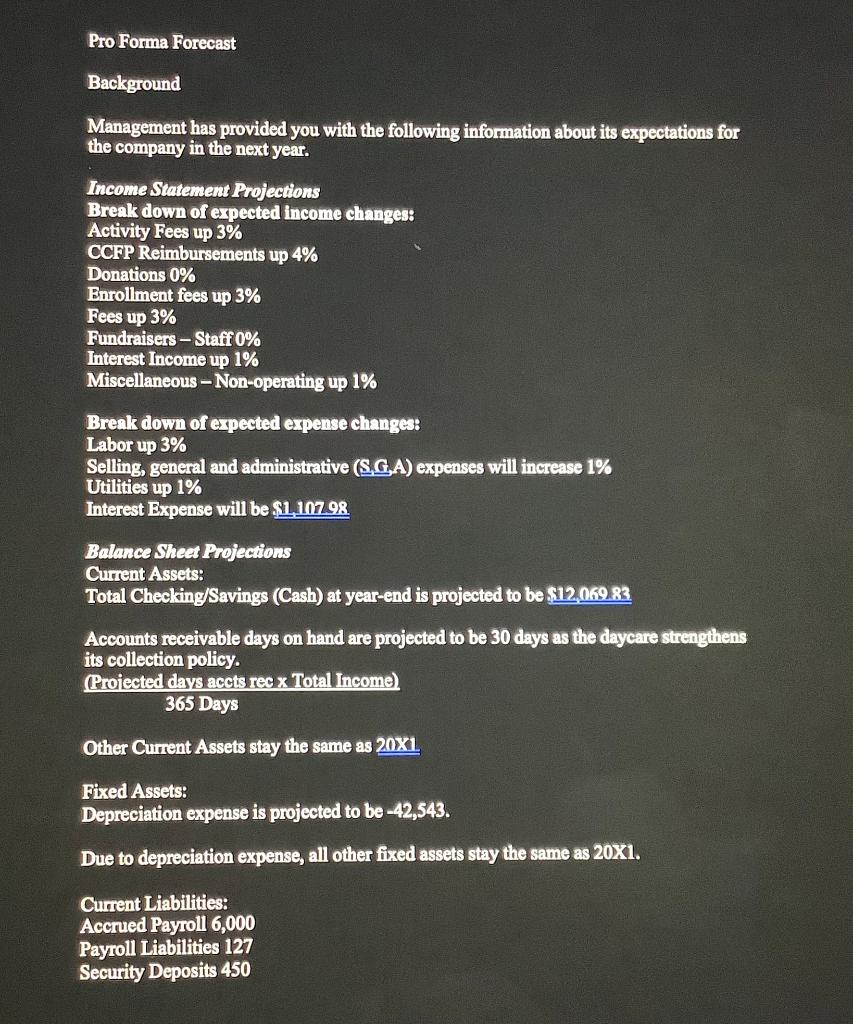

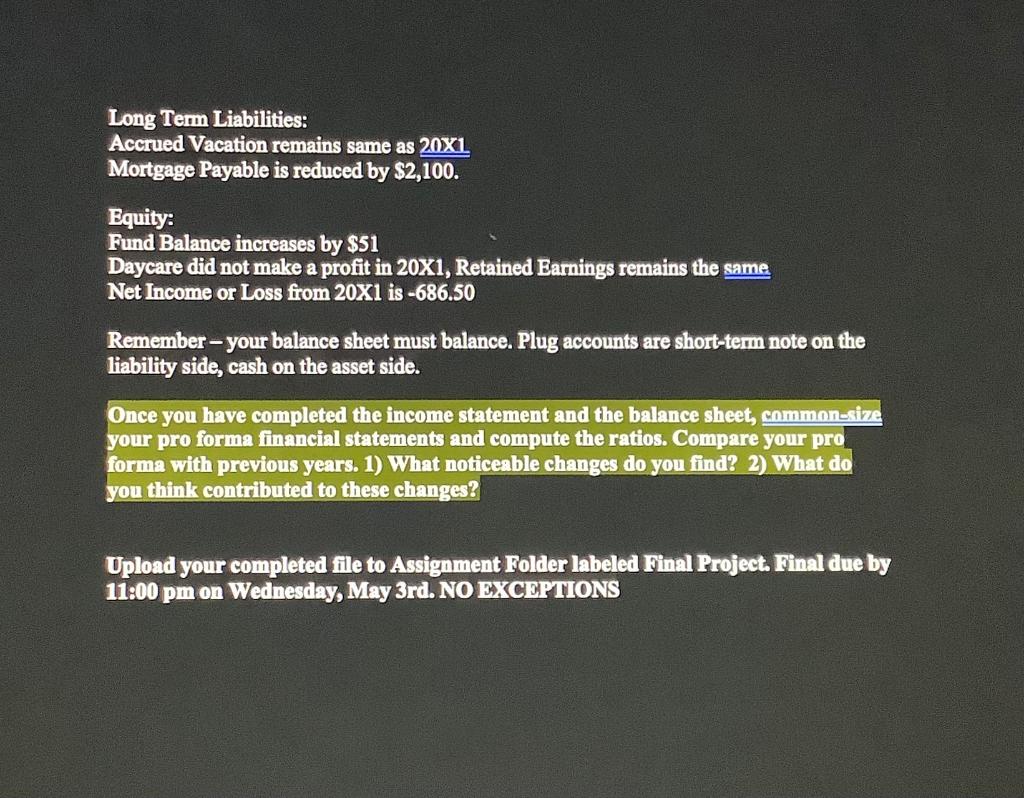

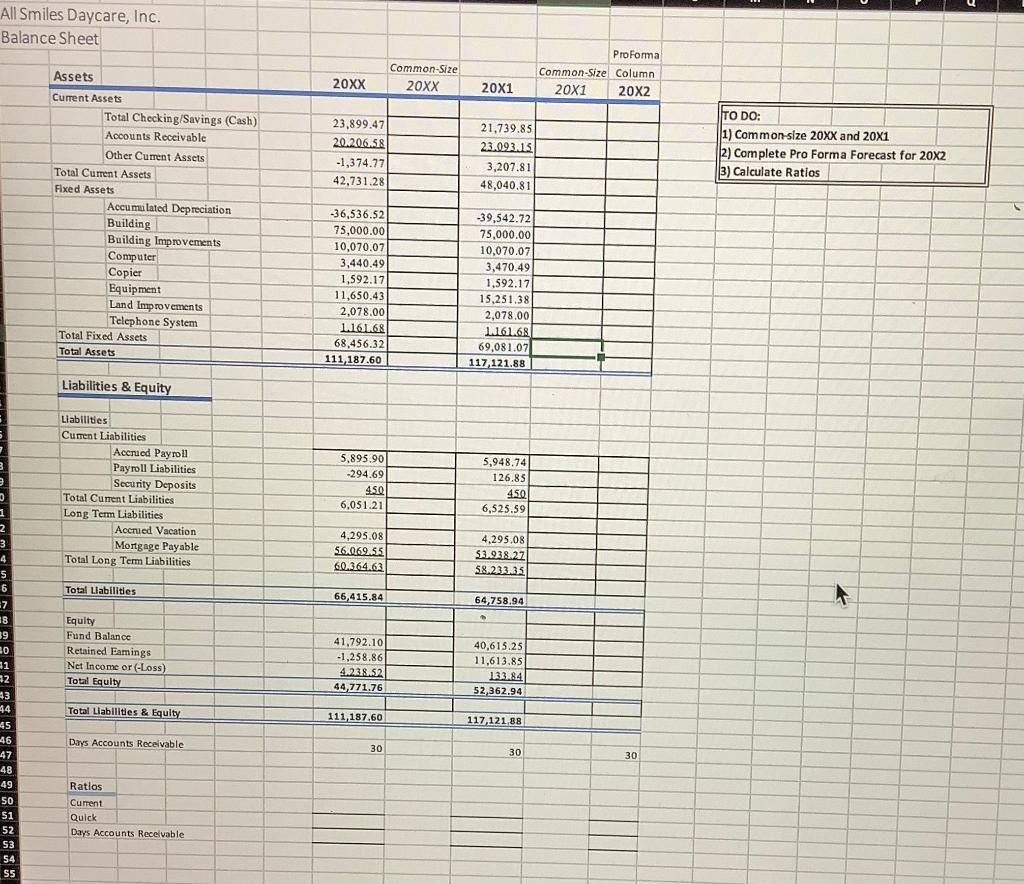

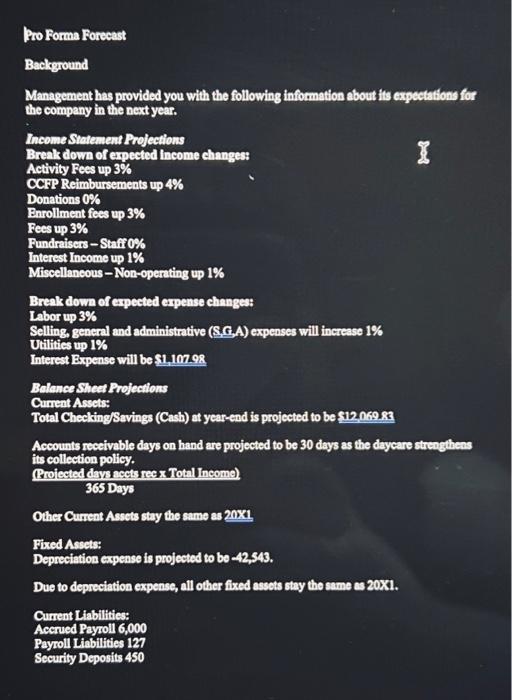

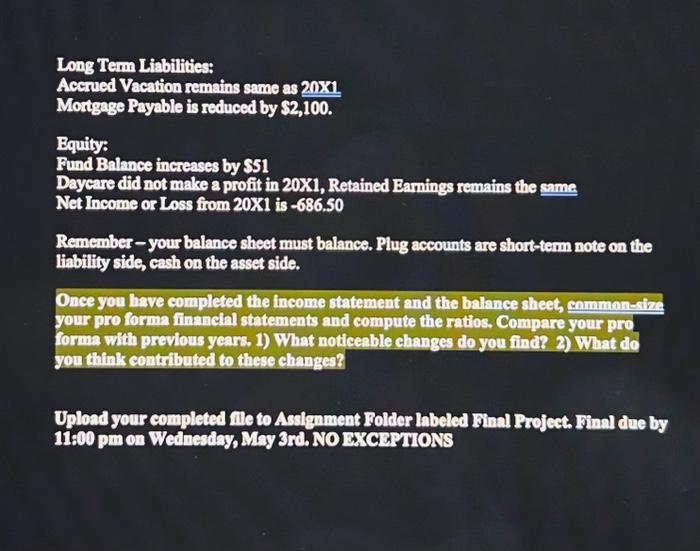

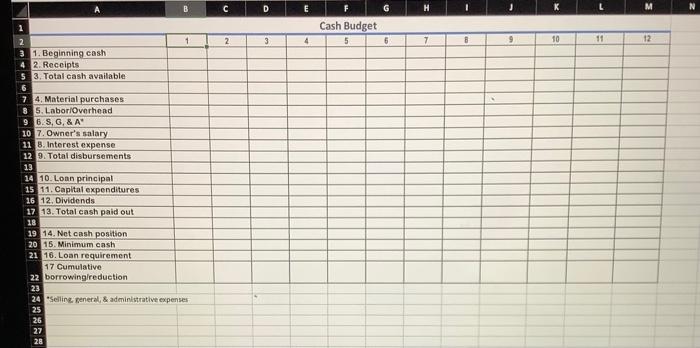

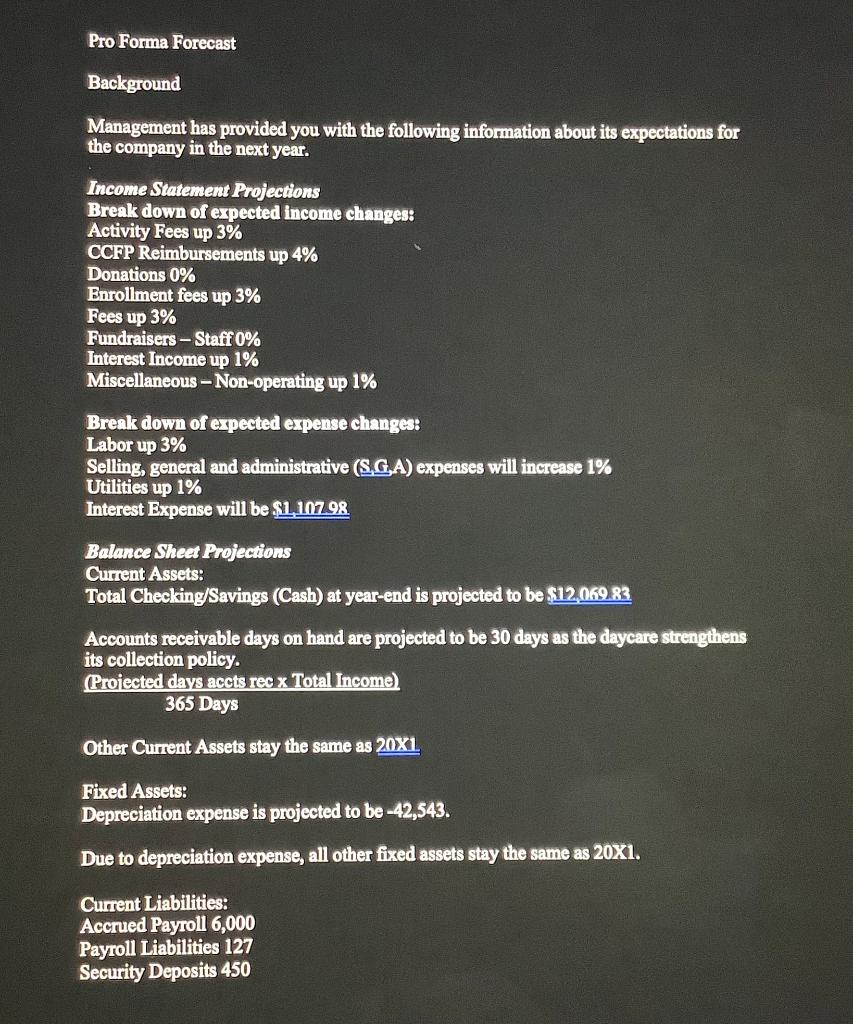

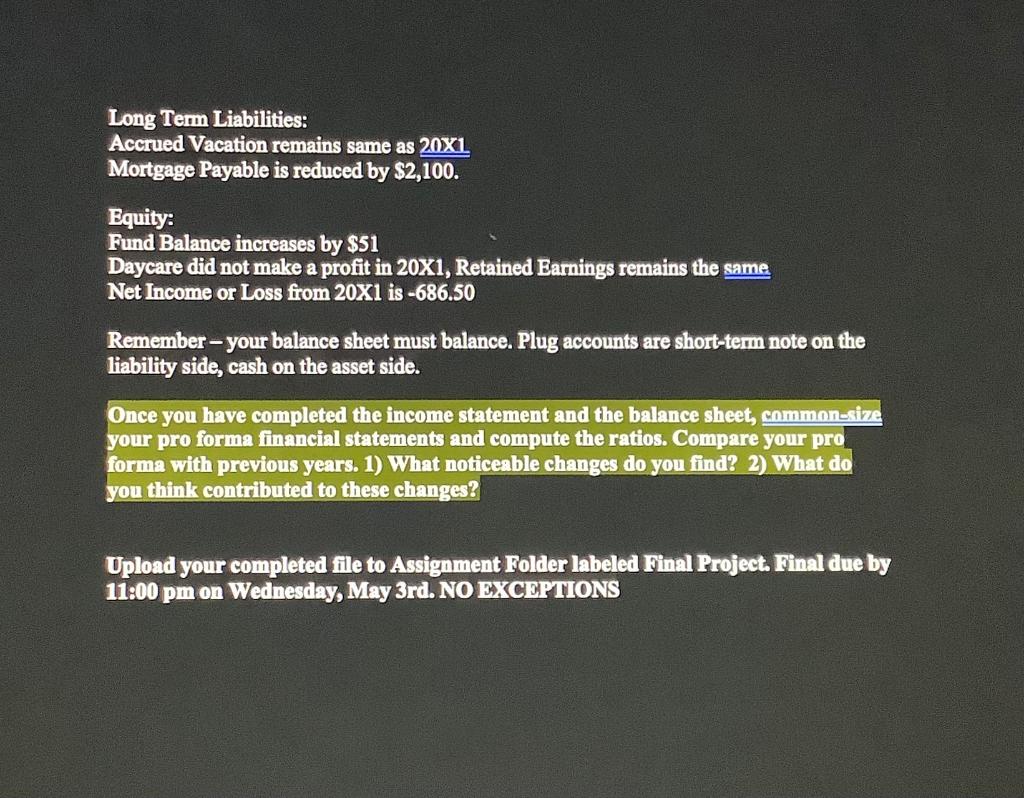

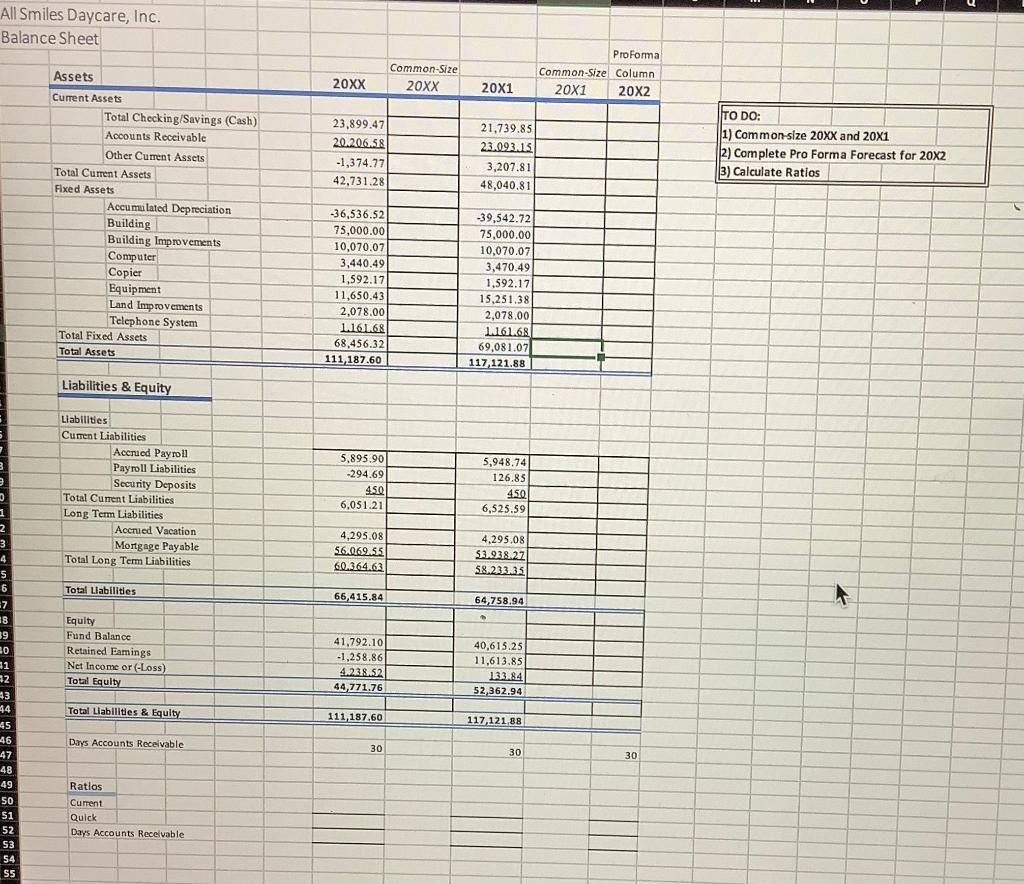

Pro Forma Forecast Background Management has provided you with the following information about its expectations for the company in the next year. Income Statement Rrojections Break down of erpected income changes: Activity Fees up 3\% CCFP Reimbursements up 4% Donations 0\% Bnrollment fees up 3% Fees up 3% Fundraisers - Stafi 0% Interest Income up 1% Miscellaneous - Non-operating up 1% Brenk down of erpected erpense changes: Labor up 3% Selling, general and administrative (S,G,A) expenses will increase 1% Utilities up 1% Interest Expense will be $1,10798 Balarce Sheet Projections Current Assets: Total Checking/Savings (Cash) at year-end is projected to be $12,0.69:83 Accounts receivable days on hand are projected to be 30 days as the daycare strengthens its collection policy. (Beoiected days accts rec Total Income). 365 Days Other Current Assets stay the same as 201 Fixed Assets: Depreciation expense is projected to be 42,543. Due to depreciation expense, all other fixed assets stay the same as 20X1. Cunent Liabilities: Accrued Payzoll 6,000 Payoll Liabilities 127 Security Deposits 450 Long Term Liabilities: Accrued Vacation remains same as 201 Mortgage Payable is reduced by $2,100. Equity: Fund Balance increases by $51 Daycare did not make a profit in 20X1, Retained Earnings remains the same Net Income or Loss from 20X1 is -686.50 Remember - your balance sheet must balance. Plug accounts are short-term note on the liability side, cash on the asset side. Once you have completed the income statement and the balance sheet, enmmnnesive your pro forma financial statements and compute the ratios. Compare your pro forma with previous years. 1) What noticeable changes do you find? 2) What do jou think contributed to these changes? Upload your completed file to Assignment Bolier labeled Binal Rroject. Dinal due by 11800 pm on Weinesiay, May 3ri. NO F. CMPILONS All Smiles Daycare, Inc. Balance Sheet TO DO: 1) Common-size 20XX and 201 2) Complete Pro Forma Forecast for 202 3) Calculate Ratios Liabilities \& Equity Liabilities Cument Liabilitics Ratios Current Quick Days Accounts Recelvable Rro Forma Foreeast Background Management has provided you with the following information about its expectations for the company in the next year. Income Statement Prolections Break down of erpected Income ehanges: Activity Fees up 3% CCFP Reimbursements up 4% Donations 0% Enrollment fees up 3% Fees up 3% Pundraisers - Staff 0% Interest Income up 1% Miscellaneous -Non-operating up 1% Break down of expected erpense changes: Labor up 3% Selling, general and administrative (S,G,A) expenses will increase 1% Utilities up 1% Interest Bxpense will be $1,107.98 Balence Sheet Prejections Current Assets: Total CheckingSevings (Cash) at year-end is projected to be 512,069.83 Accounts receivable days on hand are projected to be 30 days as the daycare strengthens its collection policy. 365DaysProiecteddavsacetsreceTotalIncome) Other Current Assets stay the same as 201 Fixed Assets: Depreciation expense is projected to be 42,543. Due to depreciation expense, all other fixed assets stay the same as 20X1. Current Liabilities: Acerued Payroll 6,000 Payroll Liabilities 127 Security Deposits 450 Long Tem Liabilities: Accrued Vacation remains same as 201. Motgage Payable is reduced by $2,100. Bquity: Fund Balance increases by 551 Daycare did not make a profit in 20X1, Retained Eamings remains the same Net Income or Loss from 20X1 is -686.50 Remember-your balance sheet must balance. Plug accounts are short-term note on the liability side, cash on the asset side. Once you have completed the income statement and the balance sheet, cnmmnn-efine your pro forma financhl statements and compute the ratios. Compare your pro forma with previous years. 1) What noticeable changes do you find? 2) What do you think contributed to these changes? Uplond your completed mle to Asslgnment Folder labeled Final Project. Final due by 11:00 pm on Weanesday, May 3rd. NO D:CMPIOAS - Scling seneral \& administrative expenses Pro Forma Forecast Background Management has provided you with the following information about its expectations for the company in the next year. Income Statement Rrojections Break down of erpected income changes: Activity Fees up 3\% CCFP Reimbursements up 4% Donations 0\% Bnrollment fees up 3% Fees up 3% Fundraisers - Stafi 0% Interest Income up 1% Miscellaneous - Non-operating up 1% Brenk down of erpected erpense changes: Labor up 3% Selling, general and administrative (S,G,A) expenses will increase 1% Utilities up 1% Interest Expense will be $1,10798 Balarce Sheet Projections Current Assets: Total Checking/Savings (Cash) at year-end is projected to be $12,0.69:83 Accounts receivable days on hand are projected to be 30 days as the daycare strengthens its collection policy. (Beoiected days accts rec Total Income). 365 Days Other Current Assets stay the same as 201 Fixed Assets: Depreciation expense is projected to be 42,543. Due to depreciation expense, all other fixed assets stay the same as 20X1. Cunent Liabilities: Accrued Payzoll 6,000 Payoll Liabilities 127 Security Deposits 450 Long Term Liabilities: Accrued Vacation remains same as 201 Mortgage Payable is reduced by $2,100. Equity: Fund Balance increases by $51 Daycare did not make a profit in 20X1, Retained Earnings remains the same Net Income or Loss from 20X1 is -686.50 Remember - your balance sheet must balance. Plug accounts are short-term note on the liability side, cash on the asset side. Once you have completed the income statement and the balance sheet, enmmnnesive your pro forma financial statements and compute the ratios. Compare your pro forma with previous years. 1) What noticeable changes do you find? 2) What do jou think contributed to these changes? Upload your completed file to Assignment Bolier labeled Binal Rroject. Dinal due by 11800 pm on Weinesiay, May 3ri. NO F. CMPILONS All Smiles Daycare, Inc. Balance Sheet TO DO: 1) Common-size 20XX and 201 2) Complete Pro Forma Forecast for 202 3) Calculate Ratios Liabilities \& Equity Liabilities Cument Liabilitics Ratios Current Quick Days Accounts Recelvable Rro Forma Foreeast Background Management has provided you with the following information about its expectations for the company in the next year. Income Statement Prolections Break down of erpected Income ehanges: Activity Fees up 3% CCFP Reimbursements up 4% Donations 0% Enrollment fees up 3% Fees up 3% Pundraisers - Staff 0% Interest Income up 1% Miscellaneous -Non-operating up 1% Break down of expected erpense changes: Labor up 3% Selling, general and administrative (S,G,A) expenses will increase 1% Utilities up 1% Interest Bxpense will be $1,107.98 Balence Sheet Prejections Current Assets: Total CheckingSevings (Cash) at year-end is projected to be 512,069.83 Accounts receivable days on hand are projected to be 30 days as the daycare strengthens its collection policy. 365DaysProiecteddavsacetsreceTotalIncome) Other Current Assets stay the same as 201 Fixed Assets: Depreciation expense is projected to be 42,543. Due to depreciation expense, all other fixed assets stay the same as 20X1. Current Liabilities: Acerued Payroll 6,000 Payroll Liabilities 127 Security Deposits 450 Long Tem Liabilities: Accrued Vacation remains same as 201. Motgage Payable is reduced by $2,100. Bquity: Fund Balance increases by 551 Daycare did not make a profit in 20X1, Retained Eamings remains the same Net Income or Loss from 20X1 is -686.50 Remember-your balance sheet must balance. Plug accounts are short-term note on the liability side, cash on the asset side. Once you have completed the income statement and the balance sheet, cnmmnn-efine your pro forma financhl statements and compute the ratios. Compare your pro forma with previous years. 1) What noticeable changes do you find? 2) What do you think contributed to these changes? Uplond your completed mle to Asslgnment Folder labeled Final Project. Final due by 11:00 pm on Weanesday, May 3rd. NO D:CMPIOAS - Scling seneral \& administrative expenses