Answered step by step

Verified Expert Solution

Question

1 Approved Answer

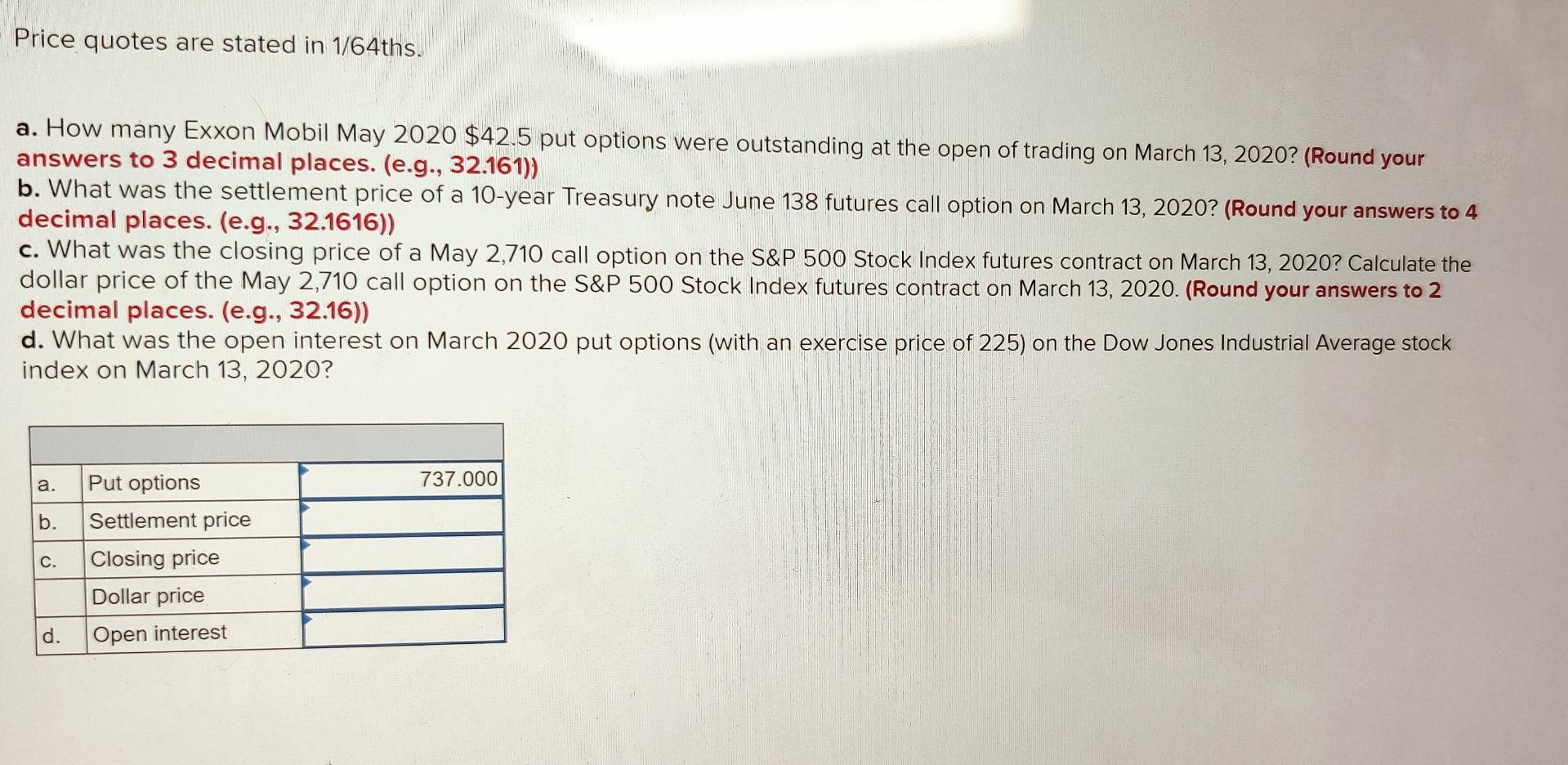

Price quotes are stated in 1/64 ths. a. How many Exxon Mobil May 2020$42.5 put options were outstanding at the open of trading on March

Price quotes are stated in 1/64 ths. a. How many Exxon Mobil May 2020$42.5 put options were outstanding at the open of trading on March 13, 2020? (Round your answers to 3 decimal places. (e.g., 32.161)) b. What was the settlement price of a 10-year Treasury note June 138 futures call option on March 13, 2020? (Round your answers to 4 decimal places. (e.g., 32.1616)) c. What was the closing price of a May 2,710 call option on the S\&P 500 Stock Index futures contract on March 13, 2020? Calculate the dollar price of the May 2,710 call option on the S\&P 500 Stock Index futures contract on March 13, 2020. (Round your answers to 2 decimal places. (e.g., 32.16)) d. What was the open interest on March 2020 put options (with an exercise price of 225) on the Dow Jones Industrial Average stock index on March 13, 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started