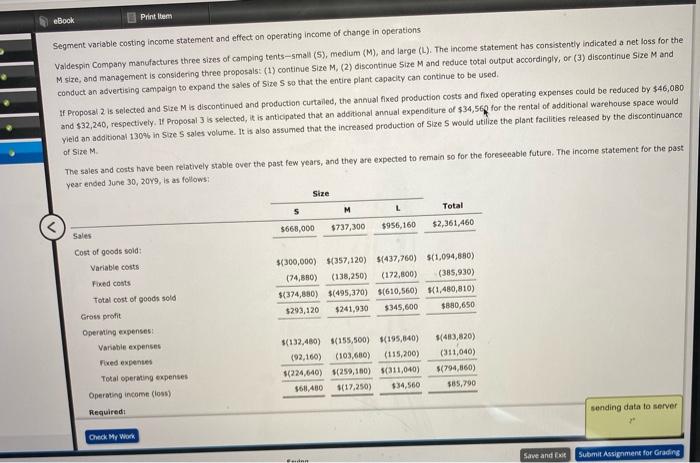

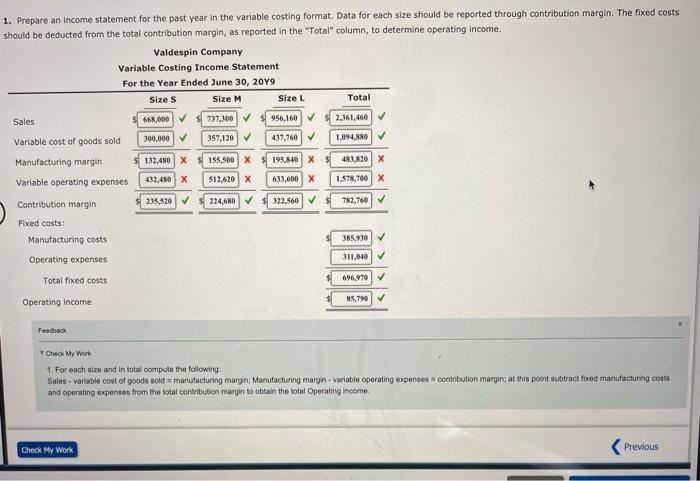

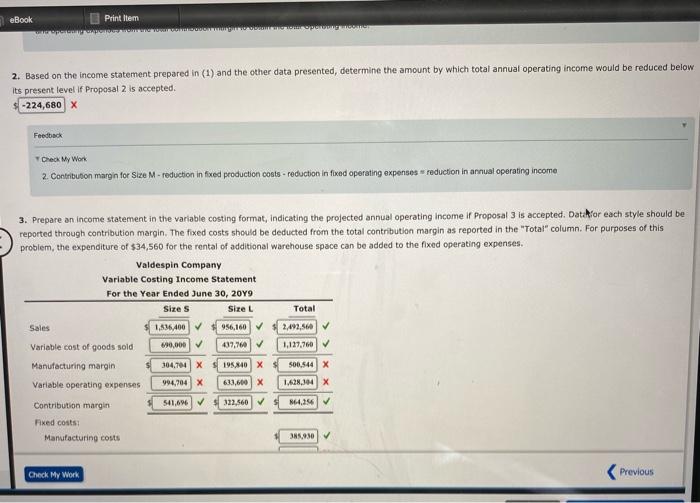

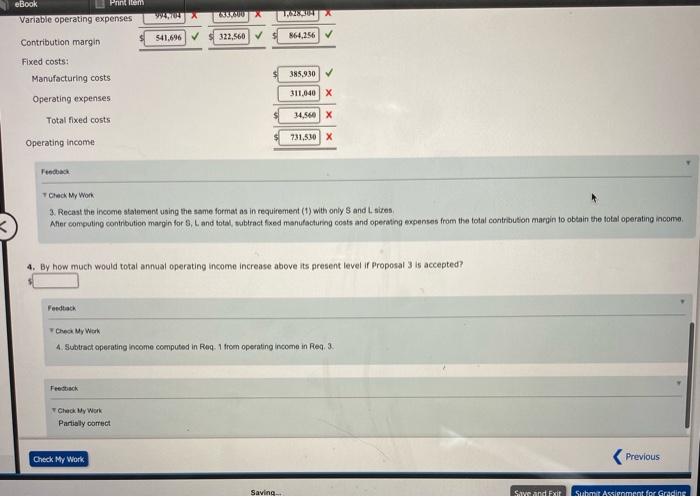

Print Item eBook Segment variable costing Income statement and effect on operating income of change in operations Valdespin Company manufactures three sizes of camping tents-small (S), medium (M), and large (L). The income statement has consistently indicated a net loss for the M size, and management is considering three proposals: (1) continue Size M, (2) discontinue Size M and reduce total output accordingly, or (3) discontinue Size M and conduct an advertising campaign to expand the sales of Size S so that the entire plant capacity can continue to be used If Proposal 2 is selected and Size M is discontinued and production curtailed, the annual fixed production costs and fixed operating expenses could be reduced by $46,080 and $32,240, respectively. It Proposal 3 is selected, it is anticipated that an additional annual expenditure of $34,56 for the rental of additional warehouse space would yield an additional 130% in Size S sales volume. It is also assumed that the increased production of Size S would utilize the plant facilities released by the discontinuance of Size M The sales and costs have been relatively stable over the past few years, and they are expected to remain so for the foreseeable future. The income statement for the past year ended June 30, 2019, is as follows: Size M L Total $668,000 $737,300 $956,160 $2,361,460 Sales Cost of goods sold: Variable costs Fixed costs $300,000) $(357,120) $(437,760) $(1,094,880) (74,890) (138,250) (172,800) (385,930) ${374,880) $(495,370) $(610,560) 1,480,810) $293,120 $241.930 $345,600 $880,650 Total cost of goods sold Gross profit Operating expenses Variable expenses Fixed expenses Total operating expenses Operating income (s) Required: $(132,480) $(155,500) 195,640) (92,160) (103,680) (115,200) $(224,640) $259,160) $(311,040) 5611,450 $(17.250) $34,560 (483,820) (311,040) $(794,860) S85,790 sending data to server Check My Work Save and Exe Submit Assignment for Grading Led 1. Prepare an income statement for the past year in the variable costing format. Data for each size should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin, as reported in the "Total" column, to determine operating Income. Valdespin Company Variable Costing Income Statement For the Year Ended June 30, 2019 Size S Size M Size L Total 737,300 956,160 2,361,460 Sales Variable cost of goods sold 660,000 300,000 357.120 437.760 1,094,880 Manufacturing margin 132,480 X 155,500 X 195.840 X 483.820 X Variable operating expenses 432,480 X 512,620 X 633,600X 1,578,700 X 215.520 224,680 322,560 782,760 Contribution margin Fixed costs: Manufacturing costs 385,930 Operating expenses 311.040 Total fixed costs 696,970 Operating income 85,790 Feedback Check My Work 1. For each size and in total compute the following Sales variable cost of goods sold manufacturing margin, Manufacturing margin-variable operating expenses contribution margin, at this point subtract fixed manufacturing costs and operating expenses from the total contribution margin to obtain the total Operating income Check My Work Previous eBook Print Item wap.com Coor 2. Based on the income statement prepared in (1) and the other data presented, determine the amount by which total annual operating income would be reduced below its present level of Proposal 2 is accepted. -224,680 X Feedback Check My Work 2. Contribution margin for Size M - reduction in fixed production costs - reduction in fixed operating expenses reduction in annual operating income 3. Prepare an income statement in the variable costing format, indicating the projected annual operating Income ir Proposal 3 is accepted. Dat kor each style should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin as reported in the "Total" column. For purposes of this problem, the expenditure of $34,560 for the rental of additional warehouse space can be added to the fixed operating expenses. Valdespin Company Variable Costing Income Statement For the Year Ended June 30, 2019 Size S Size L Total Sales 1.536,400 956,160 2,492,566 Variable cost of goods sold 690,000 439,160 1,127,760 Manufacturing margin 304.704 X 195.840 X 500.544 X Variable operating expenses 994,704 X 633,600 X 1.428,344 X Contribution margin 541,096 322,560 64.256 Fixed costs Manufacturing costs 385.930 Check My Work Previous eBook Pantiem Variable operating expenses 4. 35 199280 541.696 322.560 864.256 Contribution margin Fixed costs: 385.930 Manufacturing costs 311.640 X Operating expenses Total fixed costs 34.560 x 731.530 X Operating income Check My Work 3. Recast the income statement using the same formatos in requirement (1) with only S and I sures Afer computing contribution margin for 8, L and total, subtract fixed manufacturing costs and operating expenses from the total contribution margin to obtain the total operating income 4. By how much would total annual operating income increase above its present level or Proposal 3 is accepted? Feedback Check My Work 4. Subtract operating income computed in Req. 1 from operating income in Reg. 3 Feedback Check My Work Partially correct Check My Work Previous Saving.. Save and Exit Suht Assignmentanding