Answered step by step

Verified Expert Solution

Question

1 Approved Answer

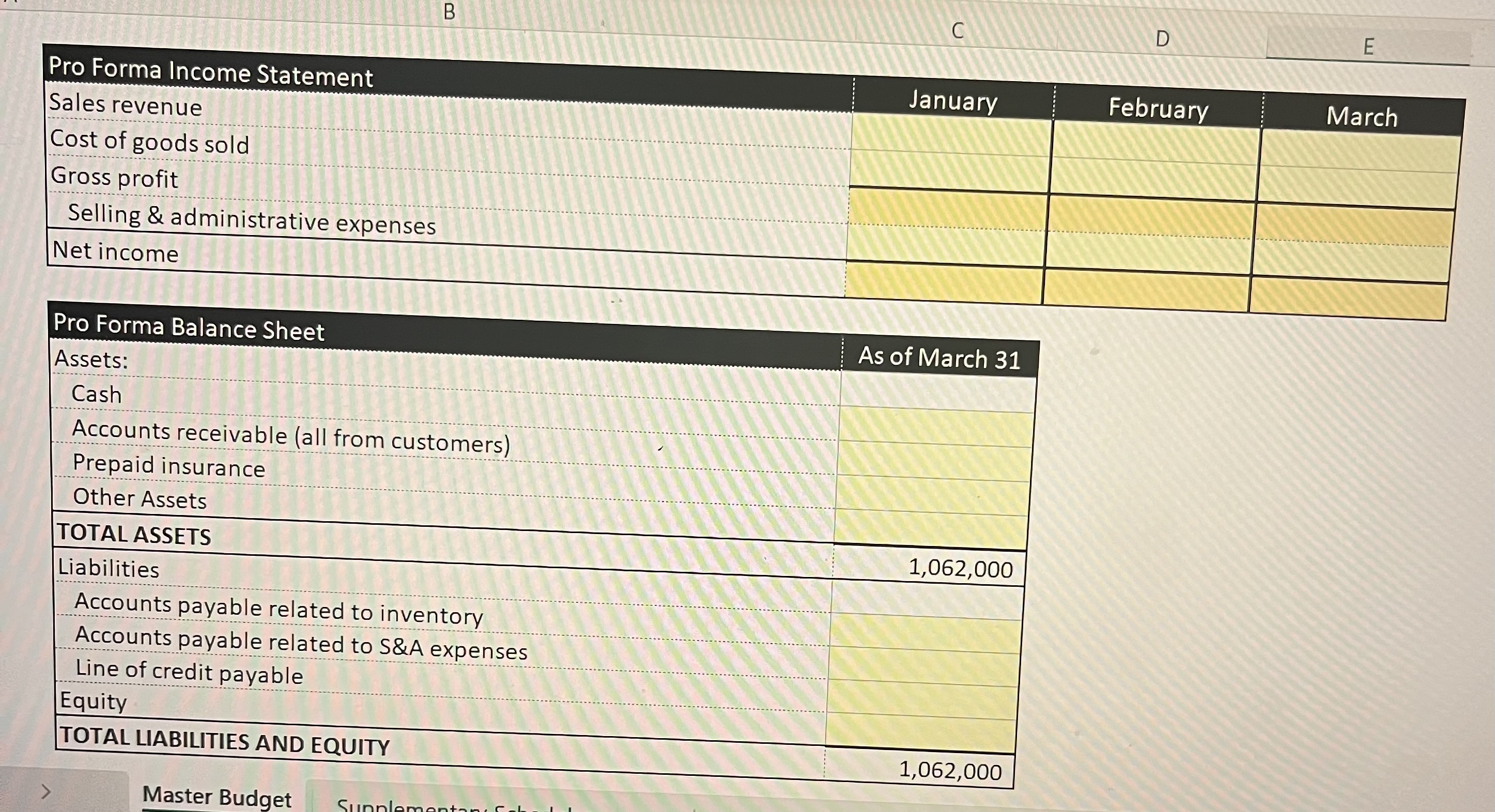

Pro Forma Income Statement Problem: a . Last January there were 7 , 0 0 0 sales at $ 4 5 each. This year the

Pro Forma Income Statement Problem:

a Last January there were sales at $ each. This year the company expects to sell the same amount in January, and then increase sales by each month in the following year. The company typically has a ratio for credit and cash sales in any given month.

b Sales made on account are typically collected in the month of the sale and in the month following the sale.

c Budgeted COGS are expected to be of sales each month, and the company budgets for an ending inventory balance of of next month's COGS. All inventory purchases are made on account.

d The company's cash policy pertaining to inventory purchases is to pay all bills as they become due. An analysis of historic payables estimates that of invoices require immediate payment, and are due the following month.

e The company's budgeted selling and admin expenses are shown on the Supplementary Schedules tab. The company has a policy to pay employees, rent on the office, and equipment maintenance contractors in the month the expenses are incurred. Insurance is prepaid twice per year, on January and July th All other expenses that require cash payment will be paid in the month following when the expense is incurred.

f The payments for capital budget acquisitions can be found on the supplementary schedule tab.

g The company maintains a cash balance of at least $ at the end of each month. The company can draw on a line of credit with a debt maximum of $ and draws on the account in increments of $ Payments are made in any increment. All borrowing and repayment is done on the last day of each month. The line of credit interest rate and balance are listed below. Line of credit :

$ Loan balance as of january st

annual interest rate

Find Montly interest rate

Find Cash Budget for month january febrary and march if

Beginning cash balance january

Add cash receipts

Cash available

Less disbursements:

For inventory purchases

For S&A expenses

For capital expenditures

Interest expenses at per year

Total budgeted disbursements

Cash surplus shortage

Financing activity:

Borrowing repayment

Ending cash balane

Budgeted Selling & Admin Expenses

December

January

February

March

Cleaning supplies

Equipment depreciation

Equipment maintenance expense

Insurance expense

Miscellaneous expenses

Rent expense

Salary expense

Sales Commissions of sales

Total S&A Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started