Answered step by step

Verified Expert Solution

Question

1 Approved Answer

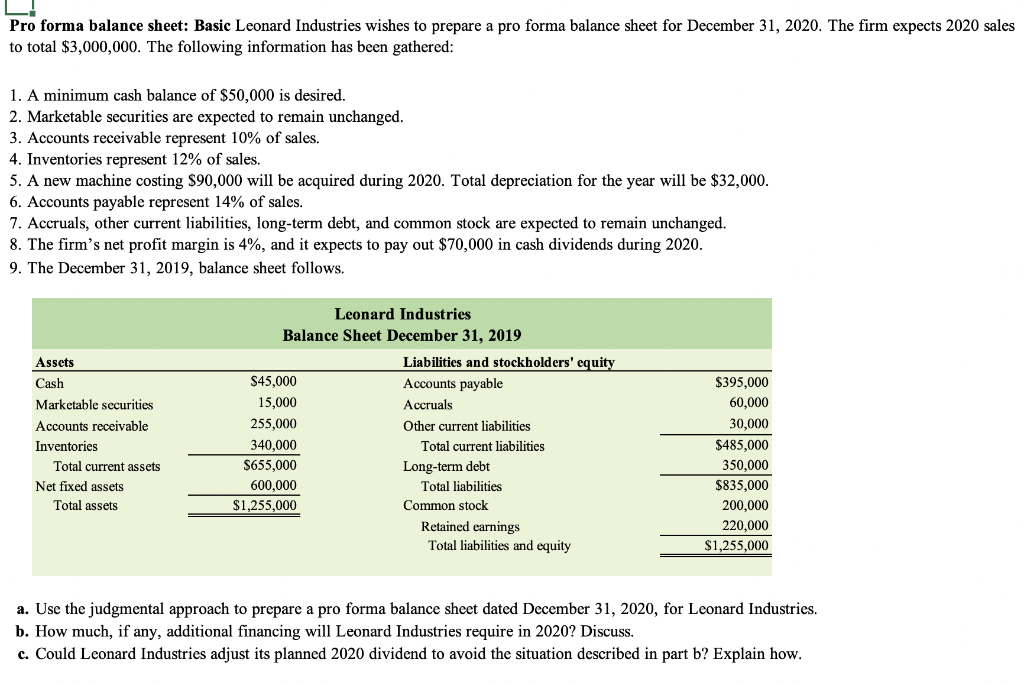

Pro forma balance sheet: Basic Leonard Industries wishes to prepare a pro forma balance sheet for December 31, 2020. The firm expects 2020 sales

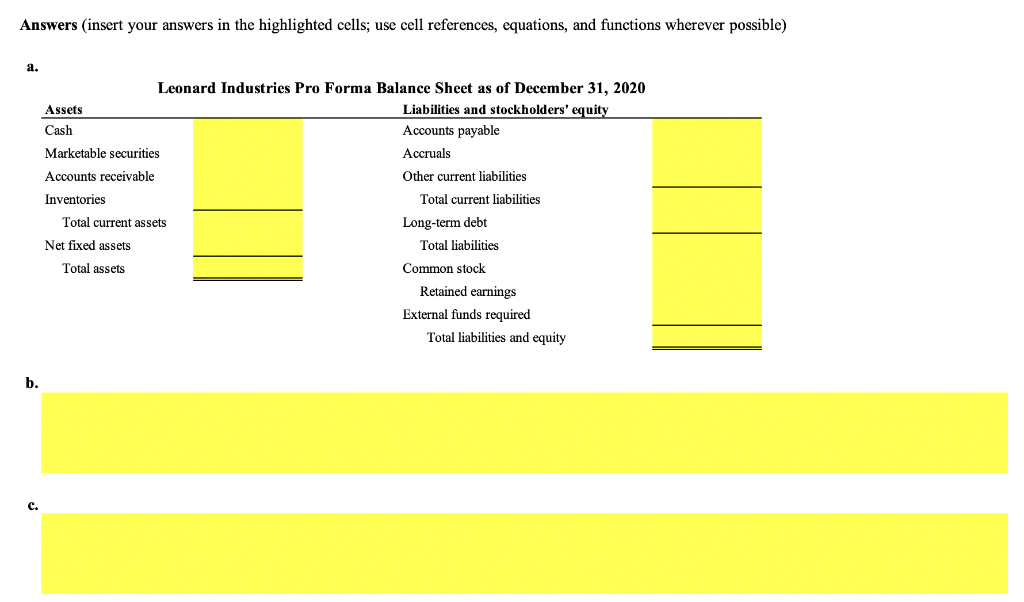

Pro forma balance sheet: Basic Leonard Industries wishes to prepare a pro forma balance sheet for December 31, 2020. The firm expects 2020 sales to total $3,000,000. The following information has been gathered: 1. A minimum cash balance of $50,000 is desired. 2. Marketable securities are expected to remain unchanged. 3. Accounts receivable represent 10% of sales. 4. Inventories represent 12% of sales. 5. A new machine costing $90,000 will be acquired during 2020. Total depreciation for the year will be $32,000. 6. Accounts payable represent 14% of sales. 7. Accruals, other current liabilities, long-term debt, and common stock are expected to remain unchanged. 8. The firm's net profit margin is 4%, and it expects to pay out $70,000 in cash dividends during 2020. 9. The December 31, 2019, balance sheet follows. Leonard Industries Balance Sheet December 31, 2019 Assets Cash $45,000 Liabilities and stockholders' equity Accounts payable $395,000 Marketable securities 15,000 Accruals 60,000 Accounts receivable 255,000 Other current liabilities 30,000 Inventories 340,000 Total current liabilities $485,000 Total current assets $655,000 Net fixed assets Total assets 600,000 $1,255,000 Long-term debt Total liabilities Common stock 350,000 Retained earnings Total liabilities and equity $835,000 200,000 220,000 $1,255,000 a. Use the judgmental approach to prepare a pro forma balance sheet dated December 31, 2020, for Leonard Industries. b. How much, if any, additional financing will Leonard Industries require in 2020? Discuss. c. Could Leonard Industries adjust its planned 2020 dividend to avoid the situation described in part b? Explain how. Answers (insert your answers in the highlighted cells; use cell references, equations, and functions wherever possible) a. b. Leonard Industries Pro Forma Balance Sheet as of December 31, 2020 Assets Cash Marketable securities Accounts receivable Inventories Total current assets Net fixed assets Total assets Liabilities and stockholders' equity Accounts payable Accruals Other current liabilities Total current liabilities Long-term debt Total liabilities Common stock Retained earnings External funds required Total liabilities and equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started