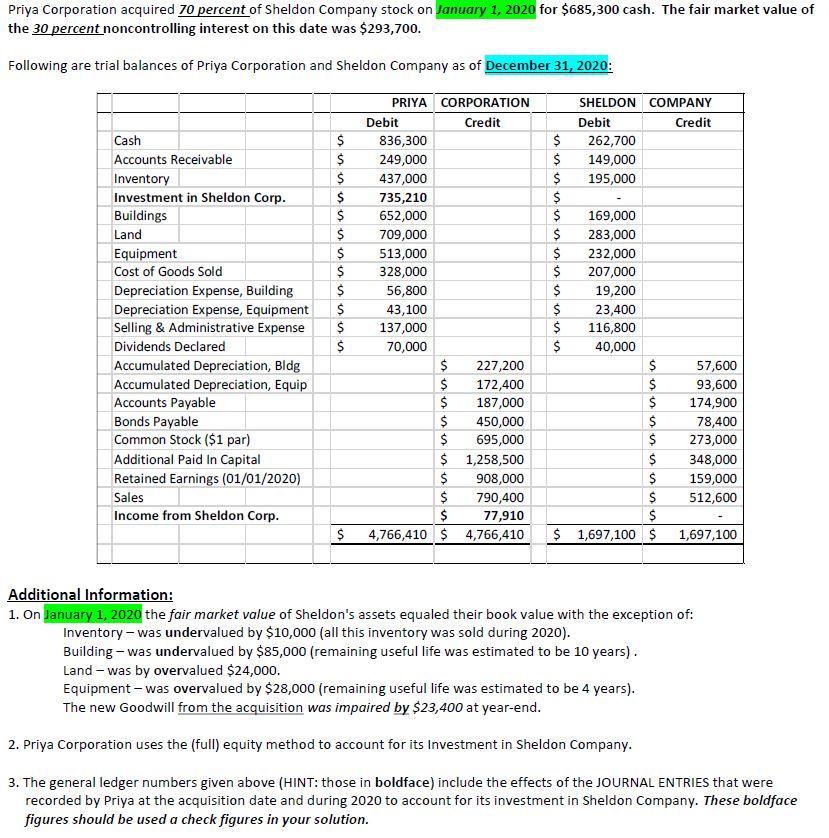

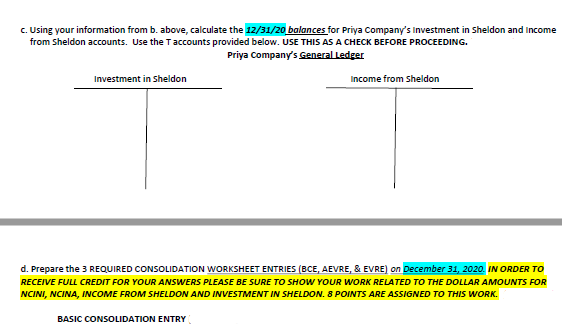

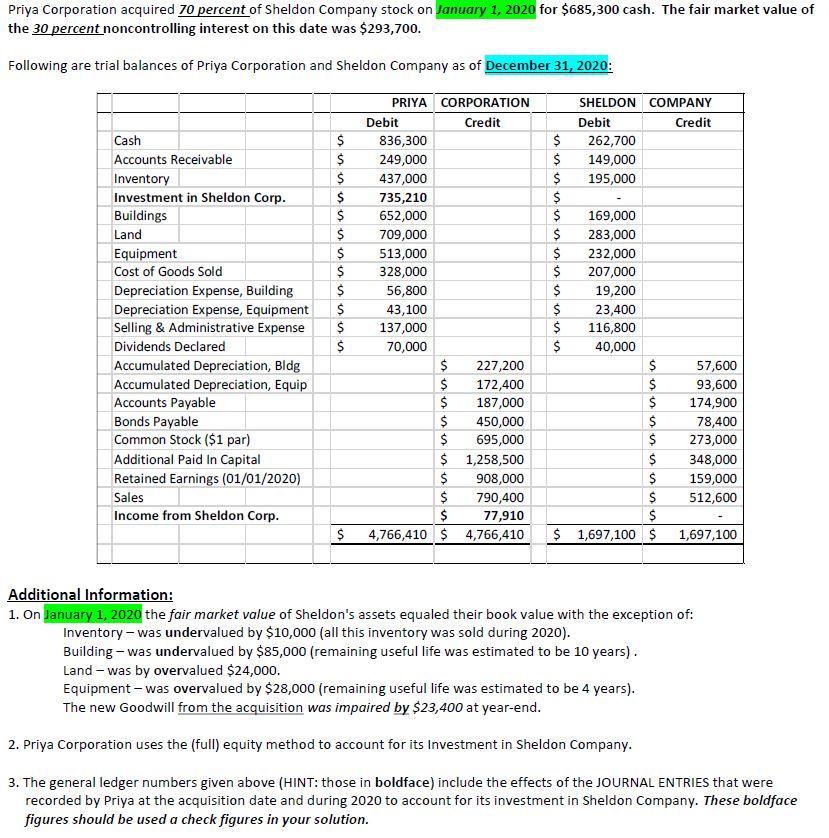

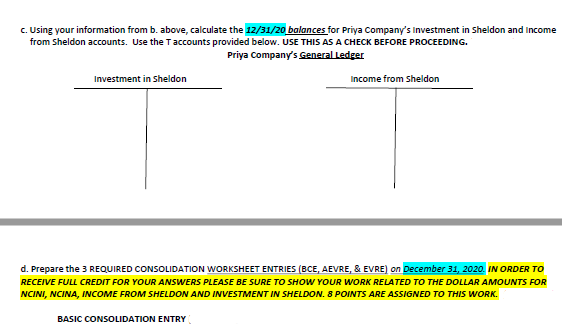

Priya Corporation acquired 70 percent of Sheldon Company stock on January 1, 2020 for $685,300 cash. The fair market value of the 30 percent noncontrolling interest on this date was $293,700. Following are trial balances of Priya Corporation and Sheldon Company as of December 31, 2020: SHELDON COMPANY Debit Credit 262,700 149,000 195,000 Cash Accounts Receivable Inventory Investment in Sheldon Corp. Buildings Land Equipment Cost of Goods Sold Depreciation Expense, Building Depreciation Expense, Equipment Selling & Administrative Expense Dividends Declared Accumulated Depreciation, Bldg Accumulated Depreciation, Equip Accounts Payable Bonds Payable Common Stock ($1 par) Additional Paid In Capital Retained Earnings (01/01/2020) Sales Income from Sheldon Corp. $ $ $ $ $ $ $ $ $ $ $ $ PRIYA CORPORATION Debit Credit 836,300 249,000 437,000 735,210 652,000 709,000 513,000 328,000 56,800 43,100 137,000 70,000 $ 227,200 $ 172,400 $ 187,000 $ 450,000 695,000 $ 1,258,500 $ 908,000 $ 790,400 $ 77,910 4,766,410 $ 4,766,410 $ 169,000 $ 283,000 $ 232,000 $ 207,000 $ 19,200 $ 23,400 $ 116,800 $ 40,000 $ $ $ $ $ $ $ $ $ $ 1,697,100 $ 57,600 93,600 174,900 78,400 273,000 348,000 159,000 512,600 $ 1,697,100 Additional Information: 1. On January 1, 2020 the fair market value of Sheldon's assets equaled their book value with the exception of: Inventory - was undervalued by $10,000 (all this inventory was sold during 2020). Building - was undervalued by $85,000 (remaining useful life was estimated to be 10 years). Land - was by overvalued $24,000. Equipment - was overvalued by $28,000 (remaining useful life was estimated to be 4 years). The new Goodwill from the acquisition was impaired by $23,400 at year-end. 2. Priya Corporation uses the (full) equity method to account for its Investment in Sheldon Company. 3. The general ledger numbers given above (HINT: those in boldface) include the effects of the JOURNAL ENTRIES that were recorded by Priya at the acquisition date and during 2020 to account for its investment in Sheldon Company. These boldface figures should be used a check figures in your solution. c. Using your information from b. above, calculate the 12/31/20 balances for Priya Company's Investment in Sheldon and Income from Sheldon accounts. Use the Taccounts provided below. USE THIS AS A CHECK BEFORE PROCEEDING. Priya Company's General Ledger Investment in Sheldon Income from Sheldon d. Prepare the 3 REQUIRED CONSOLIDATION WORKSHEET ENTRIES (BCE, AEVRE, & EVRE) on December 31, 2020. IN ORDER TO RECEIVE FULL CREDIT FOR YOUR ANSWERS PLEASE BE SURE TO SHOW YOUR WORK RELATED TO THE DOLLAR AMOUNTS FOR NCINI, NCINA, INCOME FROM SHELDON AND INVESTMENT IN SHELDON. 8 POINTS ARE ASSIGNED TO THIS WORK. BASIC CONSOLIDATION ENTRY AMORTIZATION OF EXCESS VALUE RECLASSIFICATION ENTRY (REMAINING) EXCESS VALUE RECLASSIFICATION ENTRY