Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prior on 1 May 2015, Mr Irlan purchased a shophouse in Banda RM750,000. He incurred renovation cost for RM35,500 for the shophou value in

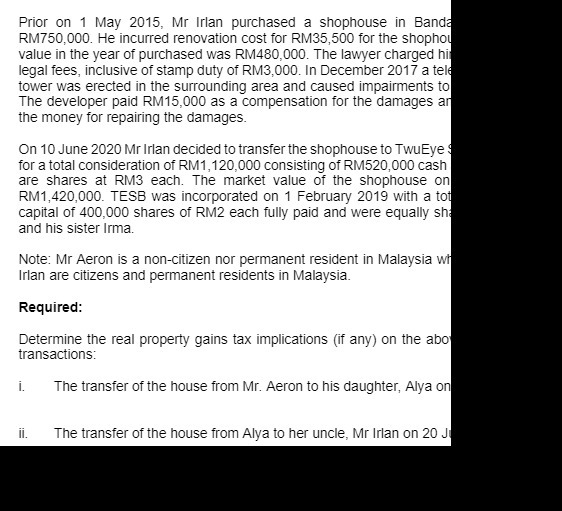

Prior on 1 May 2015, Mr Irlan purchased a shophouse in Banda RM750,000. He incurred renovation cost for RM35,500 for the shophou value in the year of purchased was RM480,000. The lawyer charged hi legal fees, inclusive of stamp duty of RM3,000. In December 2017 a tele tower was erected in the surrounding area and caused impairments to The developer paid RM15,000 as a compensation for the damages ar the money for repairing the damages. On 10 June 2020 Mr Irlan decided to transfer the shophouse to TwuEye for a total consideration of RM1,120,000 consisting of RM520,000 cash are shares at RM3 each. The market value of the shophouse on RM1,420,000. TESB was incorporated on 1 February 2019 with a tot capital of 400,000 shares of RM2 each fully paid and were equally sha and his sister Irma. Note: Mr Aeron is a non-citizen nor permanent resident in Malaysia wh Irlan are citizens and permanent residents in Malaysia. Required: Determine the real property gains tax implications (if any) on the abo transactions: The transfer of the house from Mr. Aeron to his daughter, Alya on i. ii. The transfer of the house from Alya to her uncle, Mr Irlan on 20 J

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the real property gains tax RPGT implications for the transactions mentioned i Transfer ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started