the better. 4) 0.03: All else equal, the lower the better 5) 0.30: All else equal, the lower the better