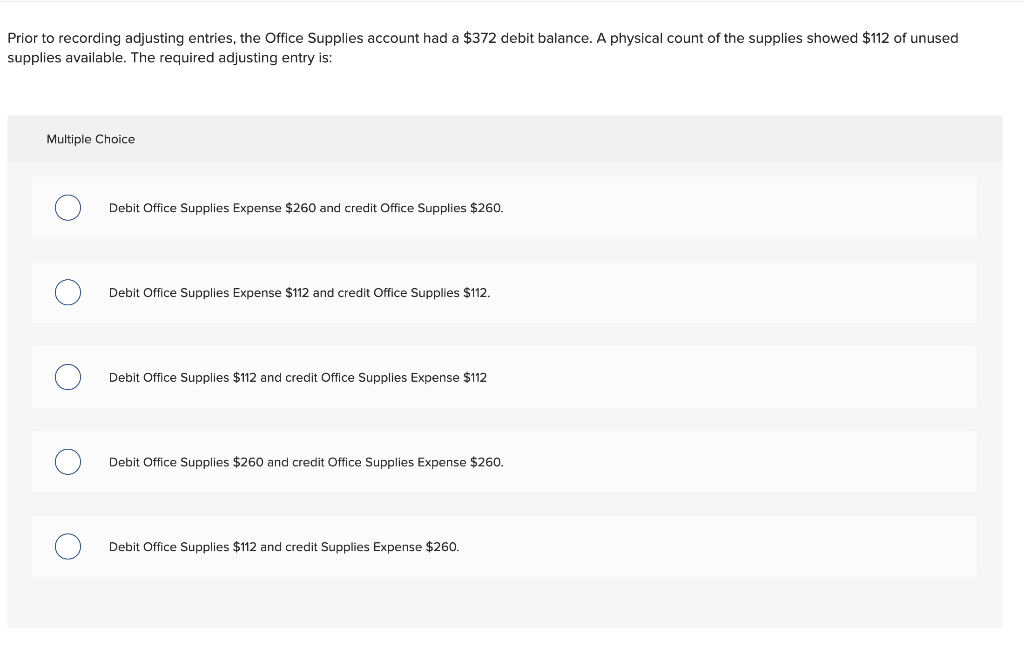

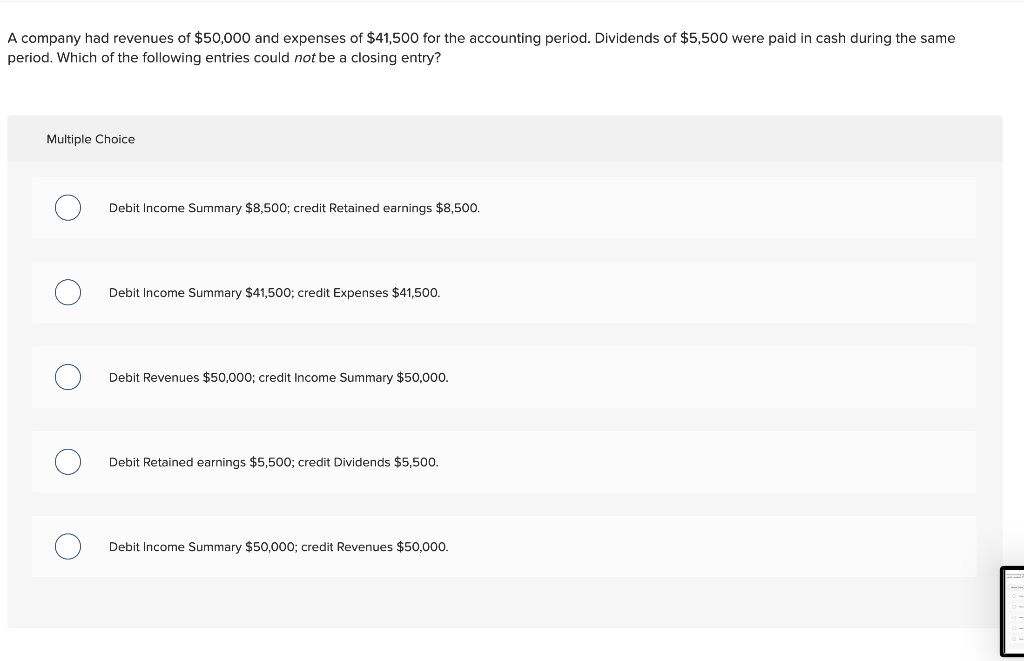

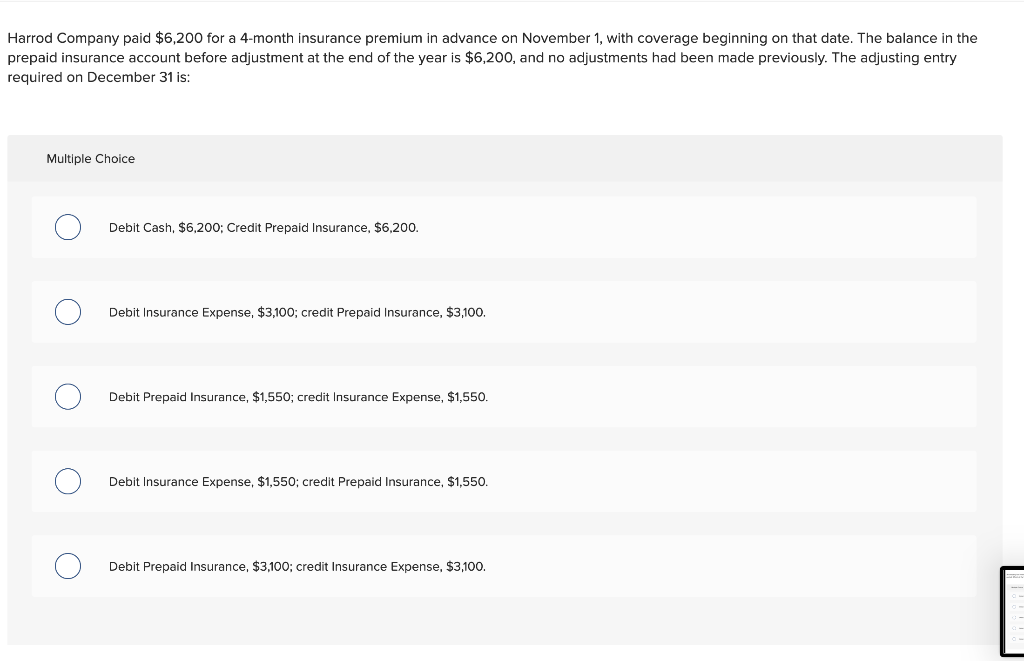

Prior to recording adjusting entries, the Office Supplies account had a $372 debit balance. A physical count of the supplies showed $112 of unused supplies available. The required adjusting entry is: Multiple Choice Debit Office Supplies Expense $260 and credit Office Supplies $260. Debit Office Supplies Expense $112 and credit Office Supplies $112. Debit Office Supplies $112 and credit Office Supplies Expense $112 O Debit Office Supplies $260 and credit Office Supplies Expense $260. Debit Office Supplies $112 and credit Supplies Expense $260. A company had revenues of $50,000 and expenses of $41,500 for the accounting period. Dividends of $5,500 were paid in cash during the same period. Which of the following entries could not be a closing entry? Multiple Choice Debit Income Summary $8,500; credit Retained earnings $8,500. Debit Income Summary $41,500; credit Expenses $41,500. Debit Revenues $50,000; credit Income Summary $50,000. Debit Retained earnings $5,500; credit Dividends $5,500. Debit Income Summary $50,000; credit Revenues $50,000. Harrod Company paid $6,200 for a 4-month insurance premium in advance on November 1, with coverage beginning on that date. The balance in the prepaid insurance account before adjustment at the end of the year is $6,200, and no adjustments had been made previously. The adjusting entry required on December 31 is: Multiple Choice Debit Cash, $6,200; Credit Prepaid Insurance, $6,200. Debit Insurance Expense, $3,100; credit Prepaid Insurance, $3,100. Debit Prepaid Insurance, $1,550, credit Insurance Expense, $1,550. Debit Insurance Expense, $1,550; credit Prepaid Insurance, $1,550. O Debit Prepaid Insurance, $3,100; credit Insurance Expense, $3,100. The Unadjusted Trial Balance columns of a company's work sheet shows the Store Supplies account with a balance of $385. The Adjustments columns shows credit of $215 for supplies used during the period. The amount shown as Store Supplies in the Balance Sheet columns of the work sheet is: Multiple Choice $170 debit. O $170 credit O $215 debit. O $385 credit. $385 debit. O Flagg records adjusting entries at its December 31 year end. At December 31, employees had earned $13,200 of unpaid and unrecorded salaries. The next payday is January 3, at which time $33,000 will be paid. Prepare the January 1journal entry to reverse the effect of the December 31 salary expense accrual. Multiple Choice Debit Salaries expense $19,800; credit Salaries payable $19,800. Debit Salaries expense $19,800; debit Salaries payable $13,200; credit Cash $33,000. O Debit Salaries expense $13,200; credit Salaries payable $13,200. Debit Salaries payable $13,200; credit Salaries expense $13,200. O Debit Salaries payable $19,800; credit Cash $19,800. O