Question

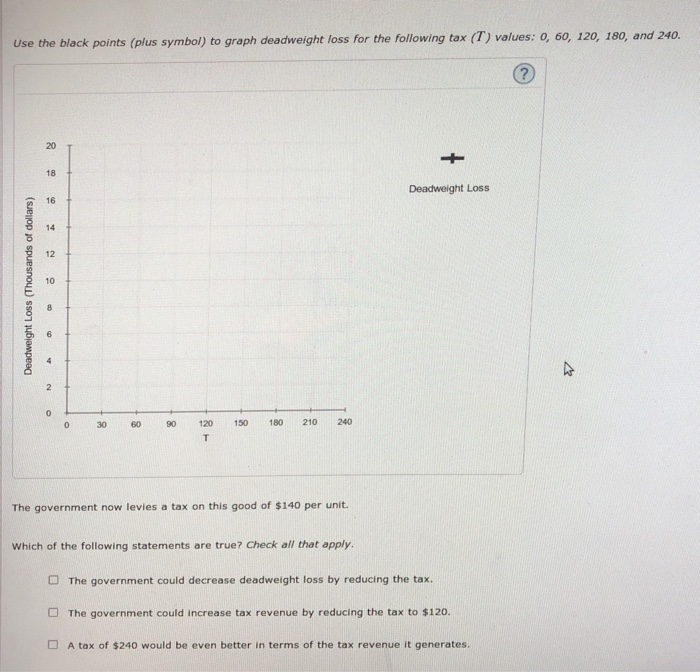

Use the black points (plus symbol) to graph deadweight loss for the following tax (T) values: 0, 60, 120, 180, and 240. ? Deadweight

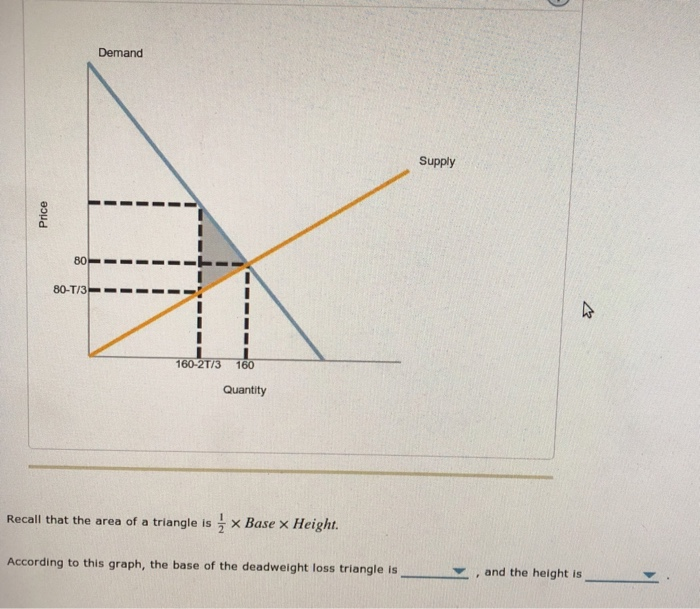

Use the black points (plus symbol) to graph deadweight loss for the following tax (T) values: 0, 60, 120, 180, and 240. ? Deadweight Loss (Thousands of dollars) 20 18 16 14 12 10 8 co 4 2 0 0 30 60 90 120 150 T 180 210 240 The government now levies a tax on this good of $140 per unit. Which of the following statements are true? Check all that apply. Deadweight Loss The government could decrease deadweight loss by reducing the tax. The government could increase tax revenue by reducing the tax to $120. A tax of $240 would be even better in terms of the tax revenue it generates. Price 80 80-T/3 Demand 160-2T/3 160 Quantity Recall that the area of a triangle is x Base x Height. According to this graph, the base of the deadweight loss triangle is Supply and the height is 2

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modern Principles of Economics

Authors: Tyler Cowen, Alex Tabarrok

3rd edition

1429278390, 978-1429278416, 1429278412, 978-1429278393

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App