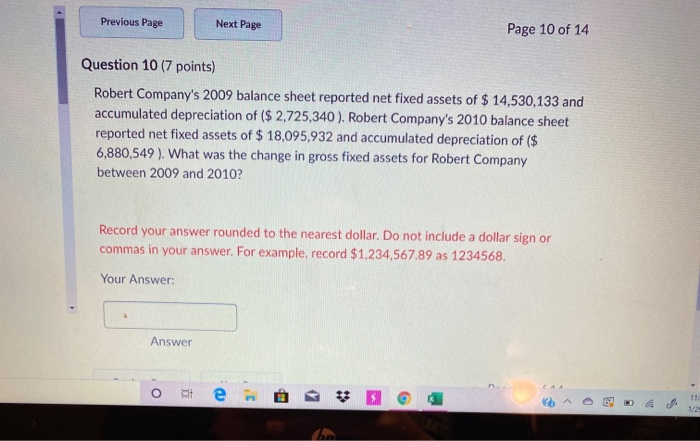

Previous Page Next Page Page 3 of 14 Question 3 (6 points) Sammy's Shovels had sales of $ 55,255 in 2010. The cost of goods sold was $ 36,196, operating expenses (excluding depreciation) were $ 19,414, interest expenses were $ 1,243, depreciation expense was $ 8,329, and dividends paid were $3,294. The firm's tax rate is 22 percent. What did Sammy's Shovels report as net income (or, net profit) in 2010? Record your answer rounded to the nearest dollar. Do not include a dollar sign or commas in your answer. If your answer is a negative number, place a minus sign before your answer with no space between the minus sign and the number. For example, record $1,234,567.89 as 1234568 or negative $543,210 as -543210. Your Answer: Answer delete backspace Question 4 (6 points) In 2010, the BowWow Company purchased 10,301 units from its supplier at a cost of $ 14 per unit. BowWow sold 12,397 units of its product in 2010 at a price of $ 23 per unit. BowWow began 2010 with $ 830,035 in inventory (inventory is carried at a cost of $ 14 per unit). Using this information, compute Bow Wow's gross profit for 2010. Record your answer rounded to the nearest dollar. Do not include a dollar sign or commas in your answer. For example, record $1,234,567.89 as 1234568. Your Answer: Answer o * e * o @GE Question 5 (6 points) In 2010, the BowWow Company purchased 19,414 units from its supplier at a cost of $13.85 per unit. BowWow sold 15,322 units of its product in 2010 at a price of $ 23.81 per unit. BowWow began 2010 with $ 985,208 in inventory (inventory is carried at a cost of $13.85 per unit). Using this information, compute Bow Wow's 2010 ending inventory balance (in dollars). Record your answer rounded to the nearest dollar. Do not include a dollar sign or commas in your answer. For example, record $1,234,567.89 as 1234568. Your Answer: Answer Previous Page Next Page Page 5 of 14 Submit Quiz O of 14 questions saved o e # 3 Question 6 (6 points) In 2010, Dangerous Dragon, Inc. (a retail clothing company) sold 555,640 units of its product at an average price of $ 19 per unit. The company reported estimated Returns and allowances in 2010 of 3 percent of gross revenue. Dangerous Dragon actually purchased 550,000 units of its product from its manufacturer in 2010 at an average cost of $ 8 per unit. Dangerous Dragon began 2010 with 85,000 units of its product in inventory (carried at an average cost of $ 8 per unit). Operating expenses (excluding depreciation) for Dangerous Dragon, Inc. in 2010 were $ 2,076,725 and depreciation expense was $ 114,028. Dangerous Dragon had $10,000,000 in debt outstanding throughout all of 2010. This debt carried an average interest rate of 6 percent. Finally, Dangerous Dragon's tax rate was 40 percent. Dangerous Dragon's fiscal year runs from January 1 through December 31. Given this information, construct Dangerous Dragon's 2010 multi-step income statement. What did Dangerous Dragon, Inc. record as NET INCOME on its 2010 income statement? Record vour answer rounded to the nearest dollar Do not include a dollar sion or OC- op Previous Page Next Page Page 10 of 14 Question 10 (7 points) Robert Company's 2009 balance sheet reported net fixed assets of $ 14,530,133 and accumulated depreciation of ($ 2,725,340 ). Robert Company's 2010 balance sheet reported net fixed assets of $ 18,095,932 and accumulated depreciation of ($ 6,880,549 ). What was the change in gross fixed assets for Robert Company between 2009 and 2010? Record your answer rounded to the nearest dollar. Do not include a dollar sign or commas in your answer. For example, record $1,234,567.89 as 1234568. Your Answer: Answer O e 3