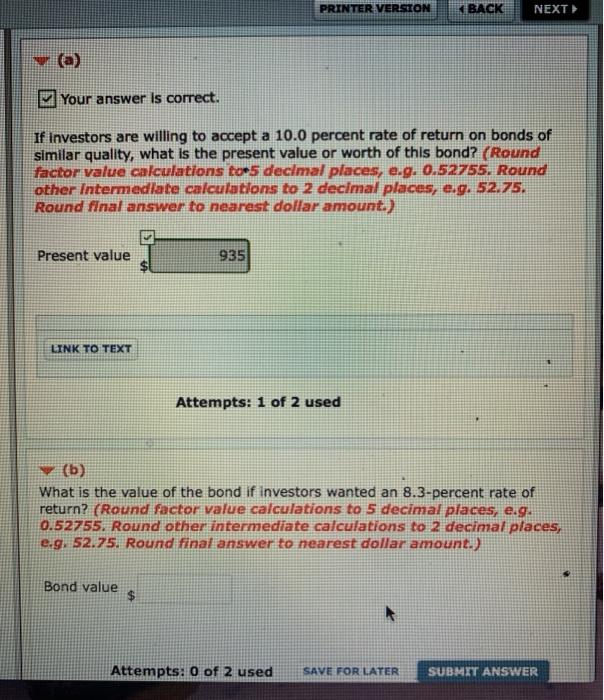

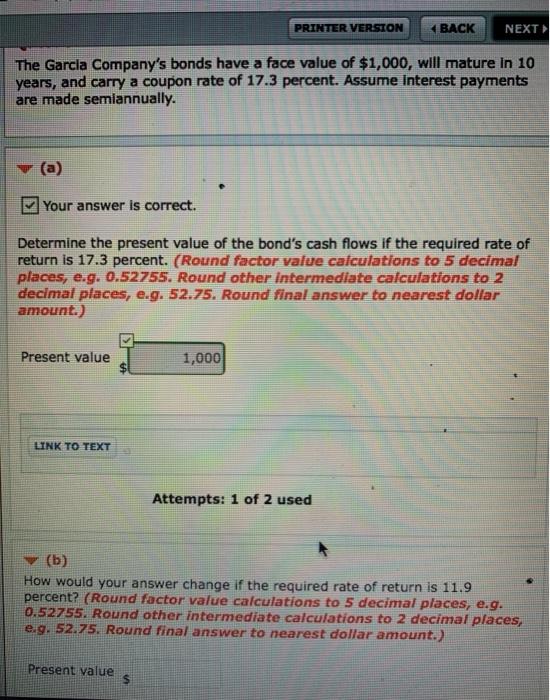

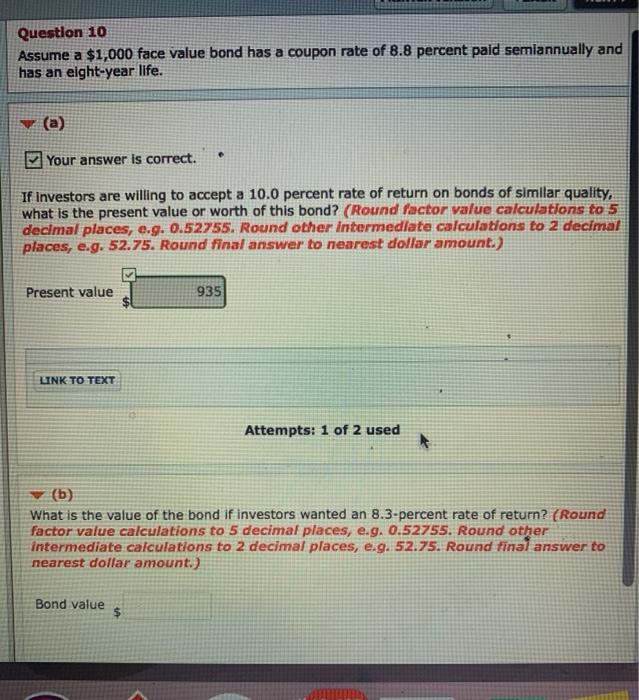

PRINTER VERSION KBACK NEXT Your answer is correct. If Investors are willing to accept a 10.0 percent rate of return on bonds of similar quality, what is the present value or worth of this bond? (Round factor value calculations toe5 decimal places, e.g. 0.52755. Round other Intermedlate calculations to 2 decimal places, e.g. 52.75. Round final answer to nearest dollar amount.) Present value 935 LINK TO TEXT Attempts: 1 of 2 used (b) What is the value of the bond if investors wanted an 8.3-percent rate of return? (Round factor value calculations to 5 decimal places, e.g. 0.52755. Round other intermediate calculations to 2 decimal places, e.g. 52.75. Round final answer to nearest dollar amount:) Bond value Attempts: 0 of 2 used SAVE FOR LATER SUBMIT ANSWER PRINTER VERSION 4 BACK NEXT The Garcia Company's bonds have a face value of $1,000, will mature in 10 years, and carry a coupon rate of 17.3 percent. Assume Interest payments are made semiannually. (a) Your answer is correct. Determine the present value of the bond's cash flows if the required rate of return is 17.3 percent. (Round factor value calculations to 5 decimal places, e.g. 0.52755. Round other intermediate calculations to 2 decimal places, e.g. 52.75. Round final answer to nearest dollar amount.) Present value 1,000 LINK TO TEXT Attempts: 1 of 2 used (b) How would your answer change if the required rate of return is 11.9 percent? (Round factor value calculations to 5 decimal places, e.g. 0.52755. Round other intermediate calculations to 2 decimal places, e.g. 52.75. Round final answer to nearest dollar amount.) Present value $ Question 10 Assume a $1,000 face value bond has a coupon rate of 8.8 percent pald semiannually and has an elght-year life. (a) Your answer is correct. If investors are willing to accept a 10.0 percent rate of return on bonds of similar quality, what is the present value or worth of this bond? (Round factor value calculations to 5 decimal places, e.g. 0.52755. Round other intermediate calculations to 2 decimal places, e.g. 52.75. Round final answer to nearest dollar amount.) Present value 935 $ LINK TO TEXT Attempts: 1 of 2 used (b) What is the value of the bond if investors wanted an 8.3-percent rate of return? (Round factor value calculations to 5 decimal places, e.g. 0.52755. Round other intermediate calculations to 2 decimal places, e.g. 52.75. Round final answer to nearest dollar amount.) Bond value