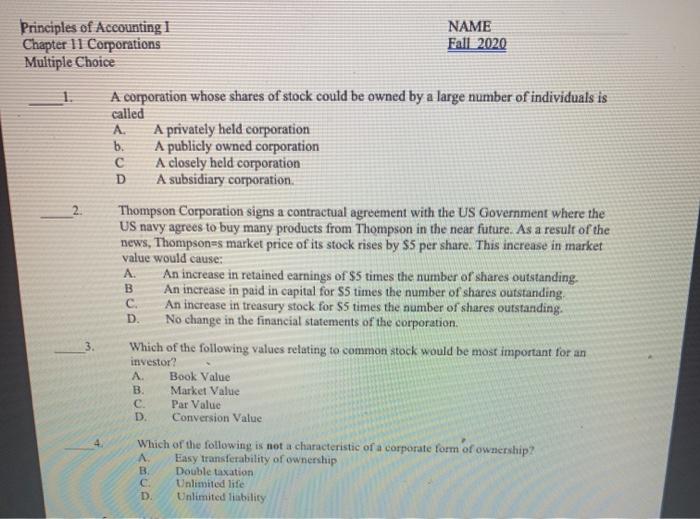

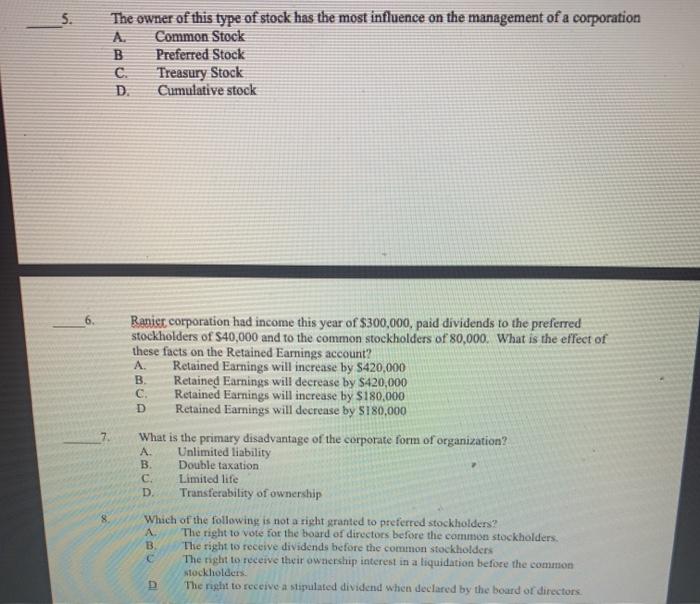

Principles of Accounting | Chapter 11 Corporations Multiple Choice NAME Fall 2020 1. D 2. A corporation whose shares of stock could be owned by a large number of individuals is called A. A privately held corporation b. A publicly owned corporation A closely held corporation A subsidiary corporation Thompson Corporation signs a contractual agreement with the US Government where the US navy agrees to buy many products from Thompson in the near future. As a result of the news, Thompsones market price of its stock rises by $5 per share. This increase in market value would cause: An increase in retained earnings of $5 times the number of shares outstanding. An increase in paid in capital for $5 times the number of shares outstanding C. An increase in treasury stock for $5 times the number of shares outstanding D. No change in the financial statements of the corporation. Which of the following values relating to common stock would be most important for an investor? Book Value B. Market Value Par Value Conversion Value A. B _3 A. C D. Which of the following is not a characteristic of a corporate form of ownership? A. Easy transferability of ownership B. Double taxation C Unlimited life D. Unlimited liability 5. The owner of this type of stock has the most influence on the management of a corporation Common Stock B Preferred Stock C. Treasury Stock D Cumulative stock 7. Ranier corporation had income this year of $300,000, paid dividends to the preferred stockholders of $40,000 and to the common stockholders of 80,000. What is the effect of these facts on the Retained Earnings account? A. Retained Earnings will increase by S420,000 . Retained Earnings will decrease by $420,000 C. Retained Earnings will increase by $180,000 D Retained Earnings will decrease by $180,000 What is the primary disadvantage of the corporate form of organization? A. Unlimited liability B Double taxation Limited life D. Transferability of ownership Which of the following is not a right granted to preferred stockholders? The right to vote for the board of directors before the common stockholders . The right to receive dividends before the common stockholders The right to receive their ownership interest in a liquidation before the common stockholders The right to receive a stipulated dividend when declared by the board of directors Principles of Accounting | Chapter 11 Corporations Multiple Choice NAME Fall 2020 1. D 2. A corporation whose shares of stock could be owned by a large number of individuals is called A. A privately held corporation b. A publicly owned corporation A closely held corporation A subsidiary corporation Thompson Corporation signs a contractual agreement with the US Government where the US navy agrees to buy many products from Thompson in the near future. As a result of the news, Thompsones market price of its stock rises by $5 per share. This increase in market value would cause: An increase in retained earnings of $5 times the number of shares outstanding. An increase in paid in capital for $5 times the number of shares outstanding C. An increase in treasury stock for $5 times the number of shares outstanding D. No change in the financial statements of the corporation. Which of the following values relating to common stock would be most important for an investor? Book Value B. Market Value Par Value Conversion Value A. B _3 A. C D. Which of the following is not a characteristic of a corporate form of ownership? A. Easy transferability of ownership B. Double taxation C Unlimited life D. Unlimited liability 5. The owner of this type of stock has the most influence on the management of a corporation Common Stock B Preferred Stock C. Treasury Stock D Cumulative stock 7. Ranier corporation had income this year of $300,000, paid dividends to the preferred stockholders of $40,000 and to the common stockholders of 80,000. What is the effect of these facts on the Retained Earnings account? A. Retained Earnings will increase by S420,000 . Retained Earnings will decrease by $420,000 C. Retained Earnings will increase by $180,000 D Retained Earnings will decrease by $180,000 What is the primary disadvantage of the corporate form of organization? A. Unlimited liability B Double taxation Limited life D. Transferability of ownership Which of the following is not a right granted to preferred stockholders? The right to vote for the board of directors before the common stockholders . The right to receive dividends before the common stockholders The right to receive their ownership interest in a liquidation before the common stockholders The right to receive a stipulated dividend when declared by the board of directors