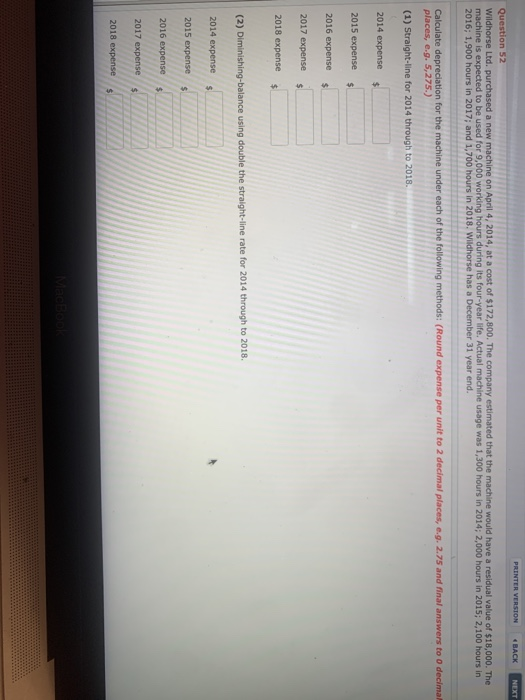

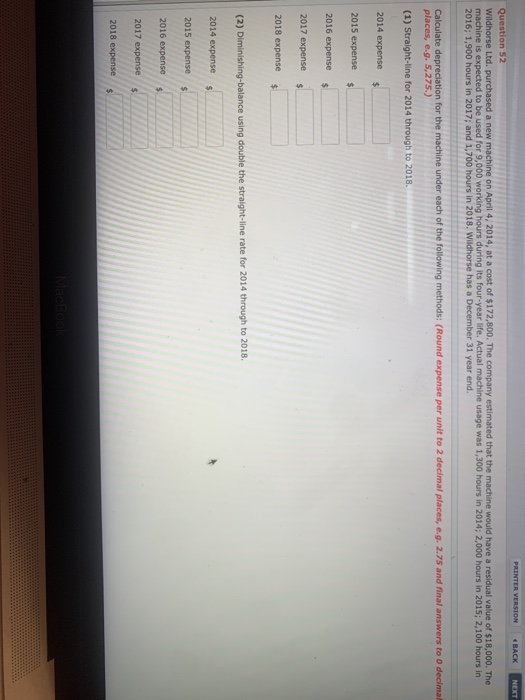

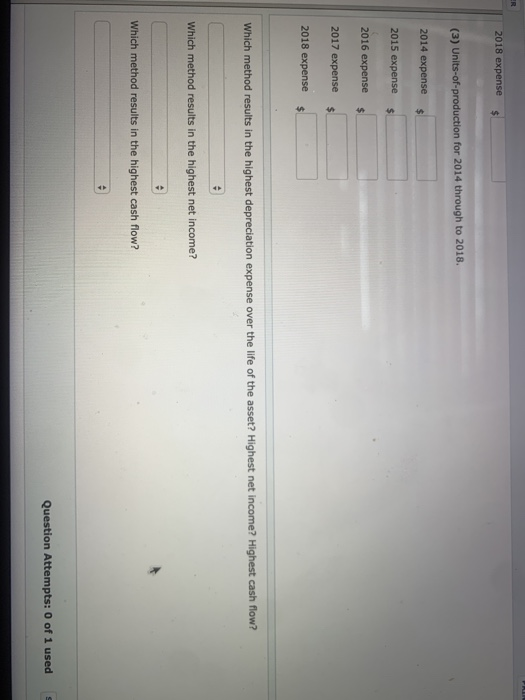

PRINTER VERSION BACK NEXT Question 52 Wildhorse Ltd. purchased a new machine on April 4, 2014, at a cost of $172,800. The company estimated that the machine would have a residual value of $18,000. The machine is expected to be used for 9,000 working hours during its four-year life. Actual machine usage was 1,300 hours in 2014; 2,000 hours in 2015; 2,100 hours in 2016; 1,900 hours in 2017; and 1,700 hours in 2018. Wildhorse has a December 31 year end. Calculate depreciation for the machine under each of the following methods: (Round expense per unit to 2 decimal places, e.g. 2.75 and final answers to 0 decimal places, e.g. 5,275.) (1) Straight-line for 2014 through to 2018. 2014 expenses 2015 expense 2016 expense 2017 expense 2018 expense (2) Diminishing-balance using double the straight-line rate for 2014 through to 2018. 2014 expense 2015 expense 2016 expense 2017 expense 2018 expense PRINTER VERSION BACK NEXT Question 52 Wildhorse Ltd. purchased a new machine on April 4, 2014, at a cost of $172,800. The company estimated that the machine would have a residual value of $18,000. The machine is expected to be used for 9,000 working hours during its four-year life. Actual machine usage was 1,300 hours in 2014; 2,000 hours in 2015; 2,100 hours in 2016; 1,900 hours in 2017; and 1,700 hours in 2018. Wildhorse has a December 31 year end. Calculate depreciation for the machine under each of the following methods: (Round expense per unit to 2 decimal places, e.g. 2.75 and final answers to 0 decimal places, e.g. 5,275.) (1) Straight-line for 2014 through to 2018. 2014 expenses 2015 expense 2016 expense 2017 expense 2018 expense (2) Diminishing-balance using double the straight-line rate for 2014 through to 2018. 2014 expense 2015 expense 2016 expense 2017 expense 2018 expense 2018 expenses (3) Units-of-production for 2014 through to 2018. 2014 expense 2015 expense 2016 expense 2017 expense 2018 expenses Which method results in the highest depreciation expense over the life of the asset? Highest net income? Highest cash flow? Which method results in the highest net income? Which method results in the highest cash flow? Question Attempts: 0 of 1 used