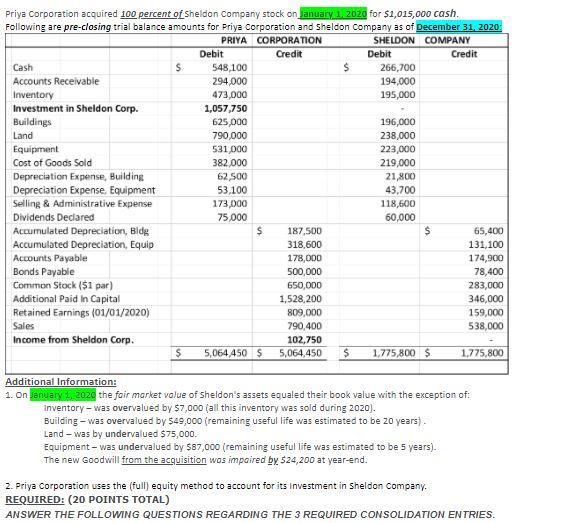

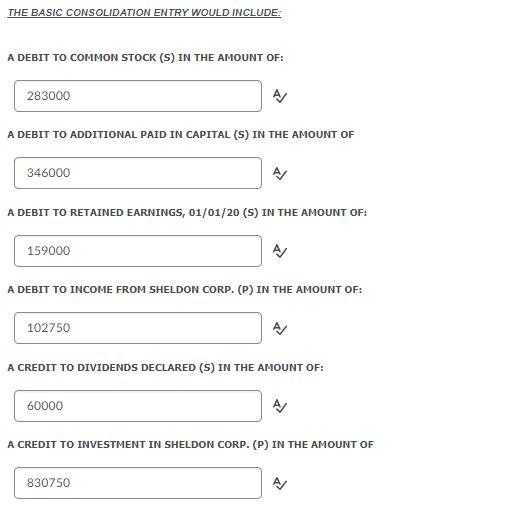

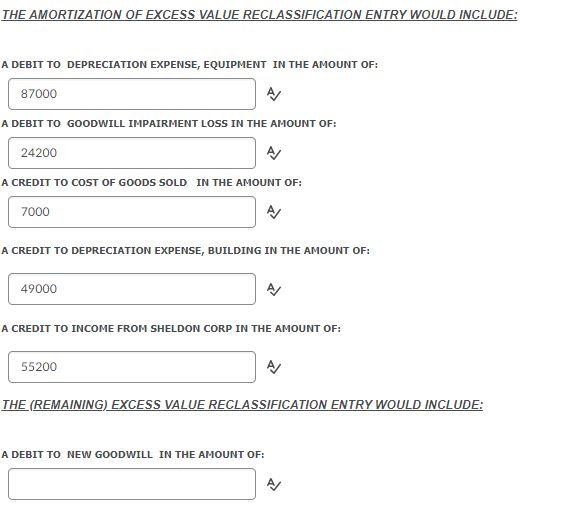

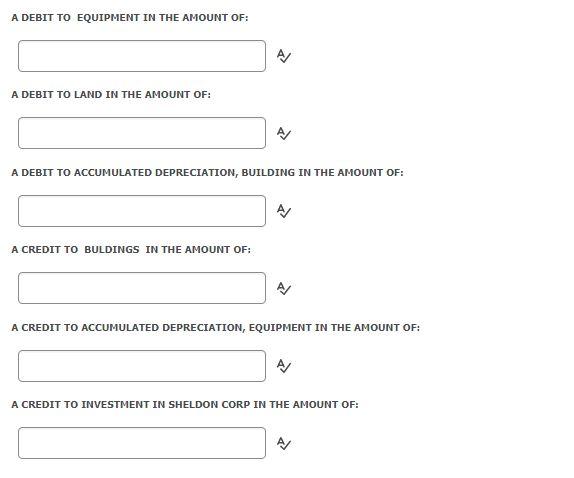

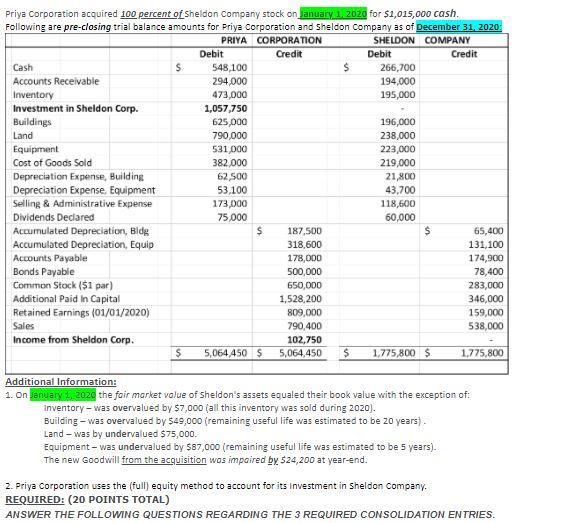

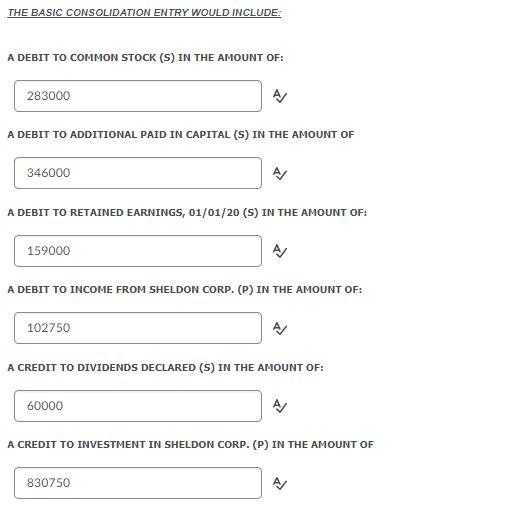

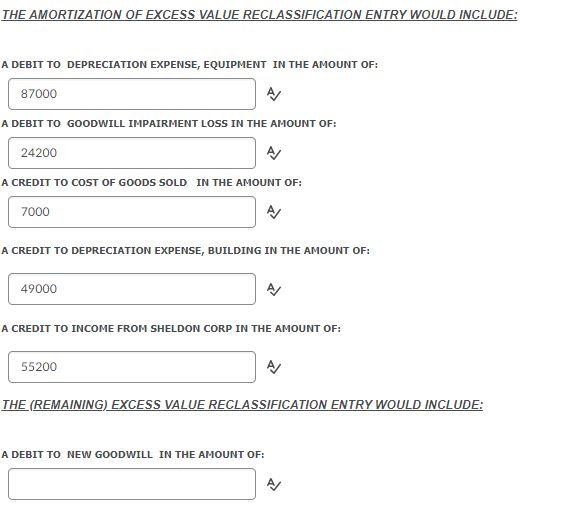

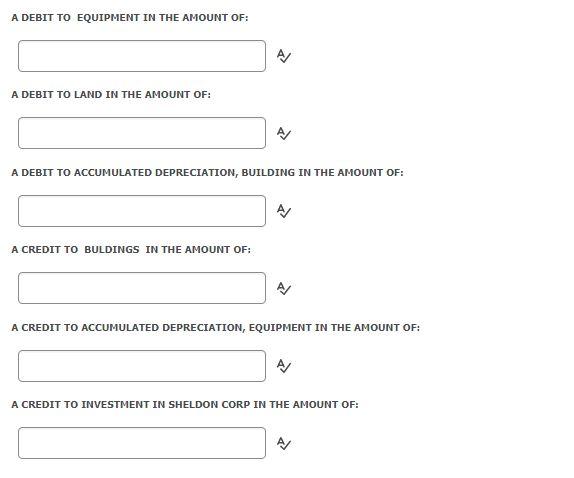

Priya Corporation acquired 100 percent of Sheldon Company stock on January 1, 2020 for $1,015,000 cash. Following are pre-closing trial balance amounts for Priya Corporation and Sheldon Company as of December 31, 2020 PRIYA CORPORATION SHELDON COMPANY Debit Credit Debit Credit Cash s 548,100 $ 266,700 Accounts Receivable 294,000 194,000 Inventory 473,000 195,000 Investment in Sheldon Corp. 1,057,750 Buildings 625,000 196,000 Land 790,000 238,000 Equipment 531000 223,000 Cost of Goods Sold 382,000 219,000 Depreciation Expense, Building 62,500 21,800 Depreciation Expense Equipment 53,100 43,700 Selling & Administrative Expense 173,000 118,600 Dividends Declared 75,000 60,000 Accumulated Depreciation, Bide 187,500 $ 65,400 Accumulated Depreciation, Equip 318,600 131,100 Accounts Payable 178,000 174,900 Bonds Payable 500,000 78,400 Common Stock ($i par) 650,000 283,000 Additional Paid in Capital 1,528,200 346,000 Retained Earnings (01/01/2020) 809,000 159,000 Sales 790,400 538,000 Income from Sheldon Corp. 102,750 $ 5,064 450 S 5,064,450 $ 1,775,800 $ 1.775,800 $ Additional Information: 1. on Banuary 1, 2020 the fair market value of sheldon's assets equaled their book value with the exception of: Inventory - was overvalued by $7,000 (all this inventory was sold during 2020). Building - was overvalued by $49,000 (remaining useful life was estimated to be 20 years). Land was by undervalued $75,000. Equipment - was undervalued by $87,000 (remaining useful life was estimated to be 5 years). The new Goodwill from the acquisition was impaired by $24,200 at year-end. 2. Priya Corporation uses the (full) equity method to account for its Investment in Sheldon Company. REQUIRED: (20 POINTS TOTAL) ANSWER THE FOLLOWING QUESTIONS REGARDING THE 3 REQUIRED CONSOLIDATION ENTRIES. THE AMORTIZATION OF EXCESS VALUE RECLASSIFICATION ENTRY WOULD INCLUDE: A DEBIT TO DEPRECIATION EXPENSE, EQUIPMENT IN THE AMOUNT OF: 87000 A DEBIT TO GOODWILL IMPAIRMENT LOSS IN THE AMOUNT OF: 24200 A CREDIT TO COST OF GOODS SOLD IN THE AMOUNT OF: 7000 A CREDIT TO DEPRECIATION EXPENSE, BUILDING IN THE AMOUNT OF: 49000 A CREDIT TO INCOME FROM SHELDON CORP IN THE AMOUNT OF: 55200 THE (REMAINING) EXCESS VALUE RECLASSIFICATION ENTRY WOULD INCLUDE: A DEBIT TO NEW GOODWILL IN THE AMOUNT OF: A A DEBIT TO EQUIPMENT IN THE AMOUNT OF: A DEBIT TO LAND IN THE AMOUNT OF: A DEBIT TO ACCUMULATED DEPRECIATION, BUILDING IN THE AMOUNT OF: A CREDIT TO BULDINGS IN THE AMOUNT OF: A CREDIT TO ACCUMULATED DEPRECIATION, EQUIPMENT IN THE AMOUNT OF: A CREDIT TO INVESTMENT IN SHELDON CORP IN THE AMOUNT OF