Question

Prince Charming, age 66 lives with his loving wife of 45 years, Cinderella. Cinderella is 60 years old. Prince has a 46% MTR, and

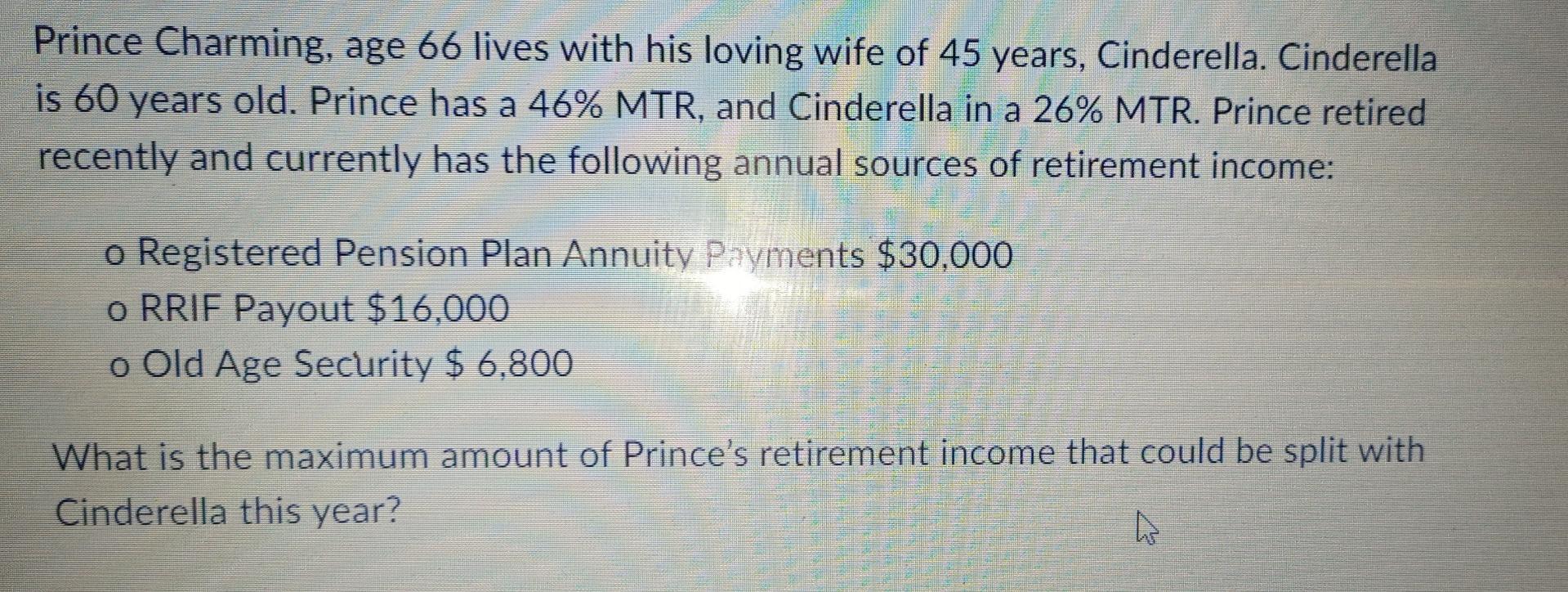

Prince Charming, age 66 lives with his loving wife of 45 years, Cinderella. Cinderella is 60 years old. Prince has a 46% MTR, and Cinderella in a 26% MTR. Prince retired recently and currently has the following annual sources of retirement income: o Registered Pension Plan Annuity Payments $30.000 o RRIF Payout $16,000 o Old Age Security $ 6,800 What is the maximum amount of Prince's retirement income that could be split with Cinderella this year? A

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Statistics

Authors: Robert S. Witte, John S. Witte

11th Edition

1119254515, 978-1119254515

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App