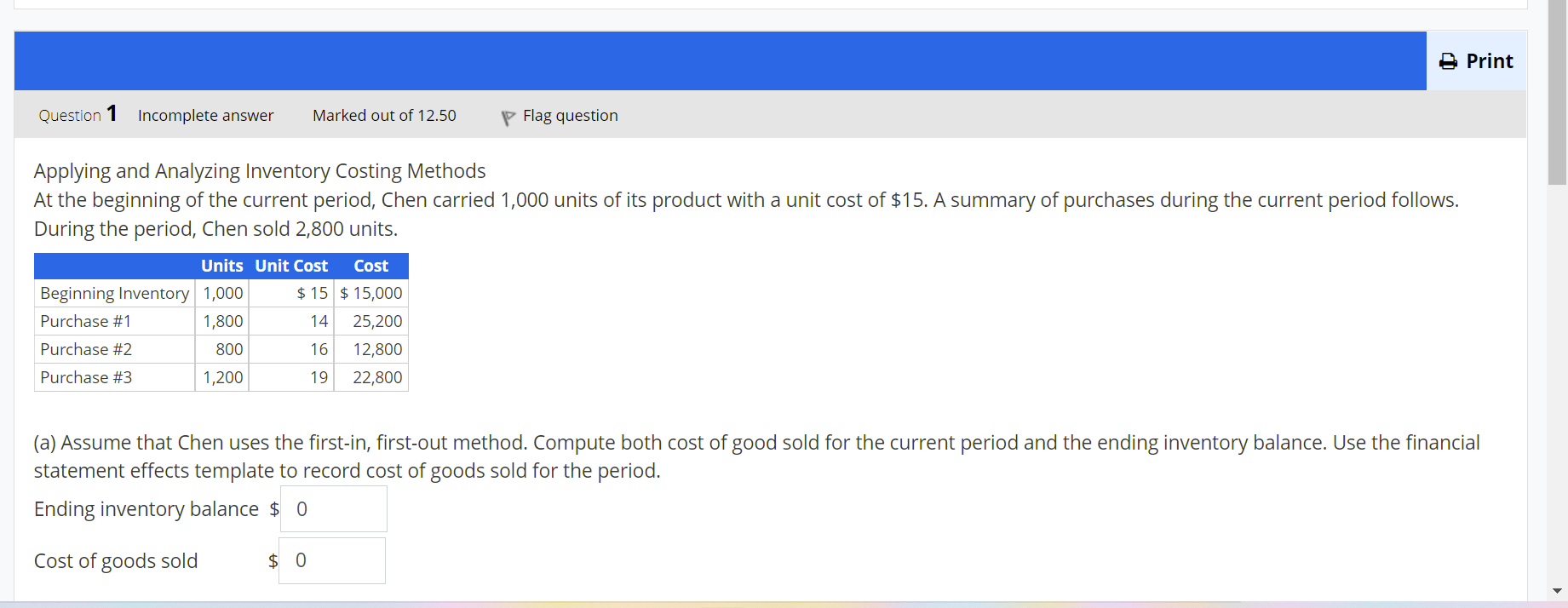

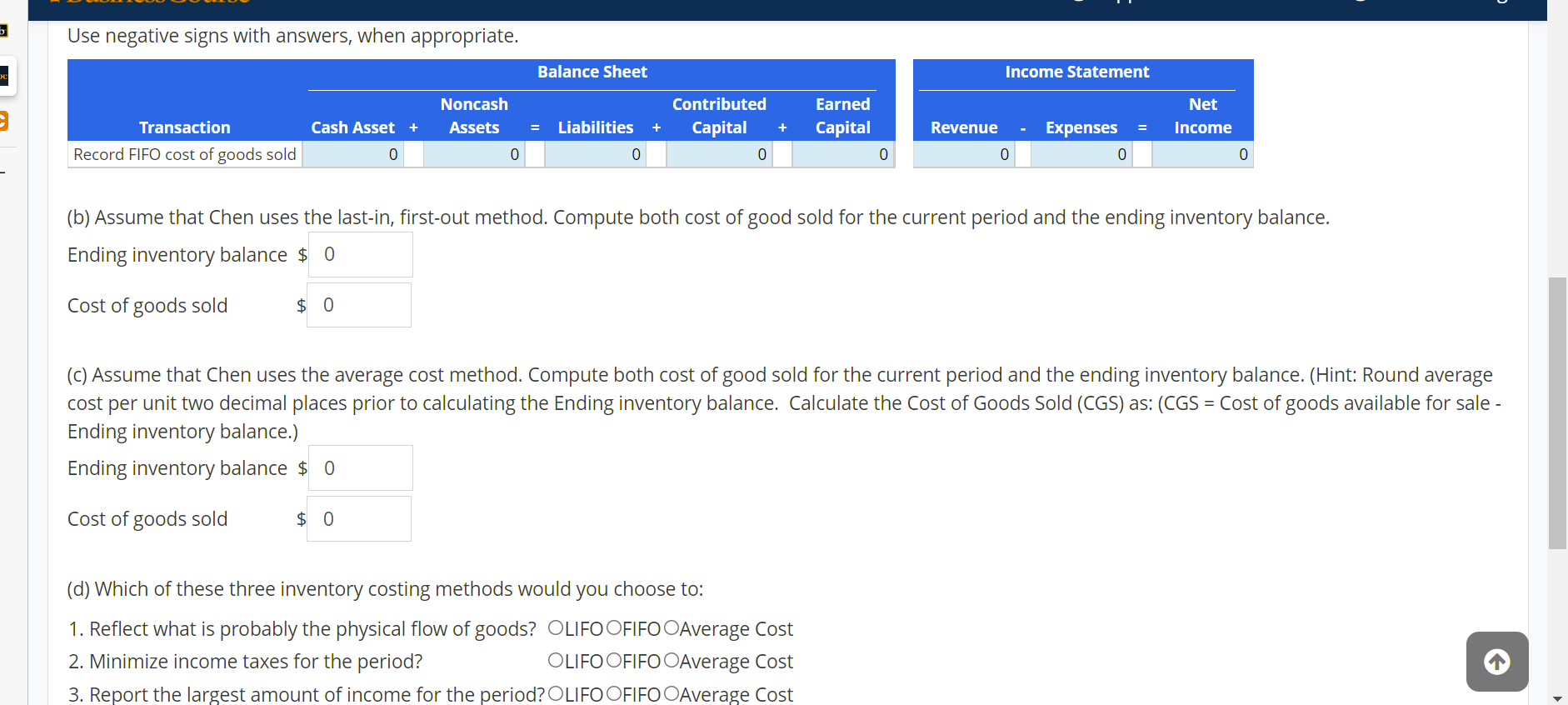

Print Question 1 Incomplete answer Marked out of 12.50 P Flag question Applying and Analyzing Inventory Costing Methods At the beginning of the current period, Chen carried 1,000 units of its product with a unit cost of $15. A summary of purchases during the current period follows. During the period, Chen sold 2,800 units. Units Unit Cost Cost Beginning Inventory 1,000 $ 15 $ 15,000 Purchase #1 1,800 14 25,200 Purchase #2 800 16 12,800 Purchase #3 1,200 19 22,800 (a) Assume that Chen uses the first-in, first-out method. Compute both cost of good sold for the current period and the ending inventory balance. Use the financial statement effects template to record cost of goods sold for the period. Ending inventory balance $ 0 Cost of goods sold $ 0 Use negative signs with answers, when appropriate. Balance Sheet Income Statement Noncash Assets = Liabilities Net Income + Contributed Capital 0 + Earned Capital 0 Transaction Record FIFO cost of goods sold Revenue Cash Asset + 0 = Expenses 0 0 0 0 (b) Assume that Chen uses the last-in, first-out method. Compute both cost of good sold for the current period and the ending inventory balance. Ending inventory balance $ 0 Cost of goods sold $ 0 (C) Assume that Chen uses the average cost method. Compute both cost of good sold for the current period and the ending inventory balance. (Hint: Round average cost per unit two decimal places prior to calculating the Ending inventory balance. Calculate the cost of Goods Sold (CGS) as: (CGS = Cost of goods available for sale - Ending inventory balance.) Ending inventory balance $ 0 Cost of goods sold $ 0 (d) Which of these three inventory costing methods would you choose to: 1. Reflect what is probably the physical flow of goods? OLIFO OFIFO O Average Cost 2. Minimize income taxes for the period? OLIFO OFIFO OAverage Cost 3. Report the largest amount of income for the period? OLIFO OFIFO O Average Cost 1 Print Question 1 Incomplete answer Marked out of 12.50 P Flag question Applying and Analyzing Inventory Costing Methods At the beginning of the current period, Chen carried 1,000 units of its product with a unit cost of $15. A summary of purchases during the current period follows. During the period, Chen sold 2,800 units. Units Unit Cost Cost Beginning Inventory 1,000 $ 15 $ 15,000 Purchase #1 1,800 14 25,200 Purchase #2 800 16 12,800 Purchase #3 1,200 19 22,800 (a) Assume that Chen uses the first-in, first-out method. Compute both cost of good sold for the current period and the ending inventory balance. Use the financial statement effects template to record cost of goods sold for the period. Ending inventory balance $ 0 Cost of goods sold $ 0 Use negative signs with answers, when appropriate. Balance Sheet Income Statement Noncash Assets = Liabilities Net Income + Contributed Capital 0 + Earned Capital 0 Transaction Record FIFO cost of goods sold Revenue Cash Asset + 0 = Expenses 0 0 0 0 (b) Assume that Chen uses the last-in, first-out method. Compute both cost of good sold for the current period and the ending inventory balance. Ending inventory balance $ 0 Cost of goods sold $ 0 (C) Assume that Chen uses the average cost method. Compute both cost of good sold for the current period and the ending inventory balance. (Hint: Round average cost per unit two decimal places prior to calculating the Ending inventory balance. Calculate the cost of Goods Sold (CGS) as: (CGS = Cost of goods available for sale - Ending inventory balance.) Ending inventory balance $ 0 Cost of goods sold $ 0 (d) Which of these three inventory costing methods would you choose to: 1. Reflect what is probably the physical flow of goods? OLIFO OFIFO O Average Cost 2. Minimize income taxes for the period? OLIFO OFIFO OAverage Cost 3. Report the largest amount of income for the period? OLIFO OFIFO O Average Cost 1