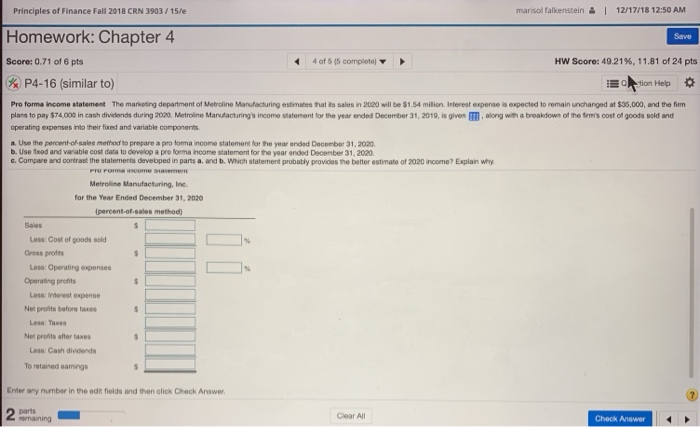

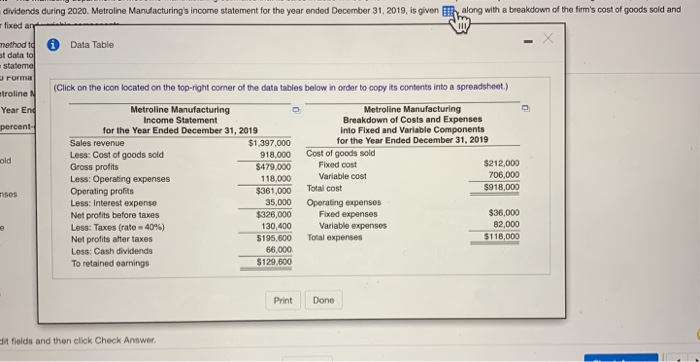

Principles of Finance Fall 2018 CRN 3903/15/e marisol falkenstein 12/17/18 12:50 AM Homework: Chapter 4 Save Score: 0.71 of 6 pts 40f$(5 completo! Hw Score: 49.21 %, I 1.81 of 24 pts P4-16 (similar to) ation Help Pro forma income statement The marketing department of Metroline Manufacturing estimates that is sales in 2020 will be $1.54 milion. Isterest expense is expected to remain unchanged at $35,000, and the fim plans to pay $74,000 in cash dividends during 2000. Metroline Manufacturing's income statement for the year ended December 31,2019, is given ,along with a breakdown of the fem's oost of goods sold and operating expenses into their foxed and variable components a. Use the percent-of sales method so prepare a pro forma income statemont for the year ended Decembor 31, 2020 b.Use ted and varable cost data todevelop pro forma ncome statement for the year ended December 31,2020. c. Compare rd oortrast the staternerts developed in parts aad b, which statemen pot atly povos ne bitter estimate or 2020 none? E plan way Metroline Manufacturing, Inc. for the Year Ended December 31, 2020 (percent-of-sales method Saies ess Cost of goods sold Loss Operating expenses Losa: interest expense Gross profts Oparating proits Net pronts before taxes Les Taxes Nel proits after taxes Less Cash dvidends To retained eamings Enter any number in the edt fields and then click Check Answer Clear All Check Answer dividends during 2020 Metrolne Manufacturings income statement for the year ended December 31, 2013, is g fixed a on along with a breakdo of tho frm's cost of goods sold method to t data to Data Table (Click on the icon located on the top-right cormer of the data tables below in order to copy its contents into a spreadsheet.) troline Year End percent Metroline Manufacturing Income Statement for the Year Ended December 31, 2019 Metroline Manufacturing Breakdown of Costs and Expenses into Fixed and Variable Components for the Year Ended December 31, 2019 $1.397,000 918,000 $479,000 Sales revenue Less: Cost of goods scld Gross profits Less: Operating expenses Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate" 40%) Net profits after taxes Less: Cash dividends To retained earnings Cost of goods sold Fixed cost old 118,000 Variable cost $361,000 Total cost $212,000 706,000 $918,000 nses 5,000 Operating expenses $36,000 82,000 $118,000 $326,000 Fixed expenses Variable expenses 130,400 $195,600 Total expenses 66,000 $129,600 PrintDone it fields and then click Check