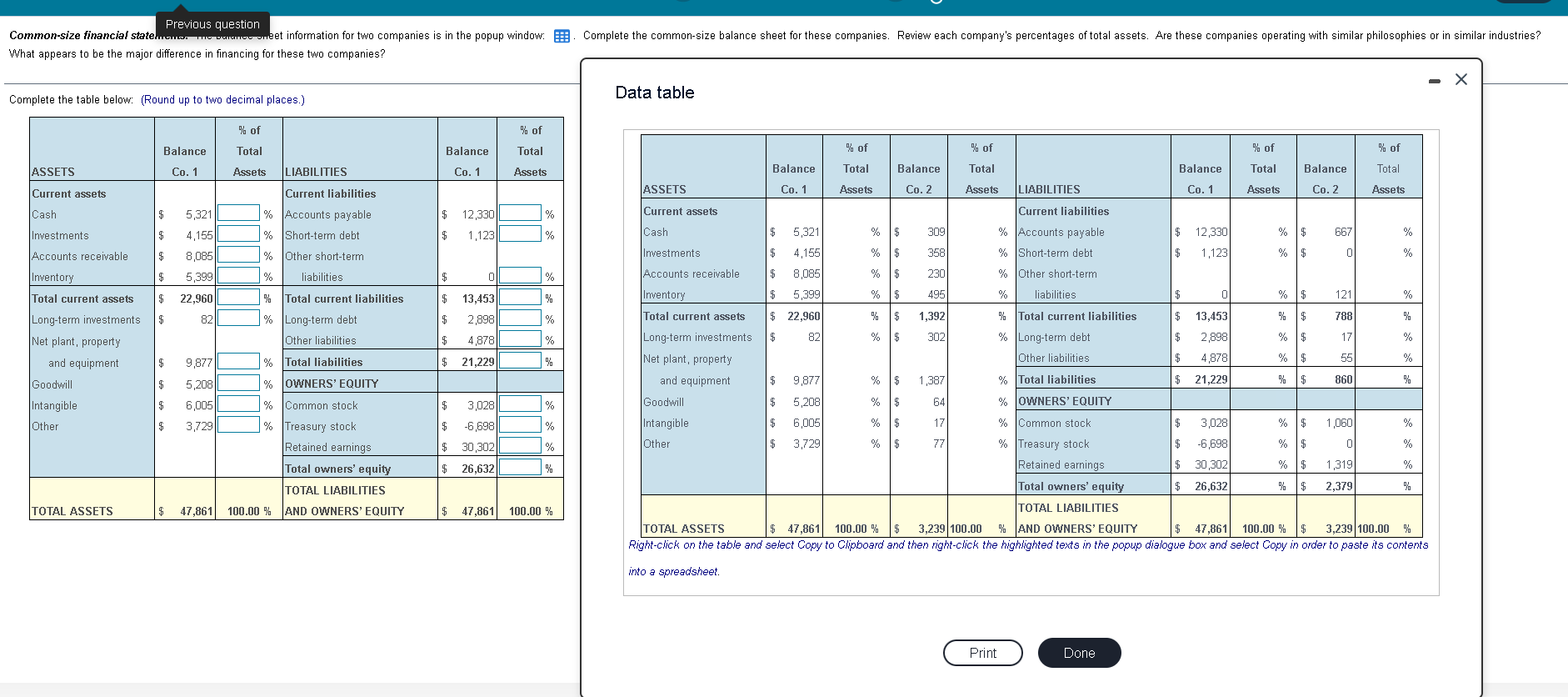

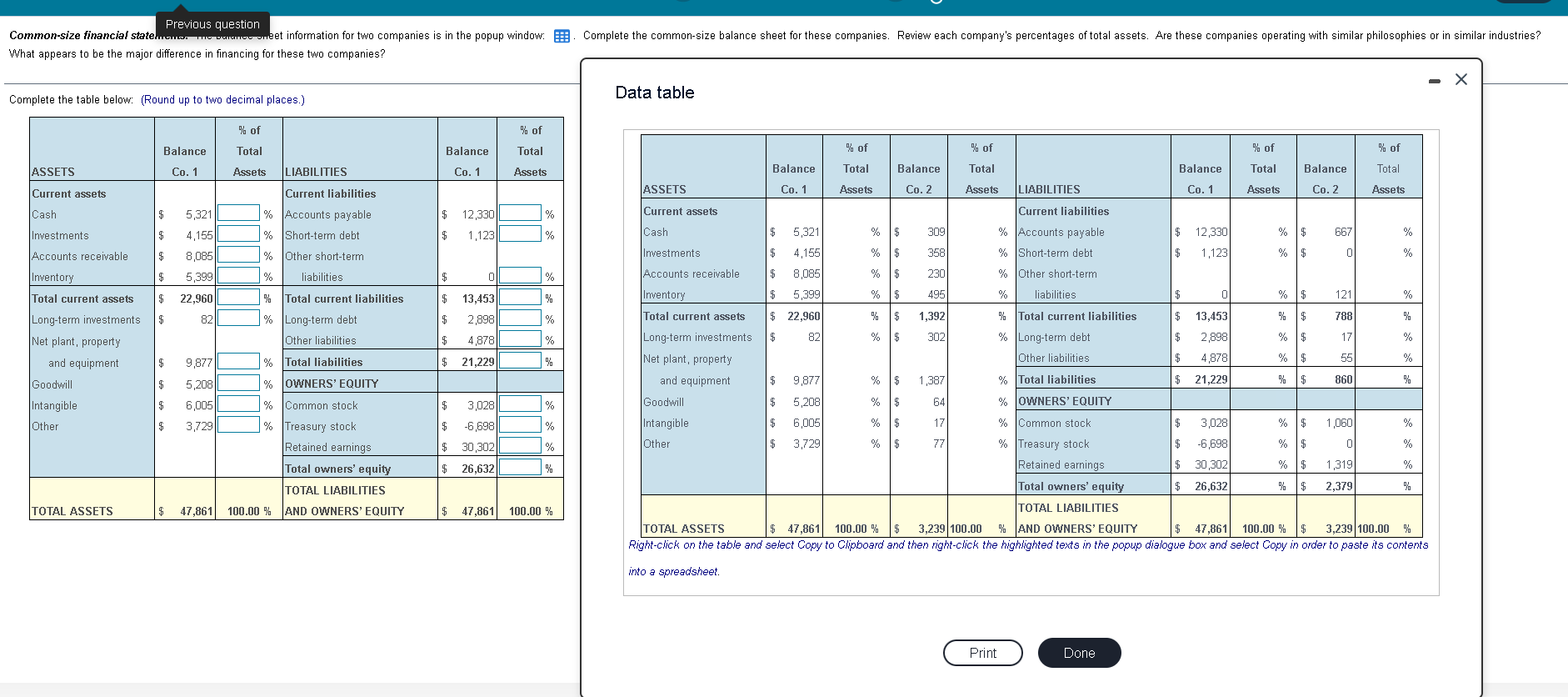

Previous question Common-size financial state.com. VIII-wmeet information for two companies is in the popup window: What appears to be the major difference in financing for these two companies? Complete the common-size balance sheet for these companies. Review each company's percentages of total assets. Are these companies operating with similar philosophies or in similar industries? Data table Complete the table below: (Round up to two decimal places.) % of % of Balance Total Balance Total % of % of % of % of ASSETS Co. 1 Assets LIABILITIES Co. 1 Assets Balance Total Balance Total Balance Total Balance Total ASSETS Co. 1 Assets Co. 2 Assets LIABILITIES Co. 1 Assets Co. 2 Assets Current assets Cash $ 5,321 Current liabilities % Accounts payable % Short-term debt $ 12,330 % Investments 5 4,1551 $ 1,123 % Accounts receivable $ 8,085 % Other short-term * Inventory $ 5,3991 $ 0 % Total current assets $ 22,960 $ % % liabilities % Total current liabilities % Long-term debt Other liabilities 13,453 2,898 Long-term investments $ 821 $ % Net plant, property $ 4,878 % > $ 9,877 % Total liabilities $ 21,229 % 5,2081 % OWNERS' EQUITY 1,387 and equipment Goodwill Intangible Other Current assets Current liabilities Cash $ 5,321 % $ 309 % Accounts payable $ 12,330 % $ 667 % Investments $ 4,155 % $ 358 % Short-term debt $ 1,123 % $ % Accounts receivable 8,085 230 % Other short-term Inventory 5,399 495 % liabilities $ % $ 121 % Total current assets $ 22,960 % $ 1,392 % Total current liabilities $ 13,453 % $ 788 % Long-term investments $ 82 % $ 302 % Long-term debt $ 2,898 17 % Net plant, property Other liabilities $ 4,878 % $ 55 % and equipment $ 9,877 % Total liabilities $ 21,229 % $ 860 % Goodwill $ 5,208) % $ 64 % OWNERS' EQUITY Intangible $ 6,005 % $ 17 % Common stock 5 3,028 % $ 1,060 % Other 3,729 % $ 77 % Treasury stock $ -6,698 % $ % Retained earnings $ 30,302 % $ 1,319 % Total owners' equity $ 26,632 % $ 2,379 % TOTAL LIABILITIES TOTAL ASSETS $ 47,861 100.00 % $ 3,239100.00 % AND OWNERS' EQUITY $ 47,861 100.00 % $ 3,239100.00 % Right click on the table and select Copy to Clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its contents into a spreadsheet $ % Common stock $ 3,028 % 6,005 3,7291 # # # $ $ -6,698 % $ 30,302 % % Treasury stock Retained earnings Total owners' equity TOTAL LIABILITIES 100.00 % AND OWNERS' EQUITY $ 26,632 TOTAL ASSETS $ 47,861 47,861 100.00 % Print Done