Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Primo Company, a publicly accountable entity, purchased a property on August 1, 2020 which included land and building for a total price of $3,500,000.

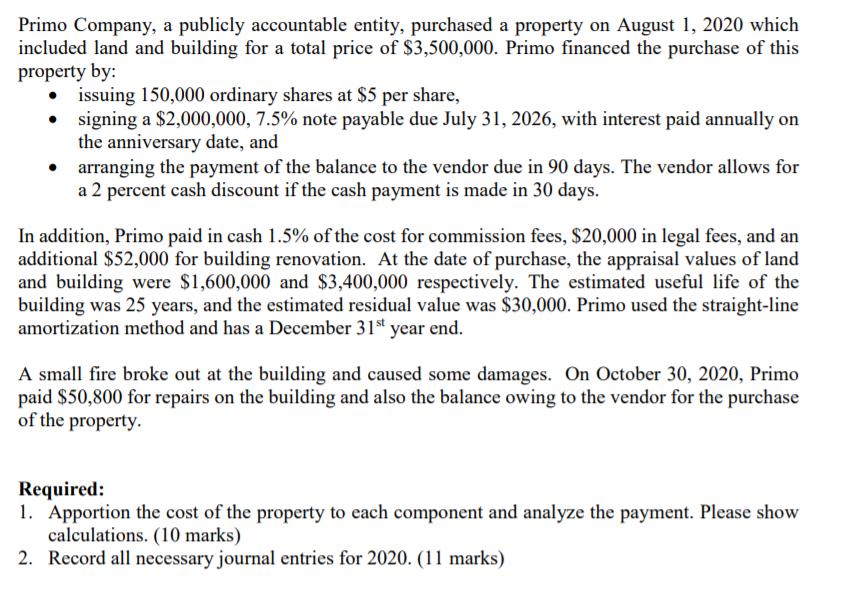

Primo Company, a publicly accountable entity, purchased a property on August 1, 2020 which included land and building for a total price of $3,500,000. Primo financed the purchase of this property by: issuing 150,000 ordinary shares at $5 per share, signing a $2,000,000, 7.5% note payable due July 31, 2026, with interest paid annually on the anniversary date, and arranging the payment of the balance to the vendor due in 90 days. The vendor allows for a 2 percent cash discount if the cash payment is made in 30 days. In addition, Primo paid in cash 1.5% of the cost for commission fees, $20,000 in legal fees, and an additional $52,000 for building renovation. At the date of purchase, the appraisal values of land and building were $1,600,000 and $3,400,000 respectively. The estimated useful life of the building was 25 years, and the estimated residual value was $30,000. Primo used the straight-line amortization method and has a December 31 year end. A small fire broke out at the building and caused some damages. On October 30, 2020, Primo paid $50,800 for repairs on the building and also the balance owing to the vendor for the purchase of the property. Required: 1. Apportion the cost of the property to each component and analyze the payment. Please show calculations. (10 marks) 2. Record all necessary journal entries for 2020. (11 marks)

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

journal entries in the books of Primo Company date particulars debit cre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started