Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PrinceGee Photography wants to expand its business in the next operating year and wants to determine some key operation figures including the determination of

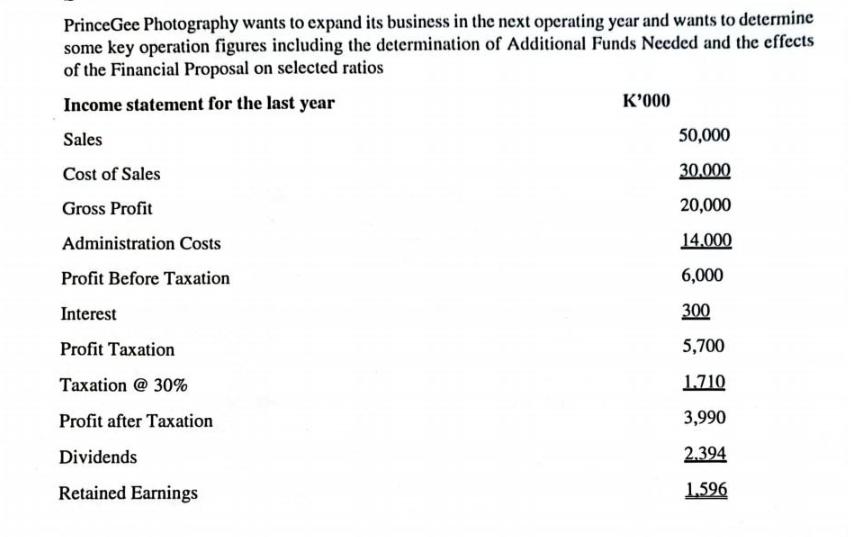

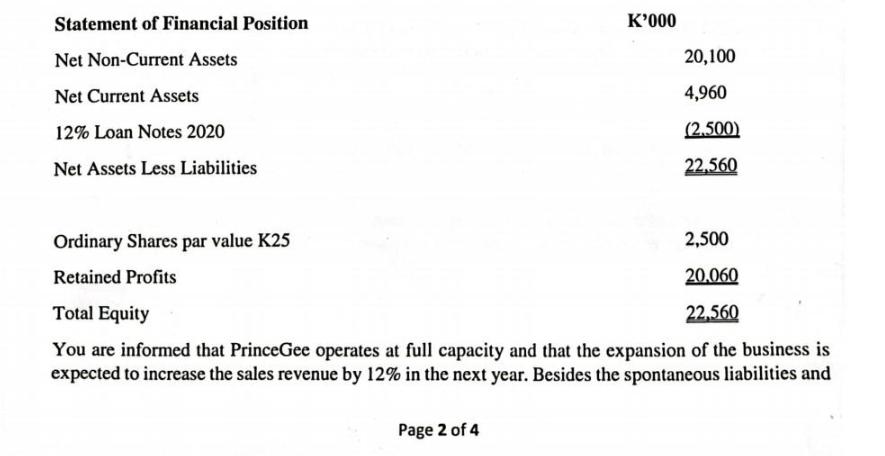

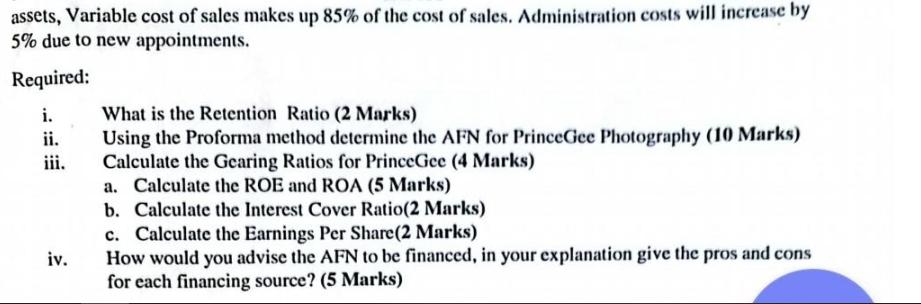

PrinceGee Photography wants to expand its business in the next operating year and wants to determine some key operation figures including the determination of Additional Funds Needed and the effects of the Financial Proposal on selected ratios Income statement for the last year Sales Cost of Sales Gross Profit Administration Costs Profit Before Taxation Interest Profit Taxation Taxation @ 30% Profit after Taxation Dividends Retained Earnings K'000 50,000 30.000 20,000 14.000 6,000 300 5,700 1.710 3,990 2.394 1.596 Statement of Financial Position Net Non-Current Assets Net Current Assets 12% Loan Notes 2020 Net Assets Less Liabilities Ordinary Shares par value K25 Retained Profits K'000 2,500 20,060 Total Equity 22,560 You are informed that PrinceGee operates at full capacity and that the expansion of the business is expected to increase the sales revenue by 12% in the next year. Besides the spontaneous liabilities and Page 2 of 4 20,100 4,960 (2,500) 22,560 assets, Variable cost of sales makes up 85% of the cost of sales. Administration costs will increase by 5% due to new appointments. Required: i. ii. iii. iv. What is the Retention Ratio (2 Marks) Using the Proforma method determine the AFN for PrinceGee Photography (10 Marks) Calculate the Gearing Ratios for PrinceGee (4 Marks) a. Calculate the ROE and ROA (5 Marks) b. Calculate the Interest Cover Ratio (2 Marks) c. Calculate the Earnings Per Share (2 Marks) How would you advise the AFN to be financed, in your explanation give the pros and cons for each financing source? (5 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution i Retention Ratio is the proportion of earnings retained in the business after paying dividends It is calculated as Retention Ratio Profit after Taxation Dividends Profit after Taxation Profi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started