Answered step by step

Verified Expert Solution

Question

1 Approved Answer

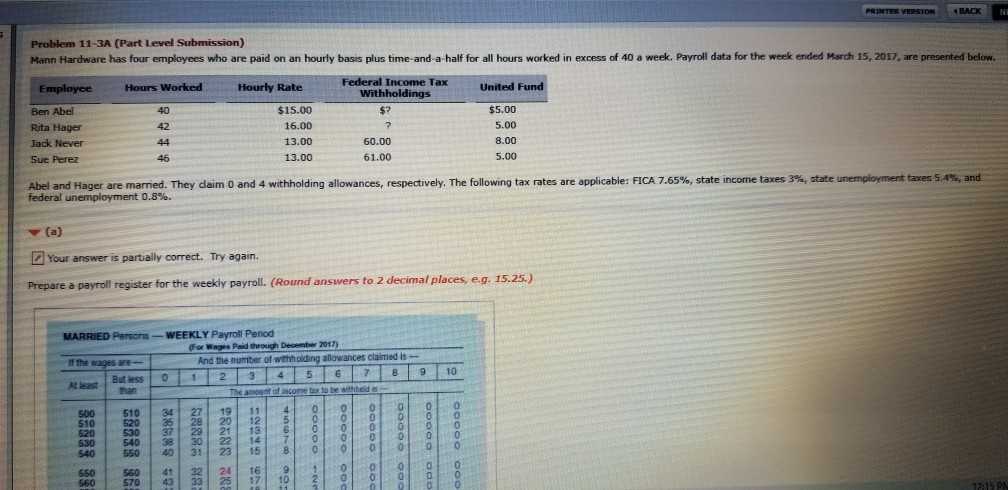

PRINTER VERSION BACK NI th Problem 11-3A (Part Level Submission) Mann Hardware has four employees who are paid on an hourly basis plus time-and-a-half for

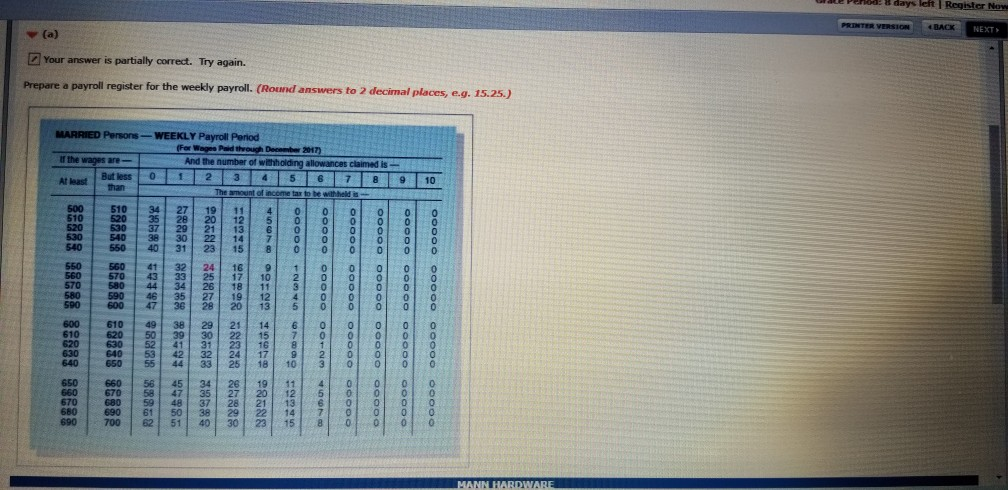

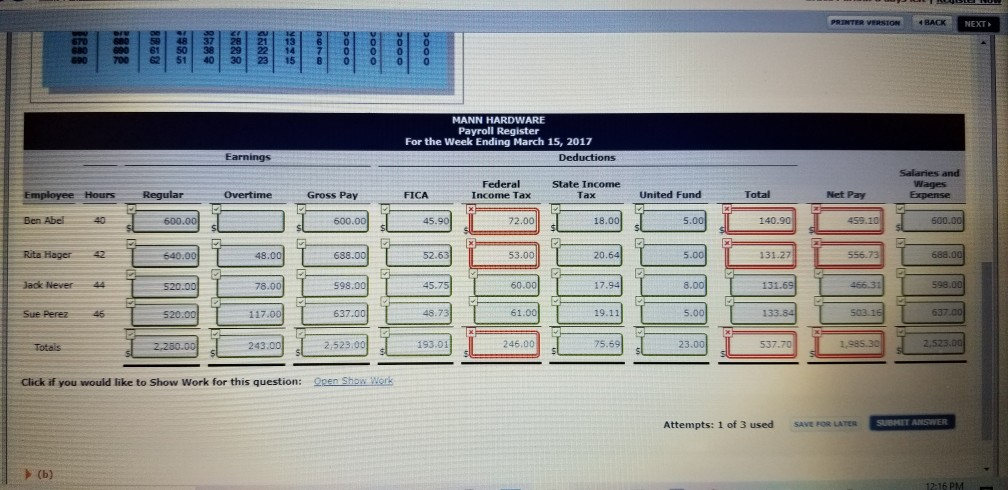

PRINTER VERSION BACK NI th Problem 11-3A (Part Level Submission) Mann Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2017, are presented below. Employee Hours Worked Hourly Rate United Fund Federal Income Tax Withholdings $? 40 $5.00 42 2 Ben Abel Rita Hager Jack Never Sue Perez $15.00 16.00 13.00 13.00 44 60.00 61.00 5.00 8.00 5.00 46 Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3%, state unemployment taxes 5.4%, and federal unemployment 0.8%. (a) Your answer is partially correct. Try again. Prepare a payroll register for the weekly payroll. (Round answers to 2 decimal places, e.g. 15.25.) 10 MARRIED Persons -WEEKLY Payroll Period (For Wages Pald through December 2017) If the wages are And the number of withholding allowances claimed is - But less 0 1 2 2 3 4 5 6 7 8 9 At least than The amount of income to be withheld is 500 510 34 27 19 11 41 0 0 0 0 0 0 510 520 35 28 20 12 5 0 0 520 530 37 21 13 60 0 530 540 38 22 0 0 0 540 550 40 31 23 15 B 0 0 0 0 0 550 560 41 32 24 16 9 1 0 0 0 560 579 43 25 17 10 2 0 0 0 O 88 9888 boo 0000 OOO 00000 2 12:15 PN [G) B: 98 | Music audies | 0|1|2|3||5|6|7|A|| 10 MARRIED Persons -WEEKLY Payroll Period For More Paid through December 2017 of income tax to be withhold claimed is on-bo AOU # Your answer is partially correct. Try again. Prepare a payroll register for the weekly payroll. (Round answers to 2 decimal places, e.g. 15.25.) In a shoes oops of Tact Ni - sosop E46 LT / oooooooooooop New ooope oooooooooooooop oooooooooooooooooo ooooooooooooooooooo eogee googo oooooooooo PRINTER VERSION 4 BACK NEXT W 1688 8988 **&8 2588 13 14 15 6 7 8 000 OOOC 0 0 0 700 $1 40 30 23 0 0 MANN HARDWARE Payroll Register For the Week Ending March 15, 2017 Deductions Earnings Employee Hours Salaries and Wages Expense Federal Income Tax Regular Gross Pay State Income Tax Overtime FICA United Fund Total Net Pay Ben Abel 40 600.00 600.00 45.90 72.00 18.00 5.00 140.90 459.10 600.00 x Rita Hager 640.00 48.00 688.00 52.63 53.00 20.64 5.00 131.27 556.73 688.00 Jack Never 44 520.001 78.00 598.00 45.75 60.00 17.94 8.00 131.691 466.31 598.00 Sue Perez $ 45 520.00 117.00 637.00 48.73 61.00 19.11 5.00 133.54 503.16 637.00 Totals 2.250.00 243.00 2,523.00 193.01 246.00 75.59 23.00 537.70 1.985 30 2.523.00 L Click if you would like to Show Work for this question: Open Show Work Attempts: 1 of 3 used SAVE FOR LATES SUBMIT ANSWER (b) 12:16 PM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started