Answered step by step

Verified Expert Solution

Question

1 Approved Answer

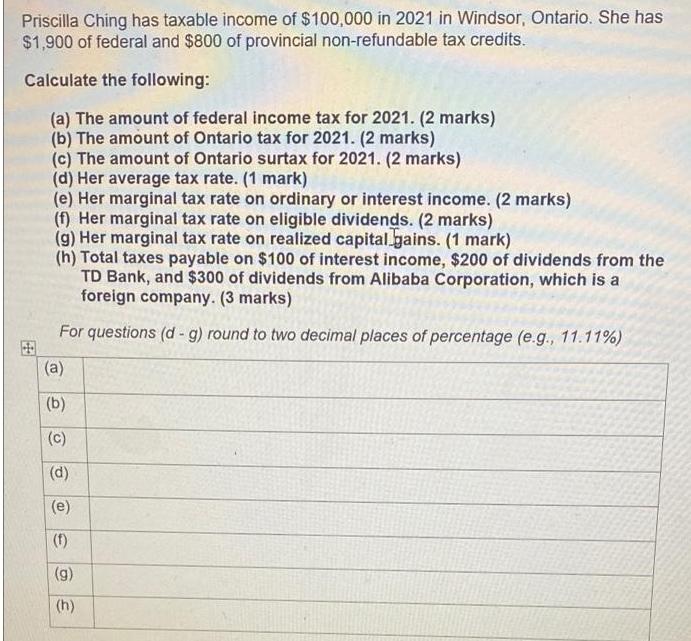

Priscilla Ching has taxable income of $100,000 in 2021 in Windsor, Ontario. She has $1,900 of federal and $800 of provincial non-refundable tax credits.

Priscilla Ching has taxable income of $100,000 in 2021 in Windsor, Ontario. She has $1,900 of federal and $800 of provincial non-refundable tax credits. Calculate the following: (a) The amount of federal income tax for 2021. (2 marks) (b) The amount of Ontario tax for 2021. (2 marks) (c) The amount of Ontario surtax for 2021. (2 marks) (d) Her average tax rate. (1 mark) (e) Her marginal tax rate on ordinary or interest income. (2 marks) (f) Her marginal tax rate on eligible dividends. (2 marks) (g) Her marginal tax rate on realized capital gains. (1 mark) (h) Total taxes payable on $100 of interest income, $200 of dividends from the TD Bank, and $300 of dividends from Alibaba Corporation, which is a foreign company. (3 marks) For questions (d- g) round to two decimal places of percentage (e.g., 11.11%) (a) (b) (C) (d) (e) (f) (g) (h)

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a The amount of federal income tax for 2021 is 18900 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started