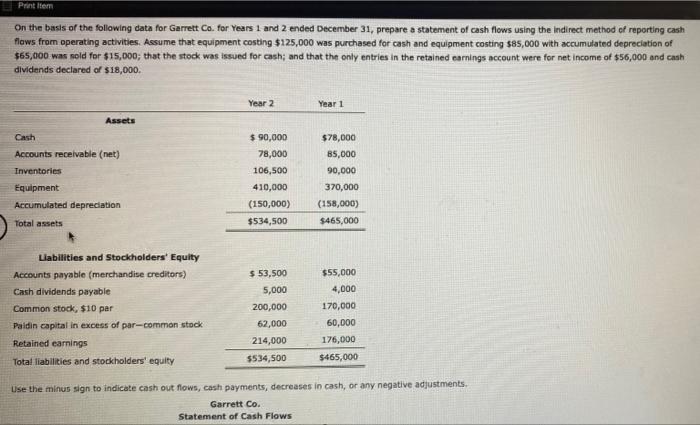

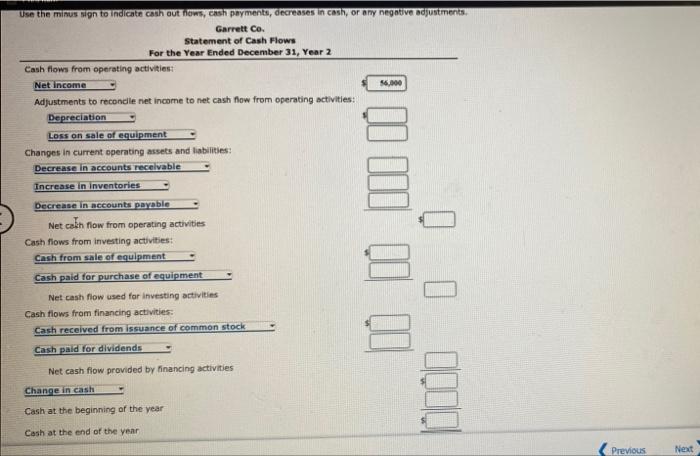

Print Item On the basis of the following data for Garrett Co. for Years 1 and 2 ended December 31, prepare a statement of cash flows using the Indirect method of reporting cash flows from operating activities. Assume that equipment costing $125,000 was purchased for cash and equipment costing $85,000 with accumulated depreciation of $65,000 was sold for $15,000; that the stock was issued for cash; and that the only entries in the retained carnings account were for net income of $56,000 and cash dividends declared of $18,000. Year 2 Year 1 Assets Cash Accounts receivable (net) Inventories Equipment Accumulated depreciation $ 90,000 78,000 106,500 410,000 (150,000) $534,500 $78,000 85,000 90,000 370,000 (158,000) $465,000 Total assets Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) Cash dividends payable Common stock, $10 par Paidin capital in excess of par-common stock Retained earnings Total liabilities and stockholders' equity $ 53,500 5,000 200,000 62,000 214,000 $534,500 $55,000 4,000 170,000 60,000 176,000 $465,000 Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments Garrett Co. Statement of Cash Flows Use the minus sign to indicate cash out hows, cash payments, decreases in casky or any negative adjustments, Garrett Co. Statement of Cash Flows For the Year Ended December 31, Year 2 Cash flows from operating activities Net Income 36.000 Adjustments to reconcile net income to net cash flow from operating activities: Depreciation LOSS on sale of equipment Changes in current operating assets and liabilities: Decrease in accounts recevable Increase in inventories Decrease in accounts payable Net calin flow from operating activities Cash flows from investing activities: Cash from sale of equipment ! ! Il 0 0 0 Cash paid for purchase of equipment Net cash flow used for investing activities Cash flows from financing activities: Cash received from issuance of common stock Cash paid for dividends Net cash flow provided by financing activities Change in cash Cash at the beginning of the year Cash at the end of the year Previous Next