Question

price. Given the Fixed Cost required for the product of $164,000, at $180 to produce each unit, and a $200 sale price, the break even

price.

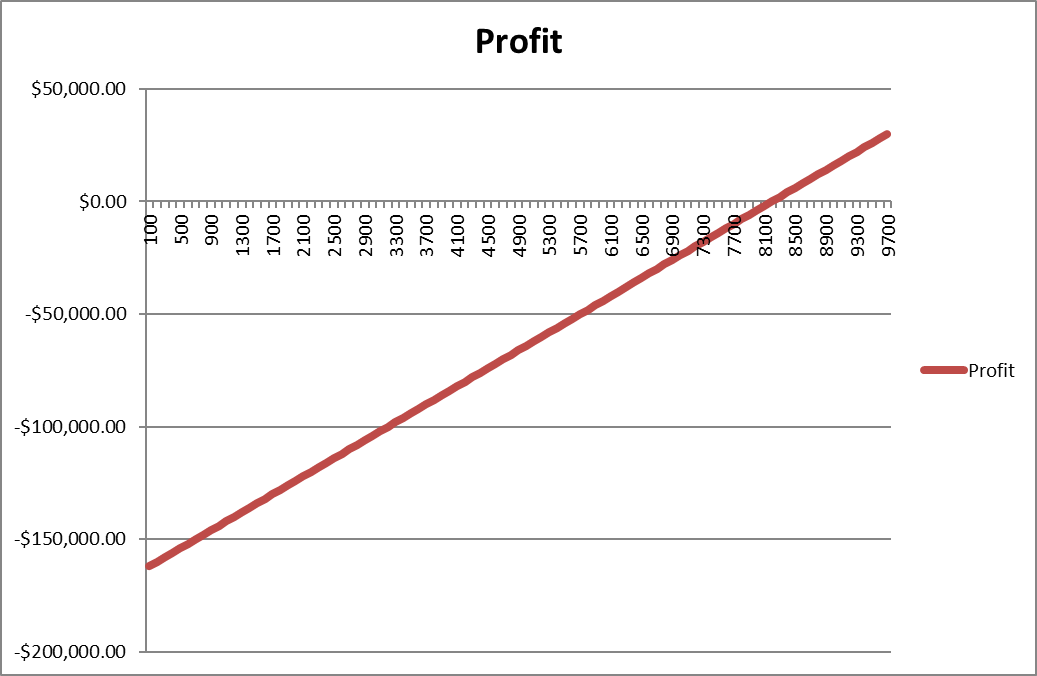

Given the Fixed Cost required for the product of $164,000, at $180 to produce each unit, and a $200 sale price, the break even point for this venture currently lies at 8,200 units (in 8.2 years).

Christina studies the problem further and establishes that based on the characteristics of the product, production methods used, and quantities involved, a learning rate of 80% could be realized.

Analysis

This case provides a study in tradeoffs that pit sales, product pricing, fixed and variable costs, and even learning rates against each other. Complete a Break Even (BE) analysis integrating learning that compares the relationship between production levels and returns, and allows for scenarios to be run in which we can alter:

- Yearly production size (1,000 units / 1,300 units / 1,500 units)

- W/corresponding Price elasticity (Sale Price of $200 / $160 / $120)

- Fixed Costs ($164,000 / $180,000)

The BE analysis should help Christina determine if the company will make a profit at the various production/sales targets as provided in the table above

- Build the model that spans the possible production rates for the following year (first table).

- Christina needs to determine whether or not, and under what conditions, the product will generate a profit.

- Determine which combination of production/pricing will maximize profits.

- Should WidgetsCo pursue this venture?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started