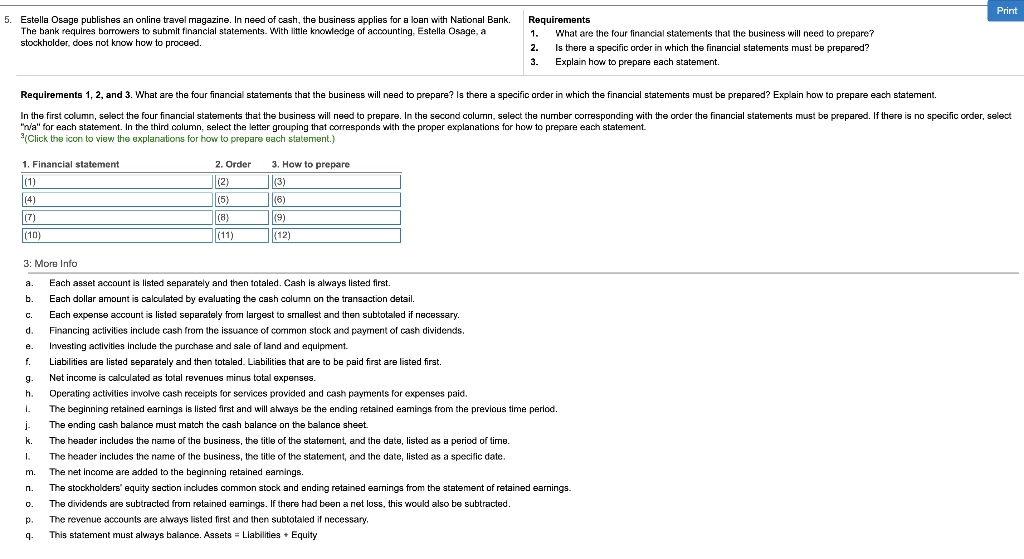

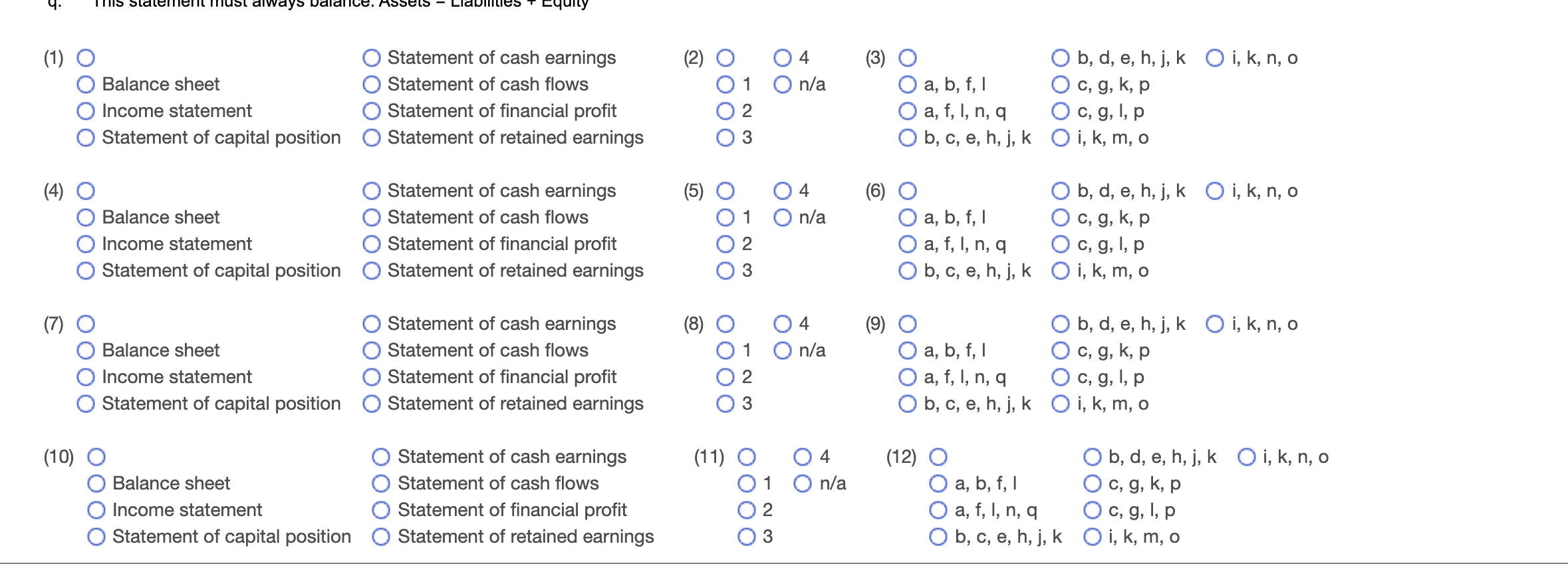

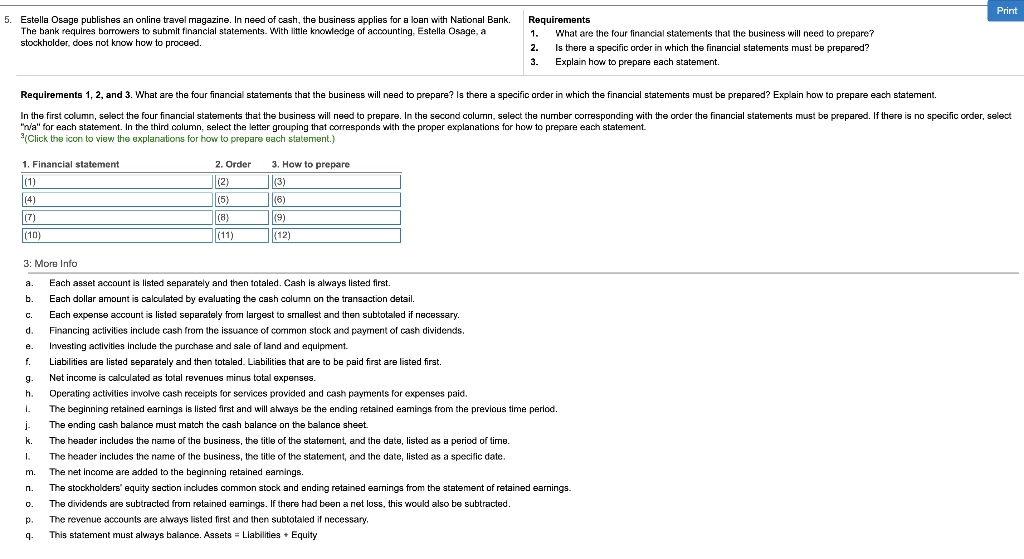

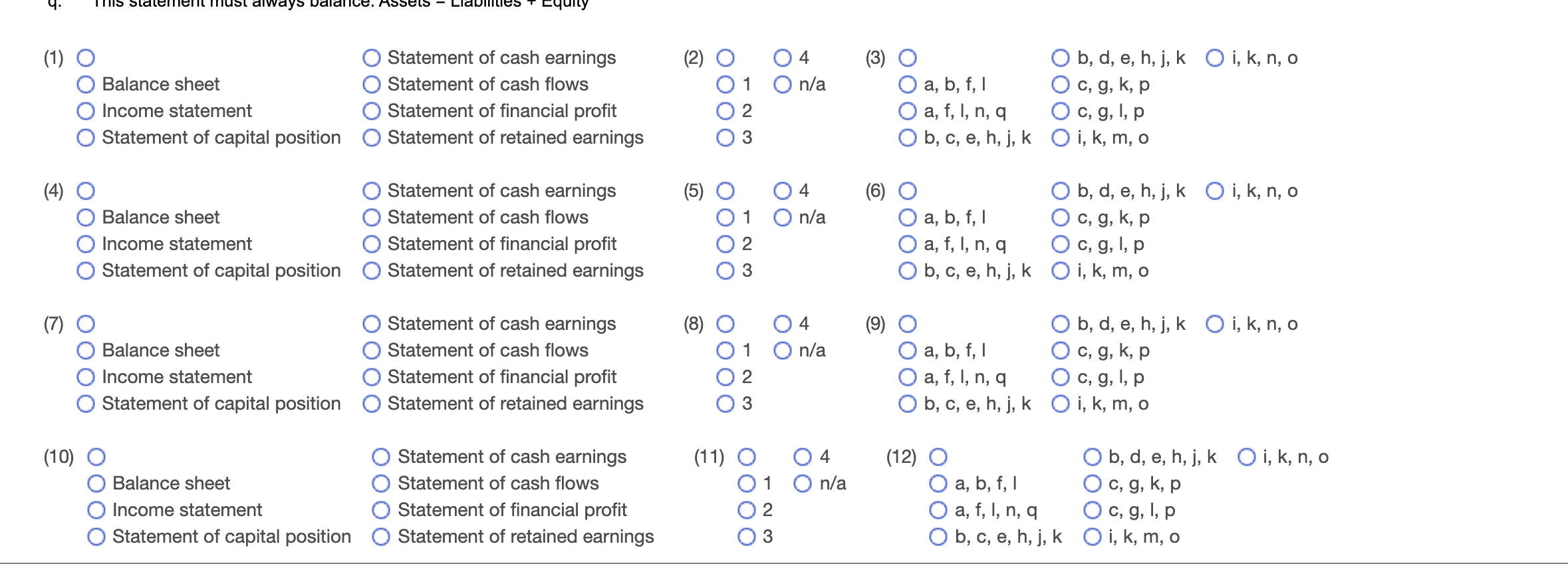

Print 5. Estella Osage publishes an online travel magazine. In need of cash, the business applies for a loan with National Bank. The bank requires borrowers to submit financial statements. With little knowledge of accounting, Estella Osage, a stockholder, does not know how to proceed. Requirements 1. What are the four financial statements that the business will need to prepare? 2. Is there a specific order in which the financial statements must be prepared? 3. Explain how to prepare each statement. Requirements 1, 2, and 3. What are the four financial statements that the business will need to prepare? Is there a specific order in which the financial statements must be prepared? Explain how to prepare each statement. In the first column, select the four financial statements that the business will need to prepare. In the second column, select the number corresponding with the order the financial statements must be prepared. If there is no specific order, select "na" for each statement. In the third column, select the letter grouping that corresponds with the proper explanations for how to prepare each statement. *(Click the icon to view the explanations for how to prepare each statement.) 3. How to prepare 1. Financial statement (1) 2. Order (2) (3) (6) 1) (8) ||19) ||(12) (10) (11) 3: More Info a. b. c. d. e. f. g. h. I. 1. k. I. m. n. 0. p. 4. Each asset account is listed separately and then totaled. Cash is always listed first. Each dollar amount is calculated by evaluating the cash column on the transaction detail. Each expense account is listed separately from largest to smallest and then subtotaled if necessary. Financing activities include cash from the issuance of common stock and payment of cash dividends. Investing activities include the purchase and sale of land and equipment. Liabilities are listed separately and then totaled. Liabilities that are to be paid first are listed first. Net income is calculated as total revenues minus total expenses. Operating activities involve cash receipts for services provided and cash payments for expenses paid. The beginning retained earnings is listed first and will always be the ending retained eamings from the previous time period. The ending cash balance must match the cash balance on the balance sheet. The header includes the name of the business, the title of the statement, and the date, listed as a period of time. The header includes the name of the business, the title of the statement, and the date, listed as a specific date. The net income are added to the beginning retained eamings. The stockholders' equity section includes common stock and ending retained earnings from the statement of retained earnings. The dividends are subtracted from retained earrings. If there had been a net loss, this would also be subtracted. The revenue accounts are always listed first and then subtotaled if necessary. This statement must always balance. Assets = Liabilities - Equity 4. TTIIS Slaleel lllust always walalice. Assets - Llaullites T cquity (2) O 04 O n/a 1. (1) O O Balance sheet O Income statement Statement of capital position O Statement of cash earnings O Statement of cash flows O Statement of financial profit Statement of retained earnings (3) O O b, d, e, h, j, k Oi, k, n, o O a, b, f, I. O c, g, k, p O a, f, I, n, a Oc, g, 1, p O b, c, e, h, j, k Oi, k, m, o 03 (5) O 04 O n/a 1 (4) O O Balance sheet Income statement Statement of capital position O Statement of cash earnings O Statement of cash flows O Statement of financial profit Statement of retained earnings O O b, d, e, h, j, k Oi, k, n, o O a, b, f, O c, g, k, p O a, f, I, n, a Oc, g, I, p. O b, c, e, h, j, k Oi, k, m, o (7) O (8) O 04 O n/a 1 Balance sheet Income statement Statement of capital position Statement of cash earnings Statement of cash flows Statement of financial profit Statement of retained earnings (9) O a, b, f,i a, f, I, n, a O b, c, e, h, j, k O b, d, e, h, j, k Oi, k, n, o Oc, g, k, p Oc, g, 1, p. Oi, k, m, o O2 03 (10) O (11) 04 O n/a Balance sheet Income statement Statement of capital position Statement of cash earnings O Statement of cash flows O Statement of financial profit Statement of retained earnings O b, d, e, h, j, k Oi, k, n, o O a, b, f, . O c, g, k, p O a, f, I, n, a Oc, g, 1, p O b, c, e, h, j, k Oi, k, m, o