Question

PRICE AT WHICH THESE FUTURES WERE BOUGHT ON 4 APRIL 20222= $141.48 you are a jet fuel oil producer, and you are going to sell

PRICE AT WHICH THESE FUTURES WERE BOUGHT ON 4 APRIL 20222= $141.48

you are a jet fuel oil producer, and you are going to sell 10,000 barrels of jet fuel oil in 3 months. You aim to use Energy future products to hedge your price risk. Record the fuel price when you start to take positions

You have $100,000 USD cash on hand at the beginning of your trading. You must use at minimum 70% of your account balance to hedge your oil price risk. Meanwhile, you are allowed to have up to 30% of your account balance to speculating/arbitraging, and the speculation/arbitrage products are not limited to Energy futures (e.g., you can even use Crypto futures to earn short-term profit, but also mind the potential loss).

You can take both long and short positions in the future contracts

Marking Guide Your report must include the following sections: 1. Trading objectives: (2 marks) Give an overview of your trading objectives. 2. Summarize your hedging strategy (8 marks)

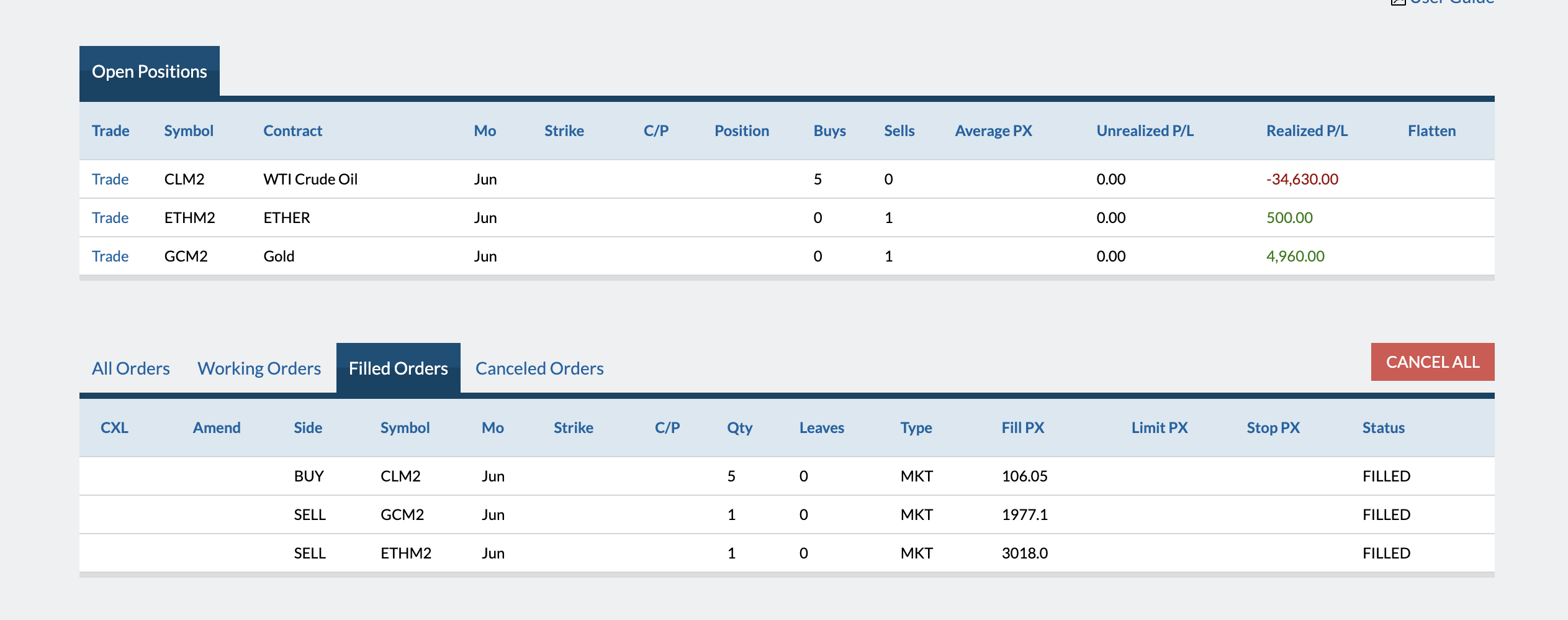

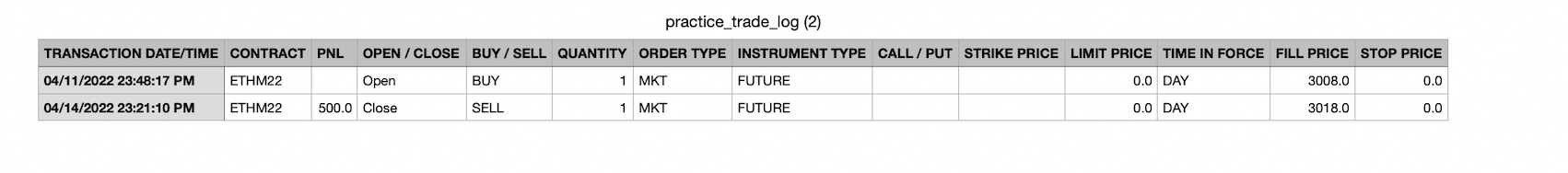

Provide a summary on how you use Energy future products to hedge your commodity price risk. The content should include but not limited to: Do you think it is necessary to hedge your jet fuel price risk, and what percentage of your exposure you think you should hedge (e.g., ?% out of the 10,000 barrels) Which future product(s) you use to hedge your risk, outline their basic specs? What strategy you employed to hedge (e.g., delivery month, contract price, contract amount, long or short, etc)? What is the performance of your hedging by Tuesday, 12nd April 2022? And how the spot price change for jet fuel oil? Are there any differences between jet fuel oil and the underlying assets of your selected hedging product? And what risk can be generated from these differences? 3. Summarize your speculation trading (5 marks) Provide a summary on how you use future contracts to speculate/arbitrage during your trading period. The content should include but not limited to: Why you takeot take speculation position? How the speculation performed and explain your profit/loss?

Open Positions Trade Symbol Contract Mo Strike C/P Position Buys Sells Average PX Unrealized P/L Realized P/L Flatten Trade CLM2 WTI Crude Oil Jun 5 0 0.00 -34,630.00 Trade ETHM2 ETHER Jun 0 1 0.00 500.00 Trade GCM2 Gold Jun O 1 0.00 4,960.00 All Orders Working Orders Filled Orders CANCEL ALL Canceled Orders CXL Amend Side Symbol Mo Strike C/P Qty Leaves Type Fill PX Limit PX Stop PX Status BUY CLM2 Jun 5 o O MKT 106.05 FILLED SELL GCM2 Jun 1 0 MKT 1977.1 FILLED SELL ETHM2 Jun 1 0 MKT 3018.0 FILLED practice_trade_log (2) OPEN / CLOSE BUY / SELL QUANTITY ORDER TYPE INSTRUMENT TYPE CALL / PUT STRIKE PRICE LIMIT PRICE TIME IN FORCE FILL PRICE STOP PRICE TRANSACTION DATE/TIME CONTRACT PNL 04/11/2022 23:48:17 PM ETHM22 Open BUY 1 MKT FUTURE 0.0 DAY 3008.0 0.0 04/14/2022 23:21:10 PM ETHM22 500.0 Close SELL 1 MKT FUTURE 0.0 DAY 3018.0 0.0 Open Positions Trade Symbol Contract Mo Strike C/P Position Buys Sells Average PX Unrealized P/L Realized P/L Flatten Trade CLM2 WTI Crude Oil Jun 5 0 0.00 -34,630.00 Trade ETHM2 ETHER Jun 0 1 0.00 500.00 Trade GCM2 Gold Jun O 1 0.00 4,960.00 All Orders Working Orders Filled Orders CANCEL ALL Canceled Orders CXL Amend Side Symbol Mo Strike C/P Qty Leaves Type Fill PX Limit PX Stop PX Status BUY CLM2 Jun 5 o O MKT 106.05 FILLED SELL GCM2 Jun 1 0 MKT 1977.1 FILLED SELL ETHM2 Jun 1 0 MKT 3018.0 FILLED practice_trade_log (2) OPEN / CLOSE BUY / SELL QUANTITY ORDER TYPE INSTRUMENT TYPE CALL / PUT STRIKE PRICE LIMIT PRICE TIME IN FORCE FILL PRICE STOP PRICE TRANSACTION DATE/TIME CONTRACT PNL 04/11/2022 23:48:17 PM ETHM22 Open BUY 1 MKT FUTURE 0.0 DAY 3008.0 0.0 04/14/2022 23:21:10 PM ETHM22 500.0 Close SELL 1 MKT FUTURE 0.0 DAY 3018.0 0.0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started