Pricing of Rosetta Stone 2009 IPO Michael J. Schill, Suprajj Papireddy, Tom Adams, Phil Clough

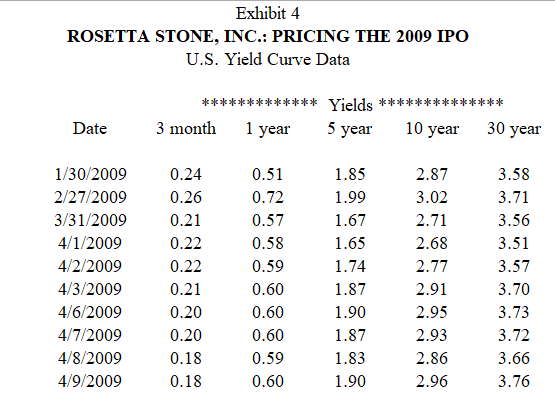

1. Using the data in the case, including comparable data, estimate the WACC of Rosetta Stone and explain the assumptions you made for the risk-free rate, the market risk premium, the equity beta, and the marginal corporate tax rate. How did you use the comparable firm data in this analysis? (plus Excel Tab 3).

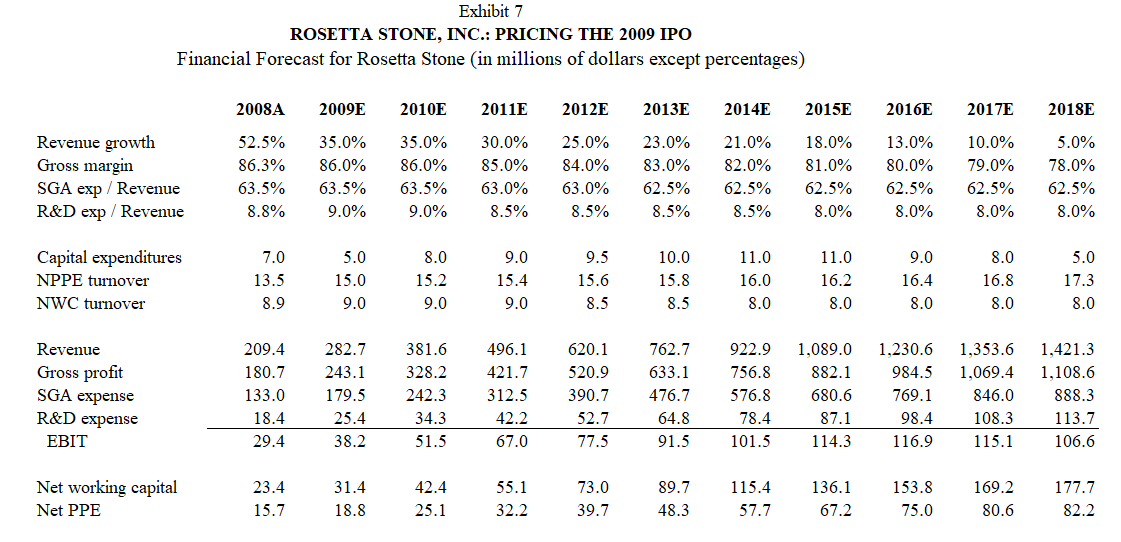

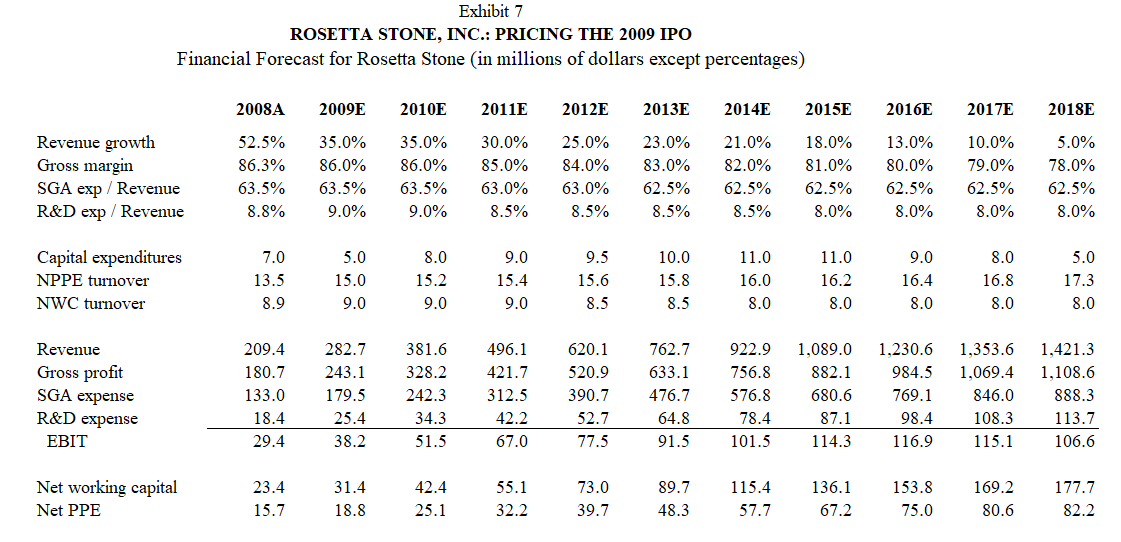

2. Using your estimate of WACC and the unlevered free cash flow projections in Exhibit 7, compose a discounted cash flow valuation for Rosetta Stone. Based on a discounted cash flow valuation, what do you expect to be value of the equity (aftermarket) and the price of the Rosetta Stone shares? What continuing value did you use in the DCF valuation and how did you determine it? (plus Excel Tab 4).

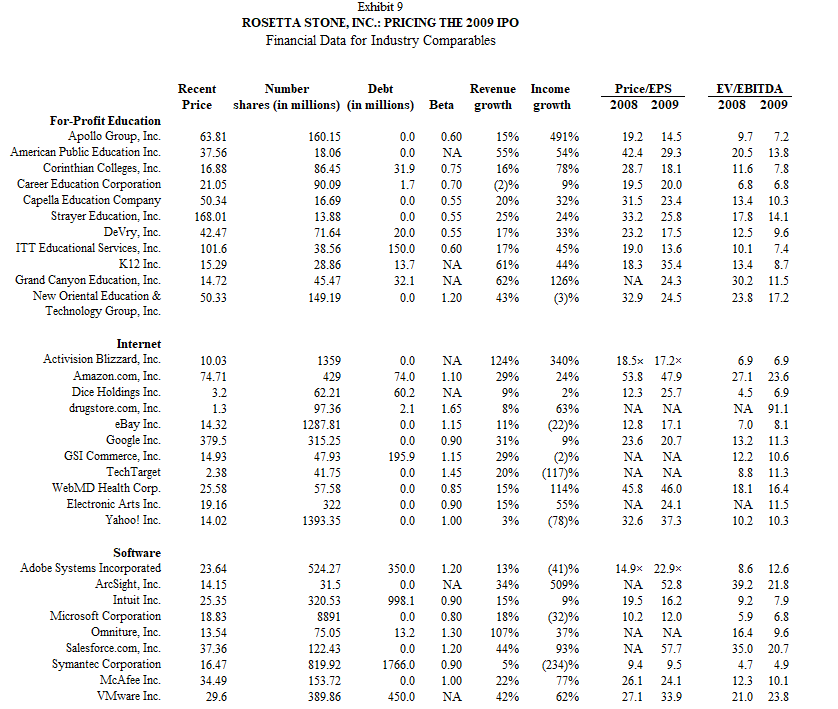

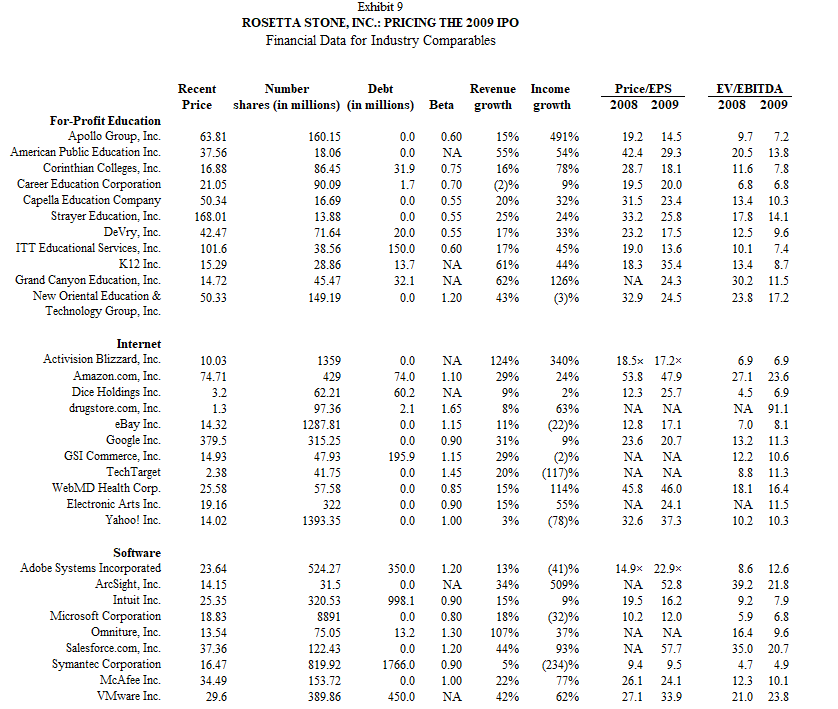

3. As an alternative to discounted cash flow, use the comparable firm data (Exhibit 9) for EBITDA multiples to estimate equity value(aftermarket) and price per share. Explain your work. (plus Excel Tab 5).

4. Based on your analysis in parts 2, and 3 at what price would you recommend that the Rosetta Stone shares be sold? Explain your reasoning.

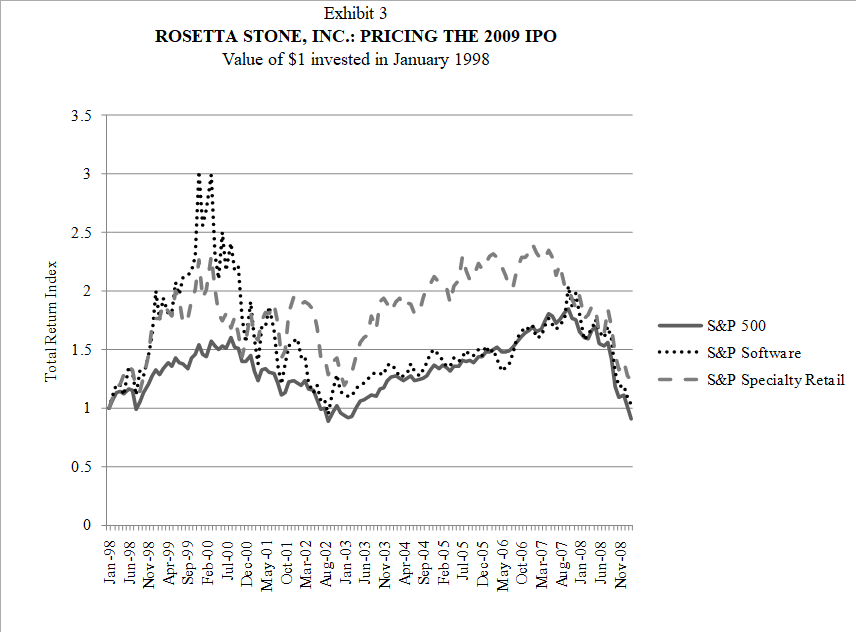

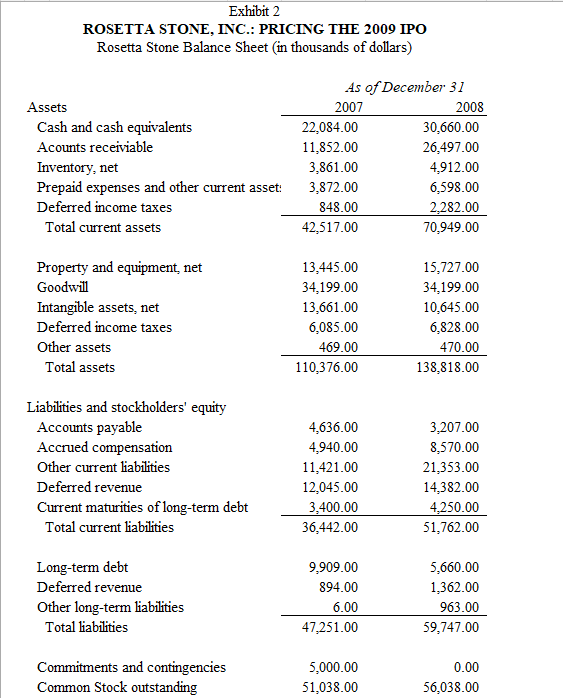

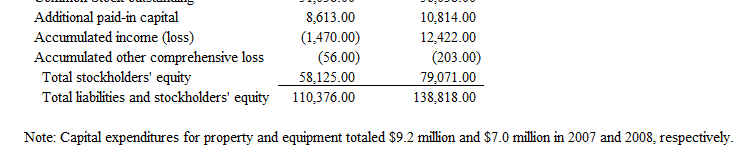

2nd half of E2

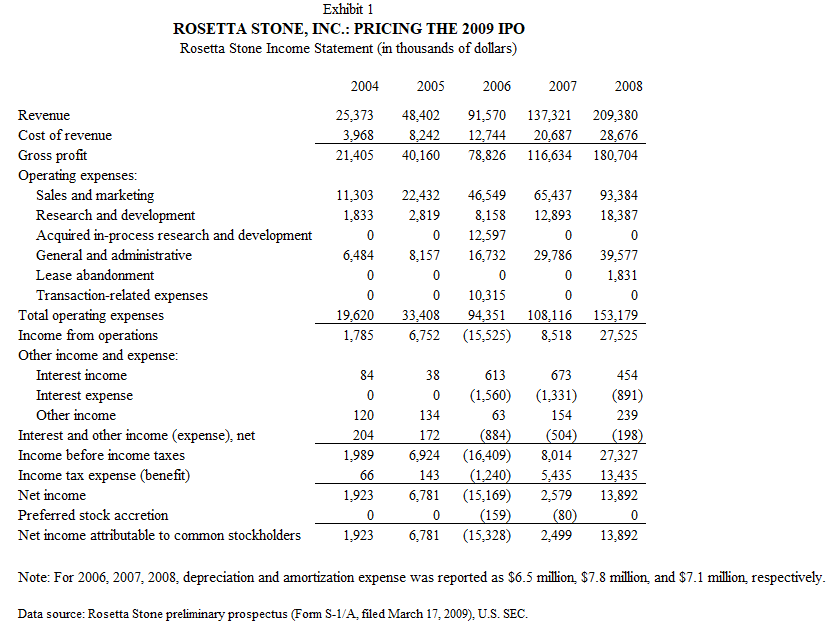

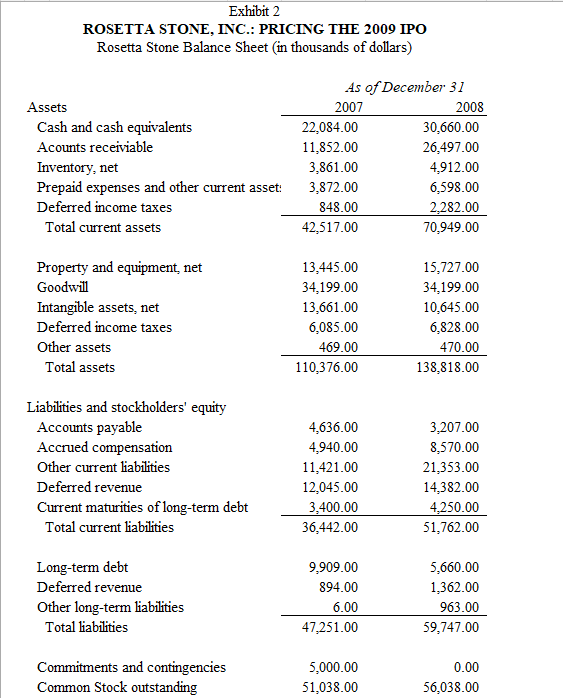

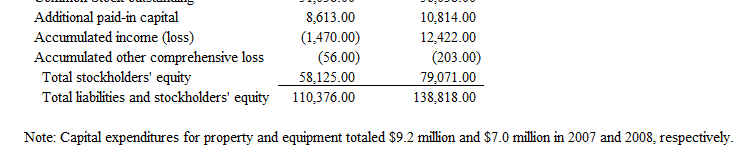

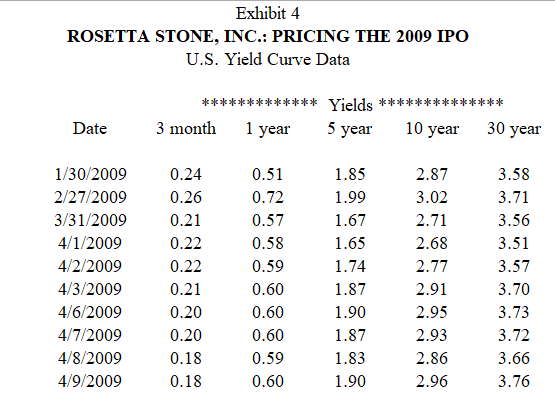

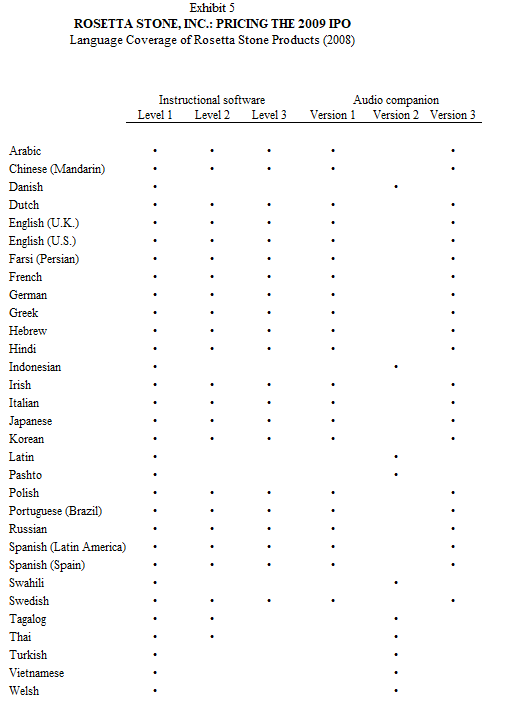

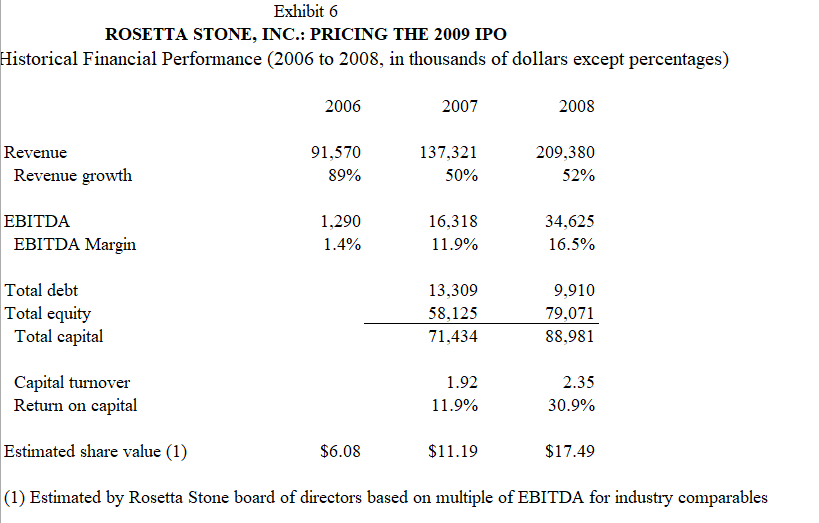

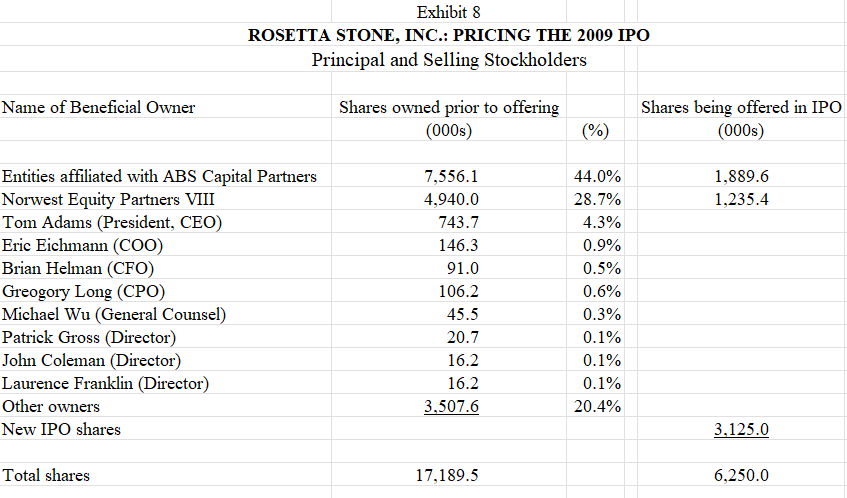

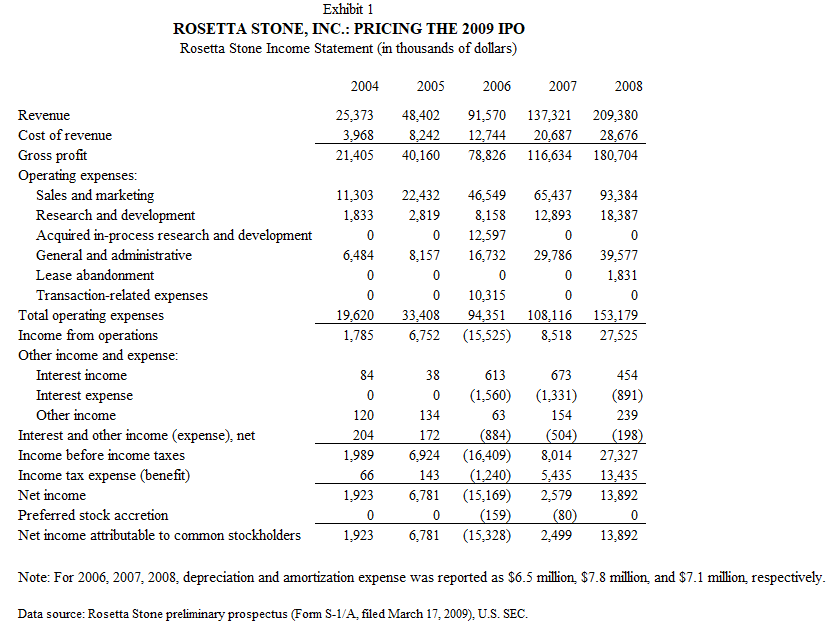

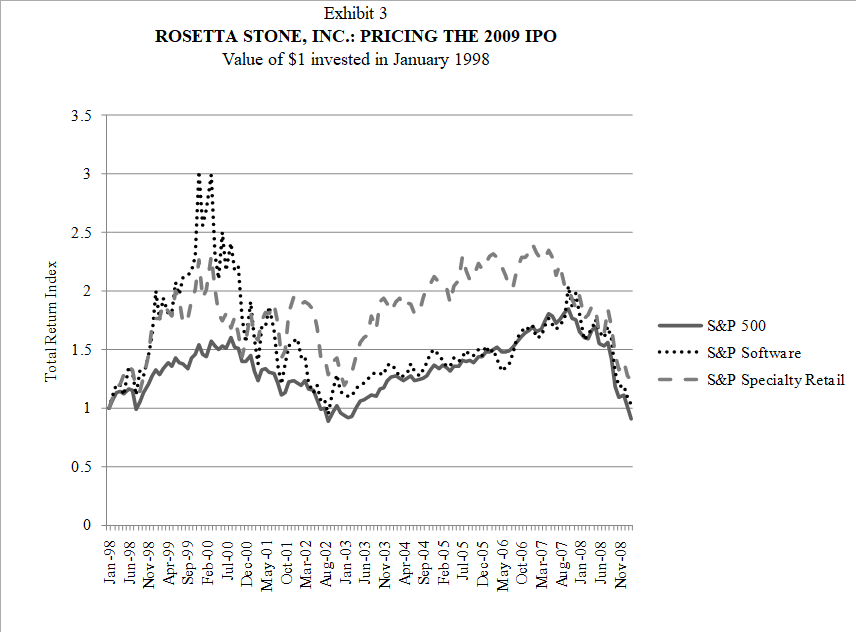

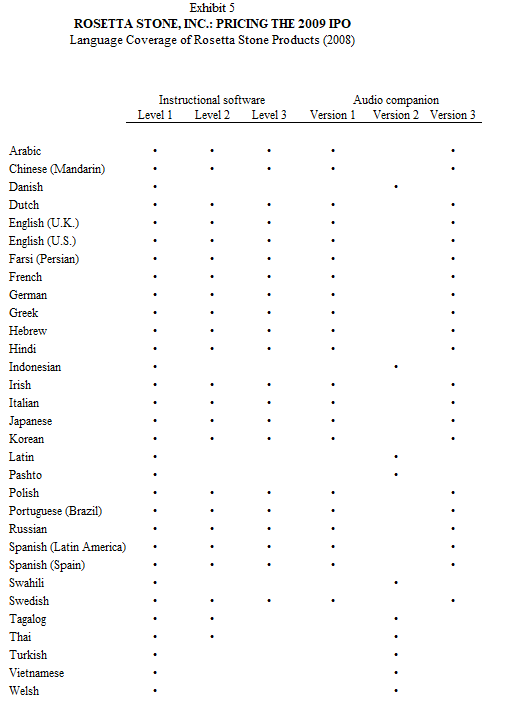

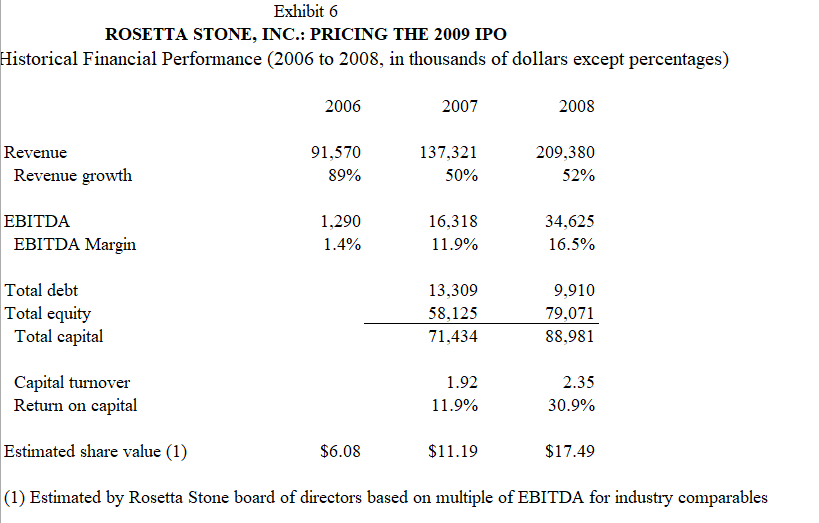

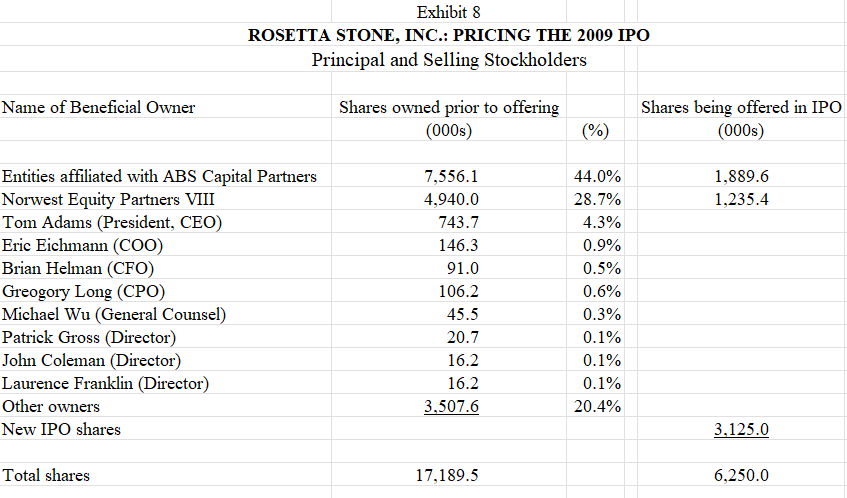

Exhibit 1 ROSETTA STONE, INC.: PRICING THE 2009 IPO Rosetta Stone Income Statement (in thousands of dollars) Note: For 2006,2007,2008, depreciation and amortization expense was reported as $6.5 million, $7.8 million, and $7.1 million, respectively. Data source: Rosetta Stone preliminary prospectus (Form S-1/A, filed March 17 , 2009), U.S. SEC. Exhibit 2 ROSETTA STONE. INC.: PRICING THE 2009 IPO Note: Capital expenditures for property and equipment totaled $9.2 million and $7.0 million in 2007 and 2008, respectively. Exhibit 3 ROSETTA STONE, INC.: PRICING THE 2009 IPO Exhibit 4 ROSETTA STONE, INC.: PRICING THE 2009 IPO U.S. Yield Curve Data Exhibit 5 ROSETTA STONE, INC.: PRICING THE 2009 IPO Language Coverage of Rosetta Stone Products (2008) Exhibit 6 ROSETTA STONE, INC.: PRICING THE 2009 IPO Tistorical Financial Performance (2006 to 2008, in thousands of dollars except percentages) (1) Estimated by Rosetta Stone board of directors based on multiple of EBITDA for industry comparables Exhibit 7 ROSETTA STONE, INC.: PRICING THE 2009 IPO Financial Forecast for Rosetta Stone (in millions of dollars except percentages Exhibit 8 ROSETTA STONE, INC.: PRICING THE 2009 IPO Principal and Selling Stockholders Name of Beneficial Owner Entities affiliated with ABS Capital Partners Norwest Equity Partners VIII Tom Adams (President, CEO) Eric Eichmann (COO) Brian Helman (CFO) Greogory Long (CPO) Michael Wu (General Counsel) Patrick Gross (Director) John Coleman (Director) Laurence Franklin (Director) Other owners New IPO shares Total shares Shares owned prior to offering (000s) 7,556.1 4,940.0 743.7 146.3 91.0 106.2 45.5 20.7 16.2 16.2 3,507.6 17,189.5 Shares being offered in IPO (000s) 1,889.6 1,235.4 4.3% 0.9% 0.5% 0.6% 0.3% 0.1% 0.1% 20.4% 3,125.0 6,250.0 Exhibit 9 ROSETTA STONE, INC.: PRICING THE 2009 IPO Exhibit 1 ROSETTA STONE, INC.: PRICING THE 2009 IPO Rosetta Stone Income Statement (in thousands of dollars) Note: For 2006,2007,2008, depreciation and amortization expense was reported as $6.5 million, $7.8 million, and $7.1 million, respectively. Data source: Rosetta Stone preliminary prospectus (Form S-1/A, filed March 17 , 2009), U.S. SEC. Exhibit 2 ROSETTA STONE. INC.: PRICING THE 2009 IPO Note: Capital expenditures for property and equipment totaled $9.2 million and $7.0 million in 2007 and 2008, respectively. Exhibit 3 ROSETTA STONE, INC.: PRICING THE 2009 IPO Exhibit 4 ROSETTA STONE, INC.: PRICING THE 2009 IPO U.S. Yield Curve Data Exhibit 5 ROSETTA STONE, INC.: PRICING THE 2009 IPO Language Coverage of Rosetta Stone Products (2008) Exhibit 6 ROSETTA STONE, INC.: PRICING THE 2009 IPO Tistorical Financial Performance (2006 to 2008, in thousands of dollars except percentages) (1) Estimated by Rosetta Stone board of directors based on multiple of EBITDA for industry comparables Exhibit 7 ROSETTA STONE, INC.: PRICING THE 2009 IPO Financial Forecast for Rosetta Stone (in millions of dollars except percentages Exhibit 8 ROSETTA STONE, INC.: PRICING THE 2009 IPO Principal and Selling Stockholders Name of Beneficial Owner Entities affiliated with ABS Capital Partners Norwest Equity Partners VIII Tom Adams (President, CEO) Eric Eichmann (COO) Brian Helman (CFO) Greogory Long (CPO) Michael Wu (General Counsel) Patrick Gross (Director) John Coleman (Director) Laurence Franklin (Director) Other owners New IPO shares Total shares Shares owned prior to offering (000s) 7,556.1 4,940.0 743.7 146.3 91.0 106.2 45.5 20.7 16.2 16.2 3,507.6 17,189.5 Shares being offered in IPO (000s) 1,889.6 1,235.4 4.3% 0.9% 0.5% 0.6% 0.3% 0.1% 0.1% 20.4% 3,125.0 6,250.0 Exhibit 9 ROSETTA STONE, INC.: PRICING THE 2009 IPO