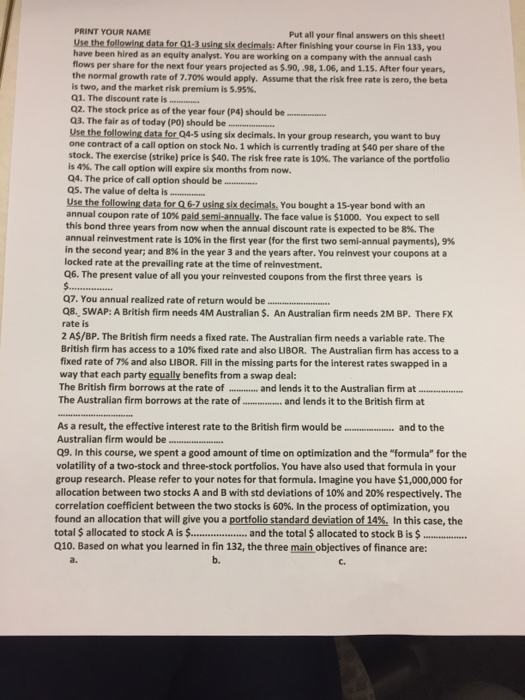

PRINT YOUR NAMIE Put all your final answers on this sheet Use the following data for Q1-3 using six decimals: After finishing your course in Fin 133, you have been hired as an equity analyst. You are working on a company with the annual cash flows per share for the next four years projected as $.90, .98, 1.06, and 1.15. After four years the normal growth rate of 7.70% would apply. Assume that the risk free rate is zero, the beta is two, and the market risk premium is 5.95%. Q1. The discount rate is Q2. The stock price as of the year four (P4) should be Q3. The fair as of today (PO) should be Use the following data for 04-5 using six decimals. In your group research, you want to buy one contract of a call option on stock No. 1 which is currently trading at $40 per share of the stock. The exercise (strike) price is $40. The risk free rate is 10%. The variance of the portfolio is 4%. The call option will expire six months from now. Q4. The price of call option should be. Q5. The value of delta is Use the following data for Q 6-7 using six decimals, You bought a 15-year bond with an annual coupon rate of 10% paid semi-annually. The face value is $1000. You expect to sell this bond three years from now when the annual discount rate is expected to be 8%. The annual reinvestment rate is 10% in the first year (for the first two semi-annual payments, 9% in the second year, and 8% in the year 3 and the years after. You reinvest your coupons at a locked rate at the prevailing rate at the time of reinvestment. Q6. The present value of all you your reinvested coupons from the first three years is Q7. You annual realized rate of return would be Q8., SWAP: A British firm needs 4M Australian $. An Australian firm needs 2M BP. There FX rate is 2 A$/BP. The British firm needs a fixed rate. The Australian firm needs a variable rate. The British firm has access to a 10% fixed rate and also uBOR. The Australian firm has access to a fixed rate of 7% and also LIBOR. Fill in the missing parts for the interest rates swapped in a way that each party equally benefits from a swap deal The British firm borrows at the rate of. and lends it to the Australian firm at The Australian firm borrows at the rate o and lends it to the British firm at As a result, the effective interest rate to the British firm would be... and to the Australian firm would be. Q9. In this course, we spent a good amount of time on optimization and the "formula" for the volatility of a two-stock and three-stock portfolios. You have also used that formula in your group research. Please refer to your notes for that formula. Imagine you have $1,000,000 for allocation between two stocks A and B with std deviations of 10% and 20% respectively. The correlation coefficient between the two stocks is 60%. In the process of optimization, you found an allocation that will give you a portfolio standard deviationf14%. In this case, the total $ allocated to stock A is and the total $ allocated to stock Bis $ Q10. Based on what you learned in fin 132, the three main objectives of finance are: a. b. C