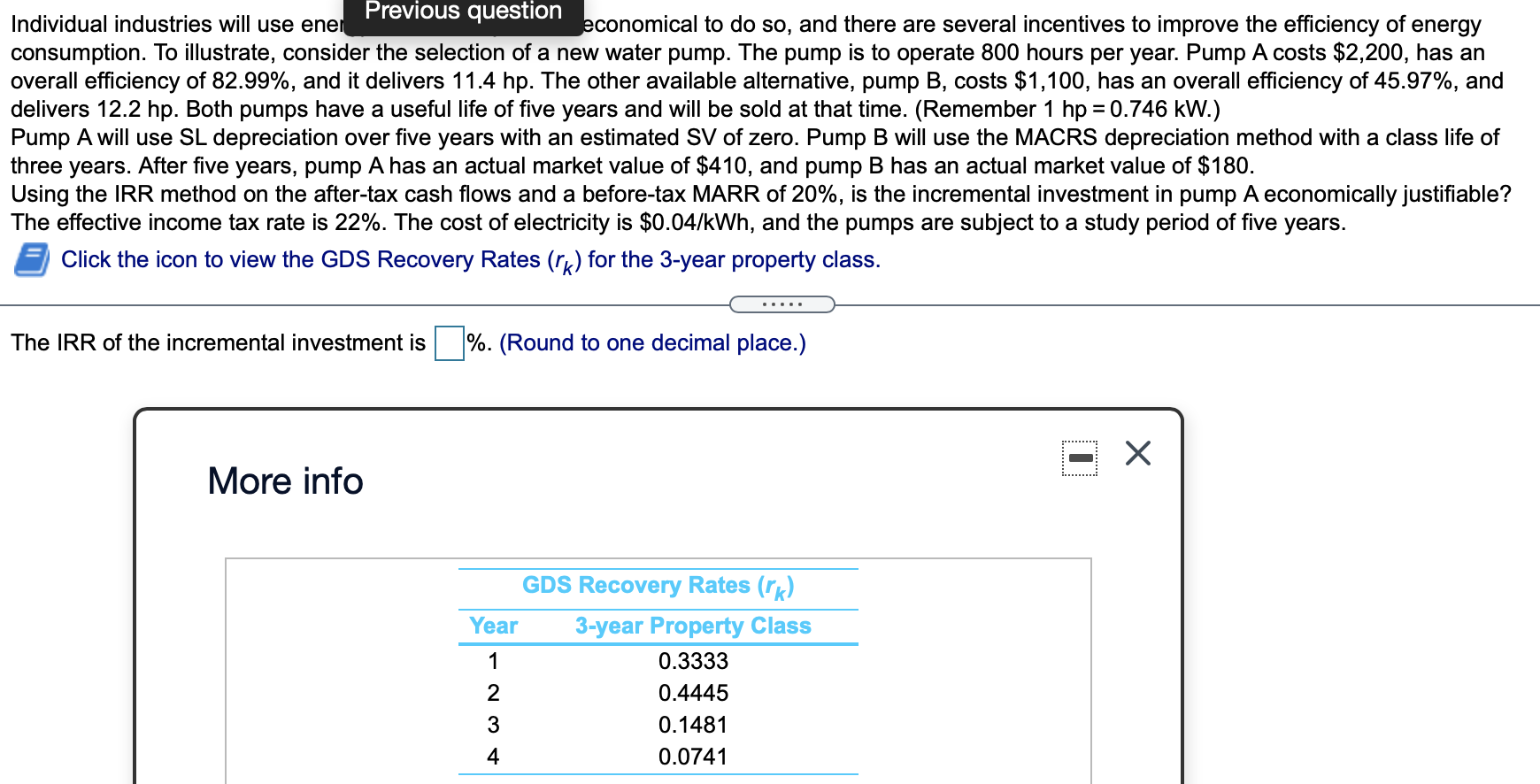

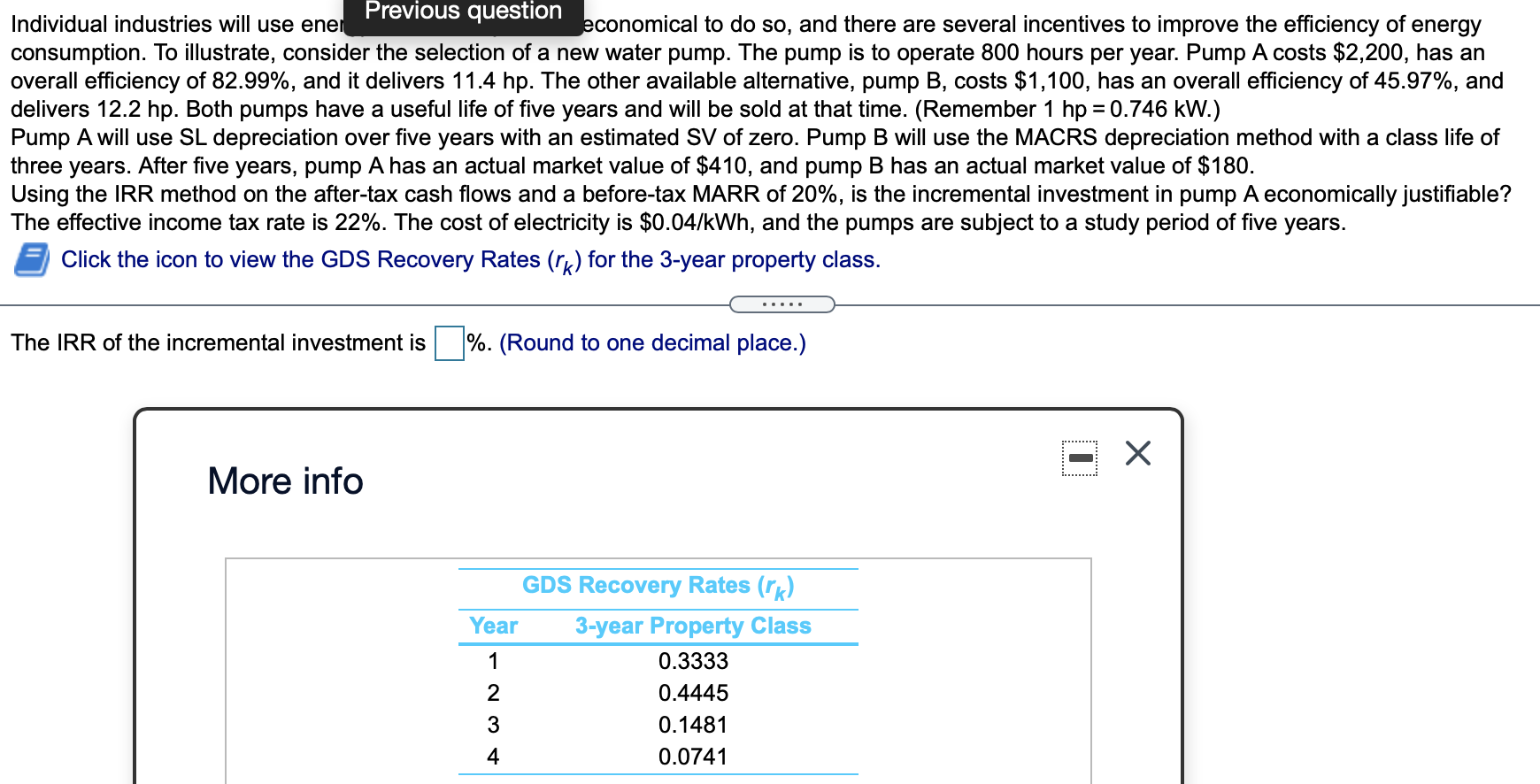

= Previous question Individual industries will use ener economical to do so, and there are several incentives to improve the efficiency of energy consumption. To illustrate, consider the selection of a new water pump. The pump is to operate 800 hours per year. Pump A costs $2,200, has an overall efficiency of 82.99%, and it delivers 11.4 hp. The other available alternative, pump B, costs $1,100, has an overall efficiency of 45.97%, and delivers 12.2 hp. Both pumps have a useful life of five years and will be sold at that time. (Remember 1 hp = 0.746 kW.) Pump A will use SL depreciation over five years with an estimated SV of zero. Pump B will use the MACRS depreciation method with a class life of three years. After five years, pump A has an actual market value of $410, and pump B has an actual market value of $180. Using the IRR method on the after-tax cash flows and a before-tax MARR of 20%, is the incremental investment in pump A economically justifiable? The effective income tax rate is 22%. The cost of electricity is $0.04/kWh, and the pumps are subject to a study period of five years. Click the icon to view the GDS Recovery Rates (tk) for the 3-year property class. The IRR of the incremental investment is %. (Round to one decimal place.) More info GDS Recovery Rates (rk) Year 3-year Property Class 1 0.3333 2 0.4445 3 0.1481 4 0.0741 = Previous question Individual industries will use ener economical to do so, and there are several incentives to improve the efficiency of energy consumption. To illustrate, consider the selection of a new water pump. The pump is to operate 800 hours per year. Pump A costs $2,200, has an overall efficiency of 82.99%, and it delivers 11.4 hp. The other available alternative, pump B, costs $1,100, has an overall efficiency of 45.97%, and delivers 12.2 hp. Both pumps have a useful life of five years and will be sold at that time. (Remember 1 hp = 0.746 kW.) Pump A will use SL depreciation over five years with an estimated SV of zero. Pump B will use the MACRS depreciation method with a class life of three years. After five years, pump A has an actual market value of $410, and pump B has an actual market value of $180. Using the IRR method on the after-tax cash flows and a before-tax MARR of 20%, is the incremental investment in pump A economically justifiable? The effective income tax rate is 22%. The cost of electricity is $0.04/kWh, and the pumps are subject to a study period of five years. Click the icon to view the GDS Recovery Rates (tk) for the 3-year property class. The IRR of the incremental investment is %. (Round to one decimal place.) More info GDS Recovery Rates (rk) Year 3-year Property Class 1 0.3333 2 0.4445 3 0.1481 4 0.0741