Previous part

Question

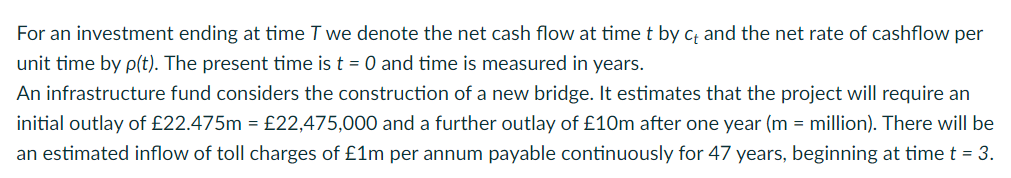

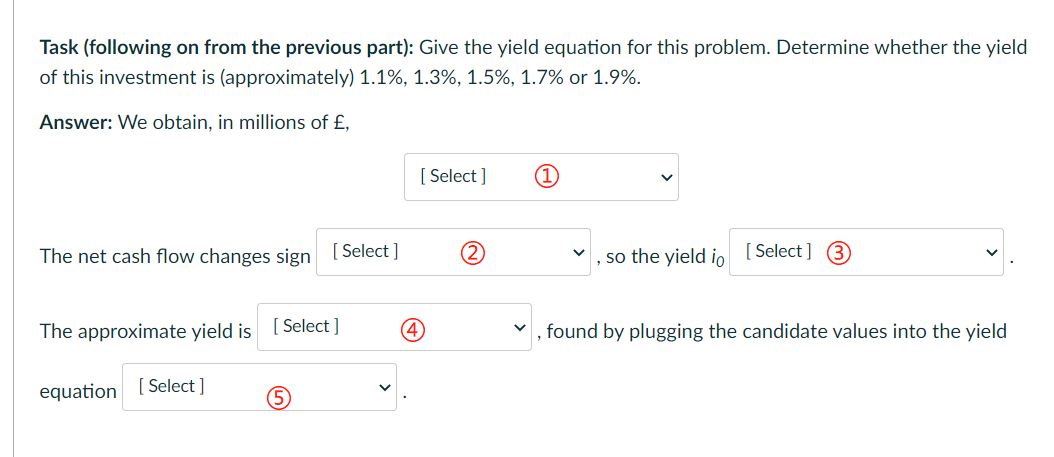

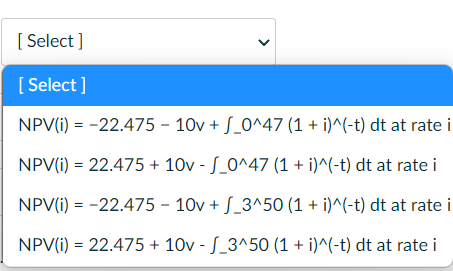

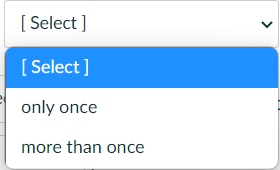

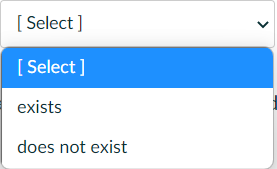

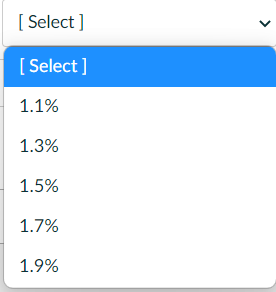

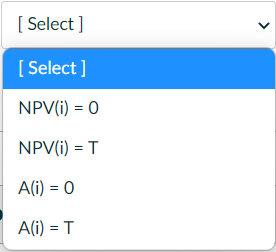

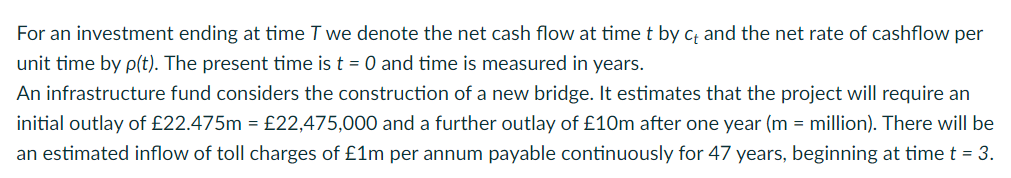

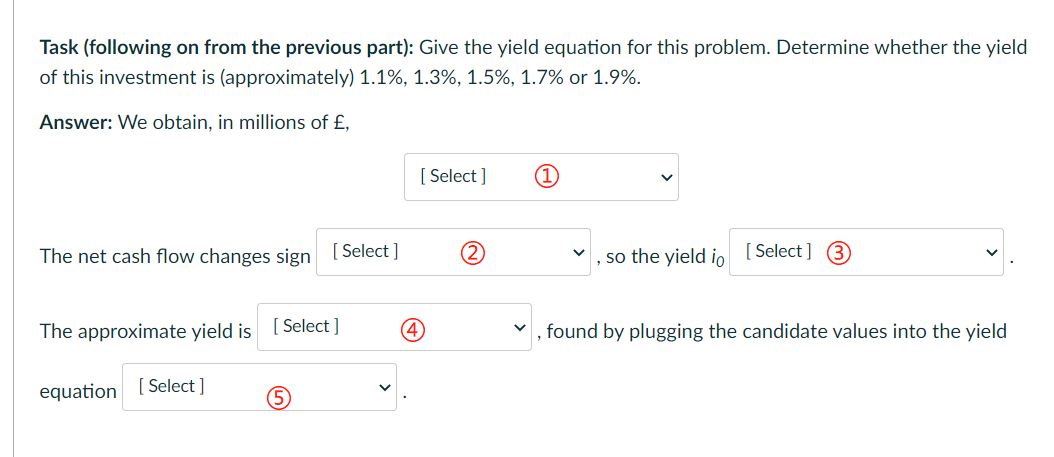

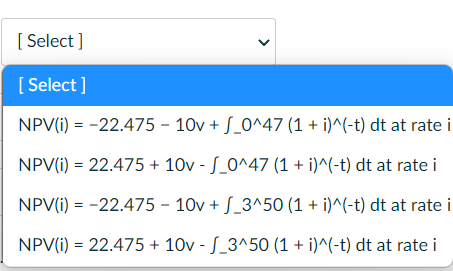

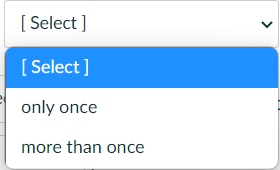

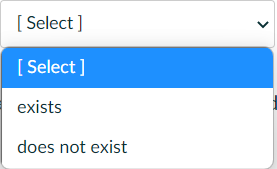

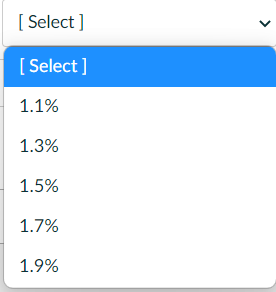

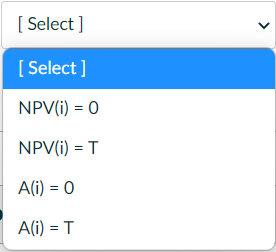

For an investment ending at time I we denote the net cash flow at time t by Ct and the net rate of cashflow per unit time by p(t). The present time is t = 0 and time is measured in years. An infrastructure fund considers the construction of a new bridge. It estimates that the project will require an initial outlay of 22.475m = 22,475,000 and a further outlay of 10m after one year (m = million). There will be an estimated inflow of toll charges of 1m per annum payable continuously for 47 years, beginning at time t = 3. Task (following on from the previous part): Give the yield equation for this problem. Determine whether the yield of this investment is (approximately) 1.1%, 1.3%, 1.5%, 1.7% or 1.9%. Answer: We obtain, in millions of , [Select] 1 The net cash flow changes sign [Select] 2 , so the yield io [ Select ] 3 The approximate yield is [ Select] 4 found by plugging the candidate values into the yield equation [Select ] 5 [ Select ] > [ Select] NPV(i) = -22.475 - 10v+S_0447 (1 + i)^(-t) dt at rate i NPV(i) = 22.475 + 10v - S_0^47 (1 + i)^(-t) dt at rate i NPV(i) = -22.475 - 10v + S_3150 (1 + i)^(-t) dt at rate i NPV(i) = 22.475 + 10v - S_3450 (1 + i)^(-t) dt at rate i [ Select] V [ Select] only once more than once [ Select] [ Select] exists does not exist L [ Select] [ Select] 1.1% 1.3% 1.5% 1.7% 1.9% [ Select] [Select ] NPV(i) = 0 NPV(i) = T A(i) = 0 A(i) = T For an investment ending at time I we denote the net cash flow at time t by Ct and the net rate of cashflow per unit time by p(t). The present time is t = 0 and time is measured in years. An infrastructure fund considers the construction of a new bridge. It estimates that the project will require an initial outlay of 22.475m = 22,475,000 and a further outlay of 10m after one year (m = million). There will be an estimated inflow of toll charges of 1m per annum payable continuously for 47 years, beginning at time t = 3. Task (following on from the previous part): Give the yield equation for this problem. Determine whether the yield of this investment is (approximately) 1.1%, 1.3%, 1.5%, 1.7% or 1.9%. Answer: We obtain, in millions of , [Select] 1 The net cash flow changes sign [Select] 2 , so the yield io [ Select ] 3 The approximate yield is [ Select] 4 found by plugging the candidate values into the yield equation [Select ] 5 [ Select ] > [ Select] NPV(i) = -22.475 - 10v+S_0447 (1 + i)^(-t) dt at rate i NPV(i) = 22.475 + 10v - S_0^47 (1 + i)^(-t) dt at rate i NPV(i) = -22.475 - 10v + S_3150 (1 + i)^(-t) dt at rate i NPV(i) = 22.475 + 10v - S_3450 (1 + i)^(-t) dt at rate i [ Select] V [ Select] only once more than once [ Select] [ Select] exists does not exist L [ Select] [ Select] 1.1% 1.3% 1.5% 1.7% 1.9% [ Select] [Select ] NPV(i) = 0 NPV(i) = T A(i) = 0 A(i) = T